Chevron 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2012 Annual Report 45

Segment managers for the reportable segments are

directly accountable to and maintain regular contact with the

company’s CODM to discuss the segment’s operating activities

and nancial performance. e CODM approves annual

capital and exploratory budgets at the reportable segment level,

as well as reviews capital and exploratory funding for major

projects and approves major changes to the annual capital and

exploratory budgets. However, business-unit managers within

the operating segments are directly responsible for decisions

relating to project implementation and all other matters con-

nected with daily operations. Company ocers who are

members of the EXCOM also have individual management

responsibilities and participate in other committees for pur-

poses other than acting as the CODM.

e company’s primary country of operation is the

United States of America, its country of domicile. Other

components of the company’s operations are reported as

“International” (outside the United States).

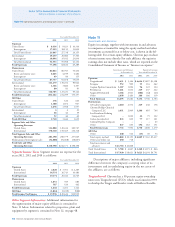

Segment Earnings e company evaluates the performance

of its operating segments on an after-tax basis, without con-

sidering the eects of debt nancing interest expense or

investment interest income, both of which are managed by the

company on a worldwide basis. Corporate administrative

costs and assets are not allocated to the operating segments.

However, operating segments are billed for the direct use of

corporate services. Nonbillable costs remain at the corporate

level in “All Other.” Earnings by major operating area are

presented in the following table:

Year ended December 31

2012 2011 2010

Segment Earnings

Upstream

United States $ 5,332 $ 6,512 $ 4,122

International 18,456 18,274 13,555

Total Upstream 23,788 24,786 17,677

Downstream

United States 2,048 1,506 1,339

International 2,251 2,085 1,139

Total Downstream 4,299 3,591 2,478

Total Segment Earnings 28,087 28,377 20,155

All Other

Interest expense – – (41)

Interest income 83 78 70

Other (1,991) (1,560) (1,160)

Net Income Attributable

to Chevron Corporation $ 26,179 $ 26,895 $ 19,024

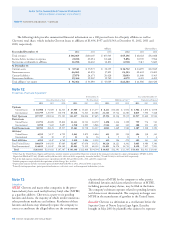

Segment Assets Segment assets do not include intercompany

investments or intercompany receivables. Segment assets at

year-end 2012 and 2011 are as follows:

At December 31

2012 2011

Upstream

United States $ 41,891 $ 37,108

International 115,806 98,540

Goodwill 4,640 4,642

Total Upstream 162,337 140,290

Downstream

United States 23,023 22,182

International 20,024 20,517

Total Downstream 43,047 42,699

Total Segment Assets 205,384 182,989

All Other*

United States 7,727 8,824

International 19,871 17,661

Total All Other 27,598 26,485

Total Assets – United States 72,641 68,114

Total Assets – International 155,701 136,718

Goodwill 4,640 4,642

Total Assets $ 232,982 $ 209,474

* “All Other” assets consist primarily of worldwide cash, cash equivalents, time

deposits and marketable securities, real estate, energy services, information sys-

tems, mining operations, power generation businesses, alternative fuels, technology

companies, and assets of the corporate administrative functions.

Segment Sales and Other Operating Revenues Operat-

ing segment sales and other operating revenues, including

internal transfers, for the years 2012, 2011 and 2010, are

presented in the table that follows. Products are transferred

between operating segments at internal product values that

approximate market prices.

Revenues for the upstream segment are derived primarily

from the production and sale of crude oil and natural gas,

as well as the sale of third-party production of natural gas.

Revenues for the downstream segment are derived from the

rening and marketing of petroleum products such as gaso-

line, jet fuel, gas oils, lubricants, residual fuel oils and

other products derived from crude oil. is segment also

generates revenues from the manufacture and sale of addi-

tives for fuels and lubricant oils and the transportation and

trading of rened products, crude oil and natural gas liquids.

“All Other” activities include revenues from mining opera-

tions, power generation businesses, insurance operations, real

estate activities, energy services, alternative fuels, and tech-

nology companies.

Note 10 Operating Segments and Geographic Data – Continued