Chevron 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Chevron Corporation 2012 Annual Report 25

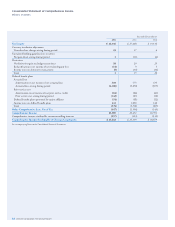

expense was based on the market value in the preceding three

months. Management considers the three-month period long

enough to minimize the eects of distortions from day-to-

day market volatility and still be contemporaneous to the end

of the year. For other plans, market value of assets as of year-

end is used in calculating thepension expense.

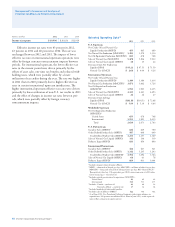

e discount rate assumptions used to determine the U.S.

and international pension and postretirement benet plan

obligations and expense reect the rate at which benets could

be eectively settled and is equal to the equivalent single rate

resulting from yield curve analysis. is analysis considered

the projected benet payments specic to the company’s plans

and the yields on high-quality bonds. At December 31, 2012,

the company used a 3.6 percent discount rate for the U.S. pen-

sion plans and 3.9 percent for the main U.S. OPEB plan. e

discount rates at the end of 2011 and 2010 were 3.8 and 4.0

percent and 4.8 and 5.0 percent for the U.S. pension plans and

the main U.S. OPEB plans, respectively.

An increase in the expected long-term return on plan

assets or the discount rate would reduce pension plan

expense, and vice versa. Total pension expense for 2012 was

$1.3 billion. As an indication of the sensitivity of pension

expense to the long-term rate of return assumption, a 1 per-

cent increase in the expected rate of return on assets of the

company’s primary U.S. pension plan would have reduced

total pension plan expense for 2012 by approximately

$80million. A 1 percent increase in the discount rate for

this same plan, which accounted for about 62 percent of the

companywide pension obligation, would have reduced total

pension plan expense for 2012 by approximately $165 million.

An increase in the discount rate would decrease the

pension obligation, thus changing the funded status of

a plan reported on the Consolidated Balance Sheet. e

aggregate funded status recognized on the Consolidated

Balance Sheet at December 31, 2012, was a net liability of

approximately $5.9 billion. As an indication of the sensitivity

of pension liabilities to the discount rate assumption, a 0.25

per cent increase in the discount rate applied to the com-

pany’s primary U.S. pension plan would have reduced the

plan obligation by approximately $335 million, which would

have decreased the plan’s underfunded status from approxi-

mately $2.6 billion to $2.2 billion. Other plans would be

less underfunded as discount rates increase. e actual rates

of return on plan assets and discount rates may vary signi-

cantly from estimates because of unanticipated changes in

the world’s nancial markets.

In 2012, the company’s pension plan contributions

were $1.2 billion (including $844 million to the U.S. plans).

In 2013, the company estimates contributions will be

approximately $1.0 billion. Actual contribution amounts are

dependent upon investment results, changes in pension obli-

gations, regulatory requirements and other economic factors.

Additional funding may be required if investment returns are

insucient to oset increases in plan obligations.

For the company’s OPEB plans, expense for 2012 was

$172million, and the total liability, which reected the unfunded

status of the plans at the end of 2012, was $3.8 billion.

As an indication of discount rate sensitivity to the deter-

mination of OPEB expense in 2012, a 1 percent increase in

the discount rate for the company’s primary U.S. OPEB plan,

which accounted for about 82 percent of the companywide

OPEB expense, would have decreased OPEB expense by

approximately $17 million. A 0.25 percent increase in the

discount rate for the same plan, which accounted for about

83 percent of the companywide OPEB liabilities, would

have decreased total OPEB liabilities at the end of 2012 by

approximately $80 million.

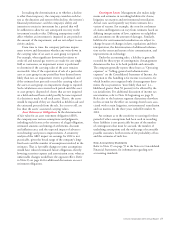

For the main U.S. postretirement medical plan, the

annual increase to company contributions is limited to 4 per-

cent per year. For active employees and retirees under age 65

whose claims experiences are combined for rating purposes,

the assumed health care cost-trend rates start with 7.5 percent

in 2013 and gradually drop to 4.5 percent for 2025 and

beyond. As an indication of the health care cost-trend rate

sensitivity to the determination of OPEB expense in 2012, a

1 percent increase in the rates for the main U.S. OPEB plan,

would have increased OPEB expense by $15 million.

Dierences between the various assumptions used to

determine expense and the funded status of each plan and

actual experience are not included in benet plan costs in

theyear the dierence occurs. Instead, the dierences are

included in actuarial gain/loss and unamortized amounts

have been reected in “Accumulated other comprehensive

loss” on the Consolidated Balance Sheet. Refer to Note 20,

beginning on page 57, for information on the $9.7bil-

lion ofbefore-tax actuarial losses recorded by the company as

of December 31, 2012; a description of the method used to

amortize those costs; and an estimate of the costs to be rec-

ognized in expense during 2013.

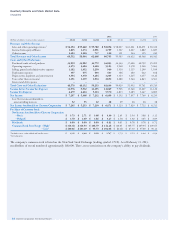

Oil and Gas Reserves Crude oil and natural gas

reserves are estimates of future production that impact cer-

tain asset and expense accounts included in the Consolidated

Financial Statements. Proved reserves are the estimated quan-

tities of oil and gas that geoscience and engineering data

demonstrate with reasonable certainty to be economically

producible in the future under existing economic conditions,

operating methods and government regulations. Proved

reserves include both developed and undeveloped volumes.

Proved developed reserves represent volumes expected to be

recovered through existing wells with existing equipment and

operating methods. Proved undeveloped reserves are volumes

expected to be recovered from new wells on undrilled proved

acreage, or from existing wells where a relatively major expen-

diture is required for recompletion. Variables impacting

Chevron’s estimated volumes of crude oil and natural gas

reserves include eld performance, available technology and

economic conditions.

e estimates of crude oil and natural gas reserves are

important to the timing of expense recognition for costs

incurred and to the valuation of certain oil and gas produc-

ing assets. Impacts of oil and gas reserves on Chevron’s