Chevron 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2012 Annual Report 51

jurisdiction to hear Chevron’s arbitration claims. On April 9,

2012, the Tribunal issued a scheduling order to hear issues

relating to the scope of the settlement and release agree-

ments between the Republic of Ecuador and Texpet, and on

July 9, 2012, the Tribunal indicated that it wanted to hear

the remaining issues in January 2014. On February 7, 2013,

the Tribunal issued its Fourth Interim Award in which it

declared that the Republic of Ecuador “has violated the First

and Second Interim Awards under the [BIT], the UNCIT-

RAL Rules and international law in regard to the nalization

and enforcement subject to execution of the Lago Agrio Judg-

ment within and outside Ecuador, including (but not limited

to) Canada, Brazil and Argentina.” A schedule for the Tribu-

nal’s order to show cause hearing will be issued separately.

rough a series of U.S. court proceedings initiated by

Chevron to obtain discovery relating to the Lago Agrio litiga-

tion and the BIT arbitration, Chevron obtained evidence that

it believes shows a pattern of fraud, collusion, corruption, and

other misconduct on the part of several lawyers, consultants

and others acting for the Lago Agrio plaintis. In February

2011, Chevron led a civil lawsuit in the Federal District

Court for the Southern District of New York against the Lago

Agrio plaintis and several of their lawyers, consultants and

supporters, alleging violations of the Racketeer Inuenced

and Corrupt Organizations Act and other state laws. rough

the civil lawsuit, Chevron is seeking relief that includes

an award of damages and a declaration that any judgment

against Chevron in the Lago Agrio litigation is the result of

fraud and other unlawful conduct and is therefore unenforce-

able. On March 7, 2011, the Federal District Court issued a

preliminary injunction prohibiting the Lago Agrio plaintis

and persons acting in concert with them from taking any

action in furtherance of recognition or enforcement of any

judgment against Chevron in the Lago Agrio case pending

resolution of Chevron’s civil lawsuit by the Federal District

Court. On May 31, 2011, the Federal District Court severed

claims one through eight of Chevron’s complaint from the

ninth claim for declaratory relief and imposed a discovery

stay on claims one through eight pending a trial on the ninth

claim for declaratory relief. On September 19, 2011, the U.S.

Court of Appeals for the Second Circuit vacated the prelimi-

nary injunction, stayed the trial on Chevron’s ninth claim, a

claim for declaratory relief, that had been set for November

14, 2011, and denied the defendants’ mandamus petition

to recuse the judge hearing the lawsuit. e Second Circuit

issued its opinion on January 26, 2012 ordering the dismissal

of Chevron’s ninth claim for declaratory relief. On February

16, 2012, the Federal District Court lifted the stay on claims

one through eight, and on October 18, 2012, the Federal Dis-

trict Court set a trial date of October 15, 2013.

e ultimate outcome of the foregoing matters, including

any nancial eect on Chevron, remains uncertain. Management

does not believe an estimate of a reasonably possible loss (or a

range of loss) can be made in this case. Due to the defects associ-

ated with the Ecuadorian judgment, the 2008 engineer’s report on

alleged damages and the September 2010 plaintis’ submission on

alleged damages, management does not believe these documents

have any utility in calculating a reasonably possible loss (or a range

of loss). Moreover, the highly uncertain legal environment sur-

rounding the case provides no basis for management to estimate a

reasonably possible loss (or a range of loss).

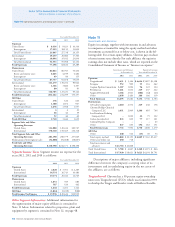

Note 14

Taxes

Income Taxes

Year ended December 31

2012 2011 2010

Taxes on income

U.S. federal

Current $ 1,703 $ 1,893 $ 1,501

Deferred 673 877 162

State and local

Current 652 596 376

Deferred (145) 41 20

Total United States 2,883 3,407 2,059

International

Current 15,626 16,548 10,483

Deferred 1,487 671 377

Total International 17,113 17,219 10,860

Total taxes on income $ 19,996 $ 20,626 $ 12,919

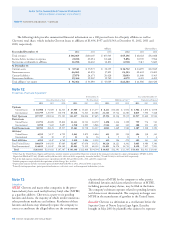

In 2012, before-tax income for U.S. operations, including

related corporate and other charges, was $8,456, compared

with before-tax income of $10,222 and $6,528 in 2011 and

2010, respectively. For international operations, before-tax

income was $37,876, $37,412 and $25,527 in 2012, 2011

and2010, respectively. U.S. federal income tax expense was

reduced by $165, $191 and $162 in 2012, 2011 and 2010,

respectively, for business tax credits.

e reconciliation between the U.S. statutory federal

income tax rate and the company’s eective income tax rate

isdetailed in the following table:

Year ended December 31

2012 2011 2010

U.S. statutory federal income tax rate 35.0% 35.0% 35.0%

Eect of income taxes from inter-

national operations at rates dierent

from the U.S. statutory rate 7.8 7.5 5.2

State and local taxes on income, net

of U.S. federal income tax benet 0.6 0.9 0.8

Prior-year tax adjustments (0.2) (0.1) (0.6)

Tax credits (0.4) (0.4) (0.5)

Eects of changes in tax rates 0.3 0.5 –

Other 0.1 (0.1) 0.4

Eective tax rate 43.2% 43.3% 40.3%

Note 13 Litigation – Continued