Chevron 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Chevron Corporation 2012 Annual Report

Notes to the Consolidated Financial Statements

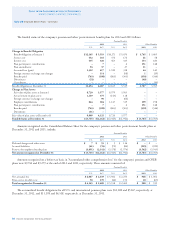

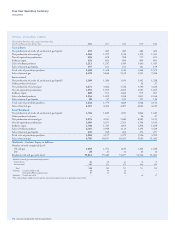

Millions of dollars, except per-share amounts

claimed by an unrelated taxpayer. It is reasonably possible

that the specic ndings from this assessment could result

in a signicant increase in unrecognized tax benets, which

may have a material eect on the company’s results of opera-

tions in any one reporting period. e company does not

expect settlement of income tax liabilities associated with

uncertain tax positions to have a material eect on its con-

solidated nancial position or liquidity.

Guarantees e company’s guarantee of $562 is associ-

ated with certain payments under a terminal use agreement

entered into by an equity aliate. Over the approximate

15-year remaining term of the guarantee, the maximum

guarantee amount will be reduced over time as certain fees

are paid by the aliate. ere are numerous cross-indemnity

agreements with the aliate and the other partners to permit

recovery of amounts paid under the guarantee. Chevron has

recorded no liability for its obligation under this guarantee.

Indemnications e company provided certain indemni-

ties of contingent liabilities of Equilon and Motiva to Shell

and Saudi Rening, Inc., in connection with the February

2002 sale of the company’s interests in those investments.

rough the end of 2012, the company paid $48 under these

indemnities and continues to be obligated up to $250 for

possible additional indemnication payments in the future.

e company has also provided indemnities relating to

contingent environmental liabilities of assets originally con-

tributed by Texaco to the Equilon and Motiva joint ventures

and environmental conditions that existed prior to the for-

mation of Equilon and Motiva, or that occurred during the

period of Texaco’s ownership interest in the joint ventures. In

general, the environmental conditions or events that are sub-

ject to these indemnities must have arisen prior to December

2001. Claims had to be asserted by February 2009 for

Equilon indemnities and February 2012 for Motiva indem-

nities. In February 2012, Motiva Enterprises LLC delivered

a letter to the company purporting to preserve unmatured

claims for certain Motiva indemnities. e company had

previously provided a negative response to similar claims.

e letter itself provides no estimate of the ultimate claim

amount. Management does not believe this letter or any

other information provides a basis to estimate the amount, if

any, of a range of loss or potential range of loss with respect

to either the Equilon or the Motiva indemnities. e com-

pany posts no assets as collateral and has made no payments

under the indemnities.

rough December 31, 2012, the company has not

received further correspondence from Equilon and Motiva

Enterprises LLC, and the company does not expect further

action to occur related to the indemnities described in the

preceding paragraphs.

In the acquisition of Unocal, the company assumed

certain indemnities relating to contingent environmental

liabilities associated with assets that were sold in 1997. e

acquirer of those assets shared in certain environmental

remediation costs up to a maximum obligation of $200,

which had been reached at December 31, 2009. Under the

indemnication agreement, after reaching the $200 obliga-

tion, Chevron is solely responsible until April 2022, when

the indemnication expires. e environmental conditions or

events that are subject to these indemnities must have arisen

prior to the sale of the assets in 1997.

Although the company has provided for known obliga-

tions under this indemnity that are probable and reasonably

estimable, the amount of additional future costs may be

material to results of operations in the period in which they

are recognized. e company does not expect these costs will

have a material eect on its consolidated nancial position or

liquidity.

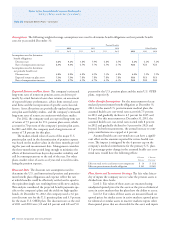

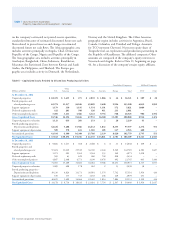

Long-Term Unconditional Purchase Obligations and

Commitments, Including roughput and Take-or-Pay

Agreements e company and its subsidiaries have certain

other contingent liabilities with respect to long-term uncon-

ditional purchase obligations and commitments, including

throughput and take-or-pay agreements, some of which relate

to suppliers’ nancing arrangements. e agreements typi-

cally provide goods and services, such as pipeline and storage

capacity, drilling rigs, utilities, and petroleum products,

to be used or sold in the ordinary course of the company’s

business. e aggregate approximate amounts of required

payments under these various commitments are: 2013 –

$3,700; 2014 – $3,900; 2015 – $4,100; 2016 – $2,400; 2017

– $1,800; 2018 and after – $6,500. A portion of these com-

mitments may ultimately be shared with project partners.

Total payments under the agreements were approximately

$3,600 in 2012, $6,600 in 2011 and $6,500 in 2010.

Environmental e company is subject to loss contingen-

cies pursuant to laws, regulations, private claims and legal

proceedings related to environmental matters that are subject

to legal settlements or that in the future may require the

company to take action to correct or ameliorate the eects on

the environment of prior release of chemicals or petroleum

substances, including MTBE, by the company or other par-

ties. Such contingencies may exist for various sites, including,

but not limited to, federal Superfund sites and analogous sites

under state laws, reneries, crude oil elds, service stations,

terminals, land development areas, and mining operations,

whether operating, closed or divested. ese future costs are

not fully determinable due to such factors as the unknown

magnitude of possible contamination, the unknown timing

and extent of the corrective actions that may be required,

Note 22 Other Contingencies and Commitments – Continued