Chevron 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

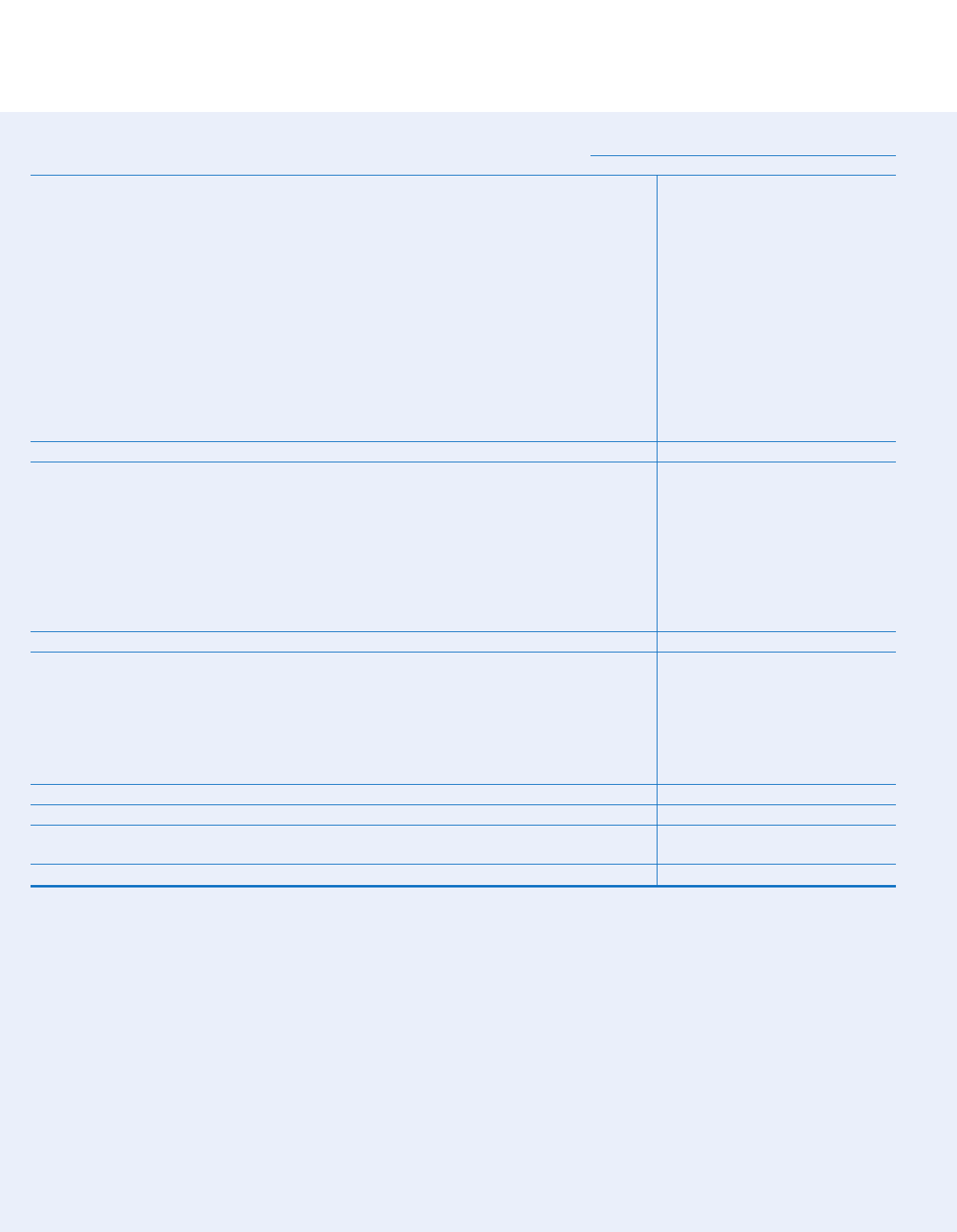

34 Chevron Corporation 2012 Annual Report

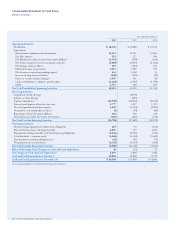

Consolidated Statement of Cash Flows

Millions of dollars

Year ended December 31

2012 2011 2010

Operating Activities

Net Income $ 26,336 $ 27,008 $ 19,136

Adjustments

Depreciation, depletion and amortization 13,413 12,911 13,063

Dry hole expense 555 377 496

Distributions less than income from equity affiliates (1,351) (570) (501)

Net before-tax gains on asset retirements and sales (4,089) (1,495) (1,004)

Net foreign currency eects 207 (103) 251

Deferred income tax provision 2,015 1,589 559

Net decrease in operating working capital 363 2,318 76

Increase in long-term receivables (169) (150) (12)

Decrease in other deferred charges 1,047 341 48

Cash contributions to employee pension plans (1,228) (1,467) (1,450)

Other 1,713 336 692

Net Cash Provided by Operating Activities 38,812 41,095 31,354

Investing Activities

Acquisition of Atlas Energy – (3,009) –

Advance to Atlas Energy – (403) –

Capital expenditures (30,938) (26,500) (19,612)

Proceeds and deposits related to asset sales 2,777 3,517 1,995

Net sales (purchases) of time deposits 3,250 (1,104) (2,855)

Net purchases of marketable securities (3) (74) (49)

Repayment of loans by equity aliates 328 339 338

Net purchases of other short-term investments (210) (255) (732)

Net Cash Used for Investing Activities (24,796) (27,489) (20,915)

Financing Activities

Net borrowings (payments) of short-term obligations 264 23 (212)

Proceeds from issuances of long-term debt 4,007 377 1,250

Repayments of long-term debt and other financing obligations (2,224) (2,769) (156)

Cash dividends – common stock (6,844) (6,136) (5,669)

Distributions to noncontrolling interests (41) (71) (72)

Net purchases of treasury shares (4,142) (3,193) (306)

Net Cash Used for Financing Activities (8,980) (11,769) (5,165)

Eect of Exchange Rate Changes on Cash and Cash Equivalents 39 (33) 70

Net Change in Cash and Cash Equivalents 5,075 1,804 5,344

Cash and Cash Equivalents at January 1 15,864 14,060 8,716

Cash and Cash Equivalents at December 31 $ 20,939 $ 15,864 $ 14,060

See accompanying Notes to the Consolidated Financial Statements.