Chevron 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

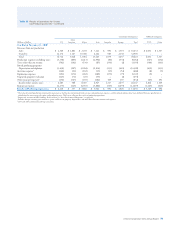

Table III Results of Operations for Oil and

Gas Producing Activities1

e company’s results of operations from oil and gas

producing activities for the years 2012, 2011 and 2010 are

shown in the following table. Net income from exploration

and production activities as reported on page 45 reects

income taxes computed on an eective rate basis.

Income taxes in Table III are based on statutory tax rates,

reecting allowable deductions and tax credits. Interest

income and expense are excluded from the results reported in

Table III and from the net income amounts on page 45.

Table III – Results of Operations for Oil and Gas Producing Activities1

Consolidated Companies Aliated Companies

Other

Millions of dollars U.S. Americas Africa Asia Australia Europe Total TCO Other

Year Ended December 31, 2012

Revenues from net production

Sales $ 1,832 $ 1,561 $ 1,480 $ 10,485 $ 1,539 $ 1,618 $ 18,515 $ 7,869 $ 1,951

Transfers 15,122 1,997 15,033 9,071 1,073 2,148 44,444 – –

Total 16,954 3,558 16,513 19,556 2,612 3,766 62,959 7,869 1,951

Production expenses excluding taxes (4,009) (1,073) (1,918) (4,545) (164) (637) (12,346) (463) (442)

Taxes other than on income (654) (123) (161) (191) (390) (3) (1,522) (439) (767)

Proved producing properties:

Depreciation and depletion (3,462) (508) (2,475) (3,399) (315) (541) (10,700) (427) (147)

Accretion expense2

(226) (33) (66) (92) (23) (46) (486) (8) (6)

Exploration expenses (244) (145) (427) (489) (133) (272) (1,710) – –

Unproved properties valuation (127) (138) (16) (133) – (15) (429) – –

Other income (expense)3 167 (169) (199) 245 2,495 13 2,552 27 31

Results before income taxes 8,399 1,369 11,251 10,952 4,082 2,265 38,318 6,559 620

Income tax expense (3,043) (310) (7,558) (5,739) (1,226) (1,511) (19,387) (1,972) (299)

Results of Producing Operations $ 5,356 $ 1,059 $ 3,693 $ 5,213 $ 2,856 $ 754 $ 18,931 $ 4,587 $ 321

Year Ended December 31, 20114

Revenues from net production

Sales $ 2,508 $ 2,047 $ 1,174 $ 9,431 $ 1,474 $ 1,868 $ 18,502 $ 8,581 $ 1,988

Transfers 15,811 2,624 15,726 8,962 1,012 2,672 46,807 – –

Total 18,319 4,671 16,900 18,393 2,486 4,540 65,309 8,581 1,988

Production expenses excluding taxes (3,668) (1,061) (1,526) (4,489) (117) (564) (11,425) (449) (235)

Taxes other than on income (597) (137) (153) (242) (396) (2) (1,527) (429) (815)

Proved producing properties:

Depreciation and depletion (3,366) (796) (2,225) (2,923) (136) (580) (10,026) (442) (140)

Accretion expense2

(291) (27) (106) (81) (18) (39) (562) (8) (4)

Exploration expenses (207) (144) (188) (271) (128) (277) (1,215) – –

Unproved properties valuation (134) (146) (27) (60) – (14) (381) – –

Other income (expense)3 163 (466) (409) 231 (18) (74) (573) (8) (29)

Results before income taxes 10,219 1,894 12,266 10,558 1,673 2,990 39,600 7,245 765

Income tax expense (3,728) (535) (7,802) (5,374) (507) (1,913) (19,859) (2,176) (392)

Results of Producing Operations $ 6,491 $ 1,359 $ 4,464 $ 5,184 $ 1,166 $ 1,077 $ 19,741 $ 5,069 $ 373

1 e value of owned production consumed in operations as fuel has been eliminated from revenues and production expenses, and the related volumes have been deducted from net production in

calculating the unit average sales price and production cost. is has no eect on the results of producing operations.

2 Represents accretion of ARO liability. Refer to Note 23, “Asset Retirement Obligations,” on page 66.

3 Includes foreign currency gains and losses, gains and losses on property dispositions (primarily related to Browse and Wheatstone gains in 2012), and other miscellaneous income and expenses.

4 2011 and 2010 conformed to 2012 presentation.

74 Chevron Corporation 2012 Annual Report