Chevron 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

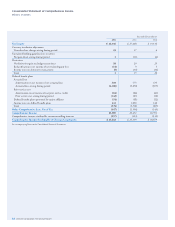

40 Chevron Corporation 2012 Annual Report

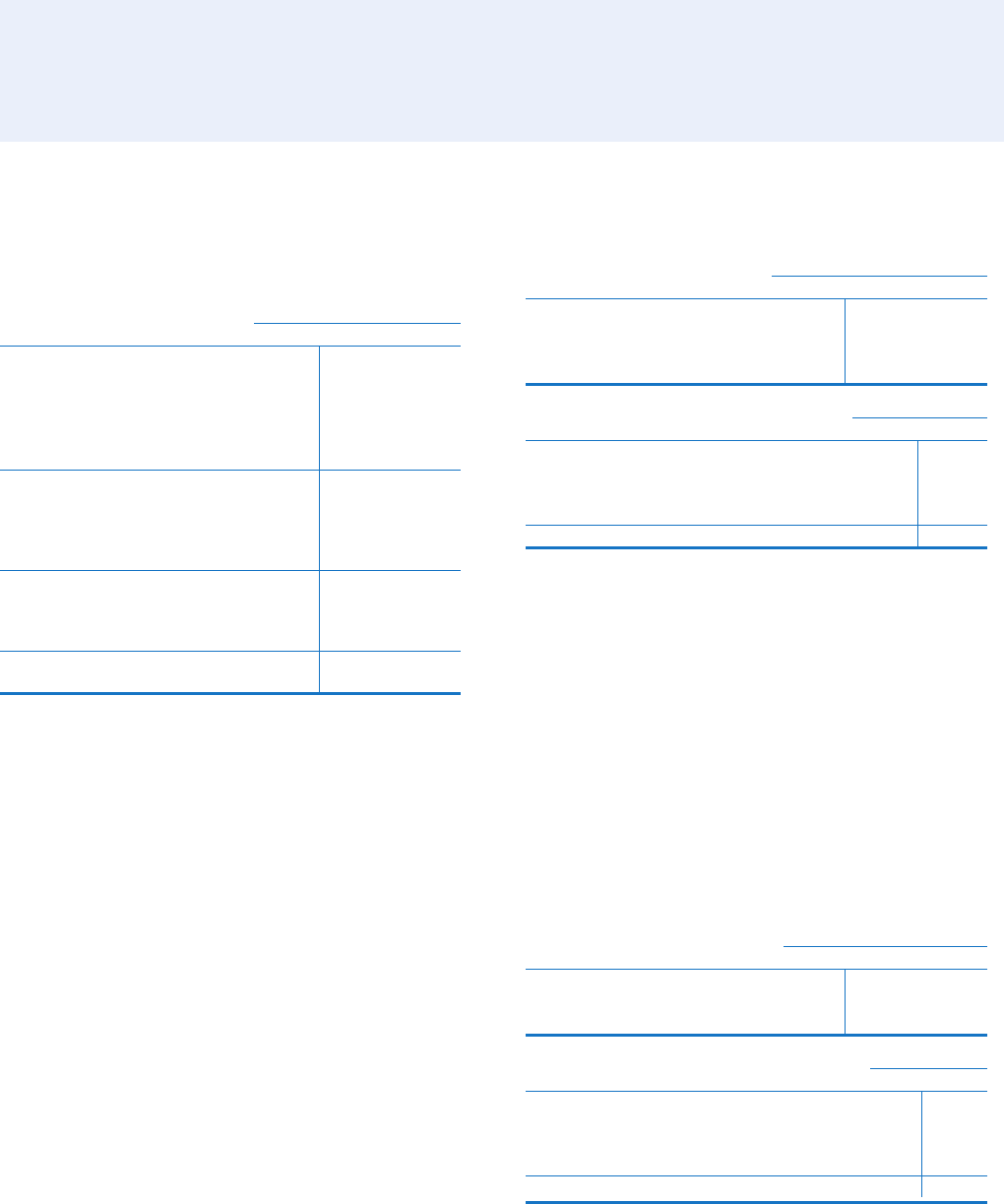

e major components of “Capital expenditures” and

the reconciliation of this amount to the reported capital and

exploratory expenditures, including equity affiliates, are

presented in the following table:

