Chevron 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Chevron Corporation 2012 Annual Report

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

natural gas and rened products. Derivatives classied

as Level 1 include futures, swaps and options contracts

traded in active markets such as the New York Mercantile

Exchange.

Derivatives classied as Level 2 include swaps,

options, and forward contracts principally with nancial

institutions and other oil and gas companies, the fair val-

ues of which are obtained from third-party broker quotes,

industry pricing services and exchanges. e company

obtains multiple sources of pricing information for the

Level 2 instruments. Since this pricing information is

generated from observable market data, it has historically

been very consistent. e company does not materi-

ally adjust this information. e company incorporates

internal review, evaluation and assessment procedures,

including a comparison of Level 2 fair values derived from

the company’s internally developed forward curves (on a

sample basis) with the pricing information to document

reasonable, logical and supportable fair value determina-

tions and proper level of classication.

Properties, plant and equipment e company did not

have any material long-lived assets measured at fair value

on a nonrecurring basis to report in 2012 or 2011.

Investments and advances e company did not have

any material investments and advances measured at fair

value on a nonrecurring basis to report in 2012 or 2011.

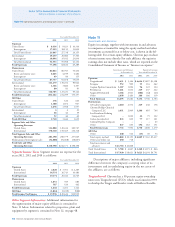

Note 8 Fair Value Measurements – Continued

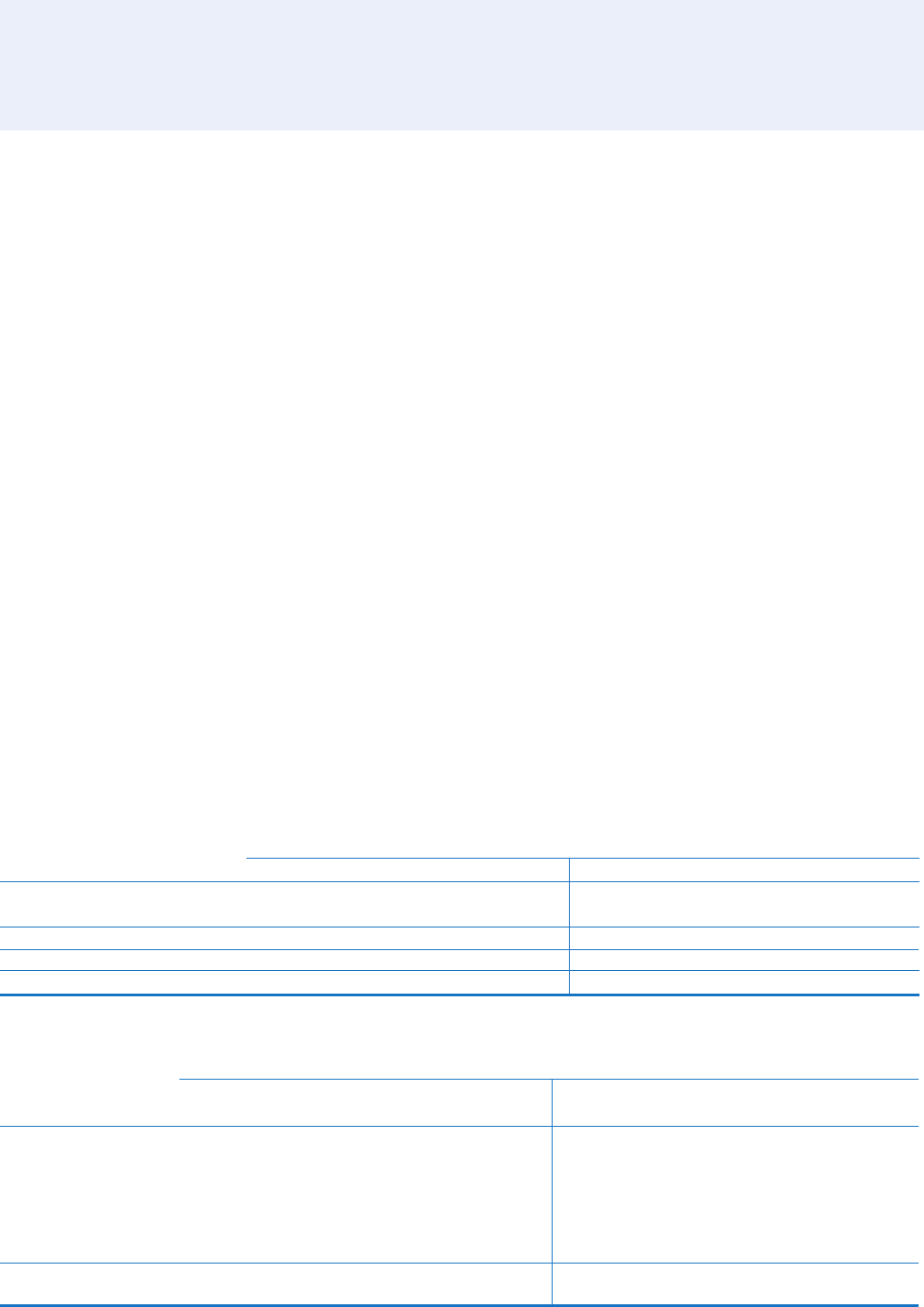

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

At December 31 At December 31

Total Level 1 Level 2 Level 3

Before-Tax

Loss

Year 2012 Total Level 1 Level 2 Level 3

Before-Tax

Loss

Year 2011

Properties, plant and

equipment, net

(held and used) $ 84 $ – $ – $ 84 $ 213 $ 67 $ – $ – $ 67 $ 81

Properties, plant and

equipment, net

(held for sale) 16 – – 16 17 167 – 167 – 54

Investments and advances – – – – 15 – – – – 108

Total Nonrecurring

Assets at Fair Value $ 100 $ – $ – $ 100 $ 245 $ 234 $ – $ 167 $ 67 $ 243

Level 3: Unobservable inputs. e company does not

use Level 3 inputs for any of its recurring fair value

measurements. Level 3 inputs may be required for

the determination of fair value associated with cer-

tain nonrecurring measurements of nonnancial assets

and liabilities.

e table below shows the fair value hierarchy for assets

and liabilities measured at fair value on a recurring basis at

December 31, 2012, and December 31, 2011.

Marketable Securities e company calculates fair value for

its marketable securities based on quoted market prices for

identical assets and liabilities. e fair values reect the cash

that would have been received if the instruments were sold at

December 31, 2012.

Derivatives e company records its derivative instru-

ments – other than any commodity derivative contracts that

are designated as normal purchase and normal sale – on the

Consolidated Balance Sheet at fair value, with the osetting

amount to the Consolidated Statement of Income. For deriv-

atives with identical or similar provisions as contracts that

are publicly traded on a regular basis, the company uses the

market values of the publicly traded instruments as an input

for fair value calculations.

e company’s derivative instruments principally include

futures, swaps, options and forward contracts for crude oil,

Assets and Liabilities Measured at Fair Value on a Recurring Basis

At December 31, 2012 At December 31, 2011

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3

Marketable securities $ 266 $ 266 $ – $ – $ 249 $ 249 $ – $ –

Derivatives 86 21 65 – 208 104 104 –

Total Assets at Fair Value $ 352 $ 287 $ 65 $ – $ 457 $ 353 $ 104 $ –

Derivatives 149 148 1 – 102 101 1 –

Total Liabilities at Fair Value $ 149 $ 148 $ 1 $ – $ 102 $ 101 $ 1 $ –