Chevron 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2012 Annual Report 11

also inhibit the company’s production capacity in an aected

region. e company closely monitors developments in the

countries in which it operates and holds investments, and

seeks to manage risks in operating its facilities and busi-

nesses. e longer-term trend in earnings for the upstream

segment is also a function of other factors, including the

company’s ability to nd or acquire and eciently produce

crude oil and natural gas, changes in scal terms of contracts,

and changes in tax laws and regulations.

e company continues to actively manage its schedule

of work, contracting, procurement and supply-chain activities

to eectively manage costs. However, price levels for capital

and exploratory costs and operating expenses associated with

the production of crude oil and natural gas can be subject

to external factors beyond the company’s control. External

factors include not only the general level of ination, but

also commodity prices and prices charged by the industry’s

material and service providers, which can be aected by the

volatility of the industry’s own supply-and-demand condi-

tions for such materials and services. Capital and exploratory

expenditures and operating expenses can also be aected by

damage to production facilities caused by severe weather or

civil unrest.

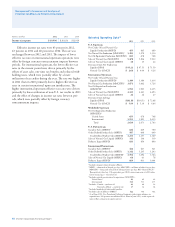

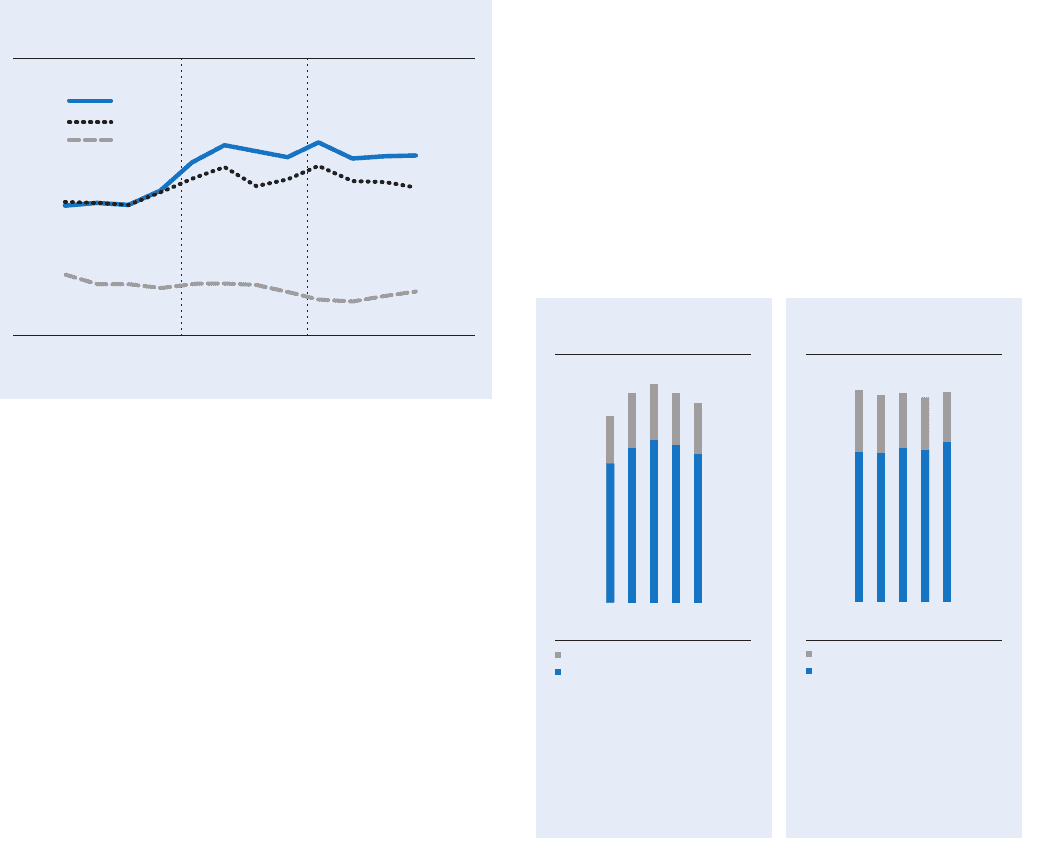

e chart above shows the trend in benchmark prices

for Brent crude oil, West Texas Intermediate (WTI) crude

oil and U.S. Henry Hub natural gas. e Brent price aver-

aged $112 per barrel for the full-year 2012, compared to

$111 in 2011. As of mid-February 2013, the Brent price was

about $118 per barrel. e majority of the company’s equity

crude production is priced based on the Brent benchmark.