Year ended December 31

2012 2011 2010

Additions to properties, plant

and equipment* $ 29,526 $ 25,440 $ 18,474

Additions to investments 1,042 900 861

Current-year dry hole expenditures 475 332 414

Payments for other liabilities

and assets, net (105) (172) (137)

Capital expenditures 30,938 26,500 19,612

Expensed exploration expenditures 1,173 839 651

Assets acquired through capital

lease obligations and other

nancing obligations 1 32 104

Capital and exploratory expenditures,

excluding equity aliates 32,112 27,371 20,367

Company’s share of expenditures

by equity aliates 2,117 1,695 1,388

Capital and exploratory expenditures,

including equity aliates $ 34,229 $ 29,066 $ 21,755

*Excludes noncash additions of $4,569 in 2012, $945 in 2011 and $2,753 in 2010.

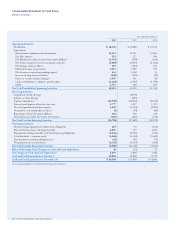

Note 4

Summarized Financial Data — Chevron U.S.A. Inc.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of

Chevron Corporation. CUSA and its subsidiaries manage

and operate most of Chevron’s U.S. businesses. Assets include

those related to the exploration and production of crude oil,

natural gas and natural gas liquids and those associated with

the rening, marketing, supply and distribution of products

derived from petroleum, excluding most of the regulated

pipeline operations of Chevron. CUSA also holds the

company’s investment in the Chevron Phillips Chemical

Company LLC joint venture, which is accounted for using

the equity method.

During 2012, Chevron implemented legal reorganiza-

tions in which certain Chevron subsidiaries transferred assets

to or under CUSA. e summarized nancial information

for CUSA and its consolidated subsidiaries presented in the

table below gives retroactive eect to the reorganizations as if

they had occurred on January 1, 2010. However, the nancial

information in the following table may not reect the nancial

position and operating results in the periods presented if the

reorganization had occurred on that date.

e summarized nancial information for CUSA and its

consolidated subsidiaries is as follows:

Year ended December 31

2012 2011 2010

Sales and other operating

revenues $ 183,215 $ 187,929 $ 143,352

Total costs and other deductions 175,009 178,510 137,964

Net income attributable to CUSA 6,216 6,898 4,154

At December 31

2012 2011

Current assets $ 18,983 $ 34,490

Other assets 52,082 47,556

Current liabilities 18,161 19,081

Other liabilities 26,472 26,160

Total CUSA net equity $ 26,432 $ 36,805

Memo: Total debt $ 14,482 $ 14,763

Note 5

Summarized Financial Data — Chevron Transport Corporation Ltd.

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s inter-

national tanker eet and is engaged in the marine transportation

of crude oil and rened petroleum products. Most of CTC’s

shipping revenue is derived from providing transportation serv-

ices to other Chevron companies. Chevron Corporation has

fully and unconditionally guaranteed this subsidiary’s obliga-

tions in connection with certain debt securities issued by a third

party. Summarized nancial information for CTC and its

consolidated subsidiaries is as follows:

Year ended December 31

2012 2011 2010

Sales and other operating revenues $ 606 $ 793 $ 885

Total costs and other deductions 745 974 1,008

Net loss attributable to CTC (135) (177) (116)

At December 31

2012 2011

Current assets $ 199 $ 290

Other assets 313 228

Current liabilities 154 114

Other liabilities 415 346

Total CTC net (decit) equity $ (57) $ 58

ere were no restrictions on CTC’s ability to pay divi-

dends or make loans or advances at December 31, 2012.

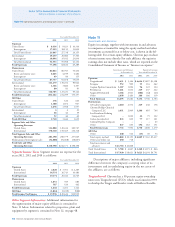

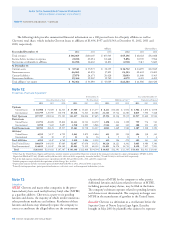

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

Note 3 Information Relating to the Consolidated Statement of Cash Flows – Continued