Chevron 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

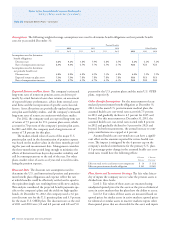

Properties were measured primarily using an income

approach. e fair values of the acquired oil and gas proper-

ties were based on signicant inputs not observable in the

market and thus represent Level 3 measurements. Refer

to Note 8, beginning on page 41 for a denition of fair

value hierarchy levels. Signicant inputs included estimated

resource volumes, assumed future production proles, esti-

mated future commodity prices, a discount rate of 8 percent,

and assumptions on the timing and amount of future oper-

ating and development costs. All the properties are in the

United States and are included in the Upstream segment.

e acquisition date fair value of the consideration trans-

ferred was $3,400 in cash. e $27 of goodwill was assigned

to the Upstream segment and represents the amount of the

consideration transferred in excess of the values assigned to

the individual assets acquired and liabilities assumed. Good-

will represents the future economic benets arising from

other assets acquired that could not be individually identied

and separately recognized. None of the goodwill is deduct-

ible for tax purposes. Goodwill recorded in the acquisition

is not subject to amortization, but will be tested periodically

for impairment as required by the applicable accounting stan-

dard (ASC 350).

Note 26

Acquisition of Atlas Energy, Inc.

On February 17, 2011, the company acquired Atlas Energy,

Inc. (Atlas), which held one of the premier acreage positions in

the Marcellus Shale, concentrated in southwestern Pennsylva-

nia. e aggregate purchase price of Atlas was approximately

$4,500, which included $3,009 cash for all the common shares

of Atlas, a $403 cash advance to facilitate Atlas’ purchase of a

49 percent interest in Laurel Mountain Midstream LLC and

about $1,100 of assumed debt. Subsequent to the close of the

transaction, the company paid o the assumed debt and made

payments of $184 in connection with Atlas equity awards. As

part of the acquisition, Chevron assumed the terms of a carry

arrangement whereby Reliance Marcellus, LLC, funds 75 per-

cent of Chevron’s drilling costs, up to $1,300.

e acquisition was accounted for as a business combina-

tion (ASC 805) which, among other things, requires assets

acquired and liabilities assumed to be measured at their

acquisition date fair values. Provisional fair value measure-

ments were made in rst quarter 2011 for acquired assets and

assumed liabilities, and the measurement process was nal-

ized in fourth quarter 2011.

Proforma nancial information is not presented, as it

would not be materially dierent from the information pre-

sented in the Consolidated Statement of Income.

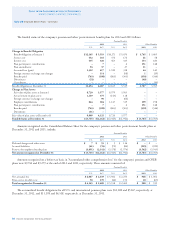

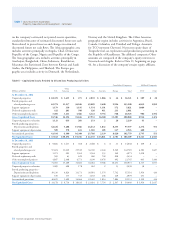

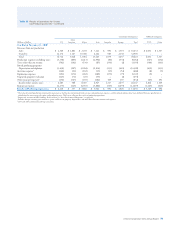

e following table summarizes the measurement of the

assets acquired and liabilities assumed:

At February 17, 2011

Current assets $ 155

Investments and long-term receivables 456

Properties 6,051

Goodwill 27

Other assets 5

Total assets acquired 6,694

Current liabilities (560)

Long-term debt and capital leases (761)

Deferred income taxes (1,915)

Other liabilities (25)

Total liabilities assumed (3,261)

Net assets acquired $ 3,433

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

68 Chevron Corporation 2012 Annual Report