e WTI price averaged $94 per barrel for the full-year

2012, compared to $95 in 2011. As of mid-February 2013,

the WTI price was about $97 per barrel. WTI traded at a

discount to Brent throughout 2012 due to high inventories

in the U.S. midcontinent market driven by strong growth in

domestic production.

A dierential in crude oil prices exists between high-

quality (high-gravity, low-sulfur) crudes and those of lower

quality (low-gravity, high-sulfur). e amount of the dif-

ferential in any period is associated with the supply of heavy

crude available versus the demand, which is a function of

the capacity of reneries that are able to process this lower

quality feedstock into light products (motor gasoline, jet

fuel, aviation gasoline and diesel fuel). During 2012, the dif-

ferential between U.S. light and heavy crude oil remained

below historical norms as light sweet crude oil production in

the midcontinent region increased and outbound capacity at

Cushing remained constrained. Outside of the U.S., the dif-

ferential narrowed modestly during 2012 as additional heavy

crude oil conversion capacity came on line.

Chevron produces or shares in the production of heavy

crude oil in California, Chad, Indonesia, the Partitioned

Zone between Saudi Arabia and Kuwait, Venezuela and in

certain elds in Angola, China and the United Kingdom

sector of the North Sea. (See page 18 for the company’s

average U.S. and international crude oil realizations.)

In contrast to price movements in the global market

for crude oil, price changes for natural gas in many regional

markets are more closely aligned with supply-and-demand

conditions in those markets. In the United States, prices at

Henry Hub averaged $2.71 per thousand cubic feet (MCF)

during 2012, compared with about $4.00 during 2011. As

of mid-February 2013, the Henry Hub spot price was about

$3.30 per MCF. Fluctuations in the price of natural gas

in the United States are closely associated with customer

demand relative to the volumes produced in North America.

Outside the United States, price changes for natural gas

depend on a wide range of supply, demand and regulatory

circumstances. In some locations, Chevron is investing in

long-term projects to install infrastructure to produce and

liquefy natural gas for transport by tanker to other markets.

International natural gas realizations averaged about $6.00

per MCF during 2012, compared with about $5.40 per MCF

during 2011. (See page 18 for the company’s average natural

gas realizations for the U.S. and international regions.)

WTI Crude Oil, Brent Crude Oil and Henry Hub Natural Gas Spot Prices —

Quarterly Average

0

60

150

120

90

30

0

10

25

20

15

5

1Q 2Q 3Q 4Q 1Q 1Q2Q 2Q3Q 3Q4Q 4Q

WTI/Brent

$/bbl

HH

$/mcf

2010 2011 2012

Brent

WTI

HH

0

5500

4400

1100

2200

3300

Net natural gas production increased

3 percent in 2012 mainly due to

increases in Thailand, Bangladesh

and the Marcellus Shale. Partially

offsetting the increases were field

declines in the United States,

Australia and the United Kingdom.

* Includes equity in affiliates.

Net Natural Gas Production*

Millions of cubic feet per day

United States

International

0908 10 11 12

5,074

0

2000

1600

1200

800

400

Net Liquids Production*

Thousands of barrels per day

United States

International

Net liquids production decreased

5 percent in 2012 mainly due to

field declines in the United States

and international locations, the

shut-in of the Frade Field in Brazil,

and a major planned turnaround at

Tengizchevroil.

* Includes equity in affiliates.

0908 10 11 12

1,764