Chevron 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

22 Chevron Corporation 2012 Annual Report

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Financial and Derivative Instruments

e market risk associated with the company’s portfolio of

nancial and derivative instruments is discussed below. e

estimates of nancial exposure to market risk do not rep-

resent the company’s projection of future market changes.

e actual impact of future market changes could dier

materially due to factors discussed elsewhere in this report,

including those set forth under the heading “Risk Factors”

in Part I, Item 1A, of the company’s 2012 Annual Report on

Form 10-K.

Derivative Commodity Instruments Chevron is

exposed to market risks related to the price volatility of crude

oil, rened products, natural gas, natural gas liquids, lique-

ed natural gas and renery feedstocks.

e company uses derivative commodity instruments to

manage these exposures on a portion of its activity, including

rm commitments and anticipated transactions for the pur-

chase, sale and storage of crude oil, rened products, natural

gas, natural gas liquids and feedstock for company reneries.

e company also uses derivative commodity instruments for

limited trading purposes. e results of these activities were

not material to the company’s nancial position, results of

operations or cash ows in 2012.

e company’s market exposure positions are monitored

and managed on a daily basis by an internal Risk Control

group in accordance with the company’s risk management

policies, which have been approved by the Audit Committee

of the company’s Board of Directors.

e derivative commodity instruments used in the

company’s risk management and trading activities consist

mainly of futures, options and swap contracts traded on the

New York Mercantile Exchange and on electronic platforms

of the Inter-Continental Exchange and Chicago Mercantile

Exchange. In addition, crude oil, natural gas and rened

product swap contracts and option contracts are entered into

principally with major nancial institutions and other oil and

gas companies in the “over-the-counter” markets.

Derivatives beyond those designated as normal purchase

and normal sale contracts are recorded at fair value on the

Consolidated Balance Sheet in accordance with accounting

standards for derivatives (ASC 815), with resulting gains and

losses reected in income. Fair values are derived principally

from published market quotes and other independent third-

party quotes. e change in fair value of Chevron’s derivative

commodity instruments in 2012 was a quarterly average

decrease of $31 million in total assets and a quarterly average

increase of $12 million in total liabilities.

e company uses a Value-at-Risk (VaR) model to esti-

mate the potential loss in fair value on a single day from the

eect of adverse changes in market conditions on derivative

commodity instruments held or issued. VaR is the maximum

projected loss not to be exceeded within a given probability

or condence level over a given period of time. e compa-

ny’s VaR model uses the Monte Carlo simulation method

that involves generating hypothetical scenarios from the

specied probability distributions and constructing a full

distribution of a portfolio’s potential values.

e VaR model utilizes an exponentially weighted

moving average for computing historical volatilities and

correlations, a 95 percent condence level, and a one-day

holding period. at is, the company’s 95 percent, one-day

VaR corresponds to the unrealized loss in portfolio value that

would not be exceeded on average more than one in every 20

trading days, if the portfolio were held constant for one day.

e one-day holding period is based on the assumption

that market-risk positions can be liquidated or hedged within

one day. For hedging and risk management, the company

uses conventional exchange-traded instruments such as

futures and options as well as non-exchange-traded swaps,

most of which can be liquidated or hedged eectively within

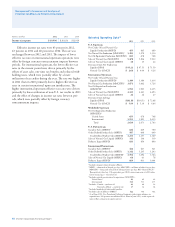

one day. e following table presents the 95 percent/one-day

VaR for each of the company’s primary risk exposures in the

area of derivative commodity instruments at December 31,

2012 and 2011.

Millions of dollars 2012 2011

Crude Oil $ 3 $ 22

Natural Gas 3 4

Rened Products 12 11

Foreign Currency e company may enter into foreign

currency derivative contracts to manage some of its foreign

currency exposures. ese exposures include revenue and

anticipated purchase transactions, including foreign currency

capital expenditures and lease commitments. e foreign cur-

rency derivative contracts, if any, are recorded at fair value on

the balance sheet with resulting gains and losses reected in

income. ere were no open foreign currency derivative con-

tracts at December 31, 2012.

Interest Rates e company may enter into interest rate

swaps from time to time as part of its overall strategy to

manage the interest rate risk on its debt. Interest rate swaps,

if any, are recorded at fair value on the balance sheet with

resulting gains and losses reected in income. At year-end

2012, the company had no interest rate swaps.