Chevron 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

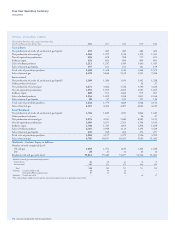

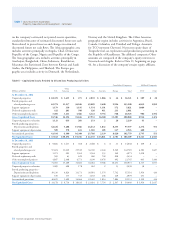

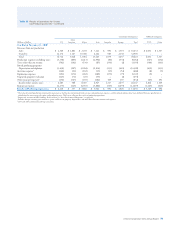

Table V Reserve Quantity Information

Reserves Governance e company has adopted a compre-

hensive reserves and resource classication system modeled

after a system developed and approved by the Society of

Petroleum Engineers, the World Petroleum Congress and

the American Association of Petroleum Geologists. e sys-

tem classies recoverable hydrocarbons into six categories

based on their status at the time of reporting – three deemed

commercial and three potentially recoverable. Within the

commercial classication are proved reserves and two cat-

egories of unproved: probable and possible. e potentially

recoverable categories are also referred to as contingent

resources. For reserves estimates to be classied as proved,

they must meet all SEC and company standards.

Proved oil and gas reserves are the estimated quantities

that geoscience and engineering data demonstrate with rea-

sonable certainty to be economically producible in the future

from known reservoirs under existing economic conditions,

operating methods and government regulations. Net proved

reserves exclude royalties and interests owned by others and

reect contractual arrangements and royalty obligations in

eect at the time of the estimate.

Proved reserves are classied as either developed or unde-

veloped. Proved developed reserves are the quantities expected

to be recovered through existing wells with existing equip-

ment and operating methods.

Due to the inherent uncertainties and the limited nature

of reservoir data, estimates of reserves are subject to change as

additional information becomes available.

Proved reserves are estimated by company asset teams

composed of earth scientists and engineers. As part of the

internal control process related to reserves estimation, the

company maintains a Reserves Advisory Committee (RAC)

that is chaired by the Manager of Corporate Reserves, a cor-

porate department that reports directly to the Vice Chairman

responsible for the company’s worldwide exploration and

production activities. e Manager of Corporate Reserves has

more than 30 years’ experience working in the oil and gas

industry and a Master of Science in Petroleum Engineering

degree from Stanford University. His experience includes

more than 15 years of managing oil and gas reserves processes.

He was chairman of the Society of Petroleum Engineers Oil

and Gas Reserves Committee, served on the United Nations

Expert Group on Resources Classication, and is a past mem-

ber of the Joint Committee on Reserves Evaluator Training

and the California Conservation Committee. He is an active

member of the Society of Petroleum Evaluation Engineers

and serves on the Society of Petroleum Engineers Oil and Gas

Reserves Committee.

All RAC members are degreed professionals, each

with more than 15 years of experience in various aspects of

reserves estimation relating to reservoir engineering, petro-

leum engineering, earth science or nance. e members

are knowledgeable in SEC guidelines for proved reserves

classication and receive annual training on the preparation

of reserves estimates. e reserves activities are managed by

two operating company-level reserves managers. ese two

reserves managers are not members of the RAC so as to pre-

serve corporate-level independence.

Consolidated Companies Aliated Companies

Other

U.S. Americas Africa Asia Australia Europe Total TCO Other

Year Ended December 31, 2012

Average sales prices

Liquids, per barrel $ 95.21 $ 87.87 $ 109.64 $ 102.46 $ 103.06 $ 108.77 $ 101.61 $ 89.34 $ 83.97

Natural gas, per thousand cubic feet 2.65 3.59 1.22 6.03 10.99 10.10 5.42 1.36 5.39

Average production costs, per barrel2 16.99 18.38 12.14 16.71 4.86 15.72 15.46 4.42 18.73

Year Ended December 31, 20113

Average sales prices

Liquids, per barrel $ 97.51 $ 89.87 $ 109.45 $ 100.55 $ 103.70 $ 107.11 $ 101.63 $ 94.60 $ 90.90

Natural gas, per thousand cubic feet 4.02 2.97 0.41 5.28 9.98 9.91 5.29 1.60 6.57

Average production costs, per barrel2 15.08 14.62 9.48 17.47 3.41 11.44 13.98 4.23 10.54

Year Ended December 31, 20103

Average sales prices

Liquids, per barrel $ 71.59 $ 66.22 $ 78.00 $ 70.96 $ 76.43 $ 76.10 $ 73.24 $ 63.94 $ 64.92

Natural gas, per thousand cubic feet 4.25 2.52 0.73 4.45 6.76 7.09 4.55 1.41 4.20

Average production costs, per barrel2 13.11 11.86 8.57 11.71 2.55 9.42 10.96 3.14 7.37

1 e value of owned production consumed in operations as fuel has been eliminated from revenues and production expenses, and the related volumes have been deducted from net

production in calculating the unit average sales price and production cost. is has no eect on the results of producing operations.

2 Natural gas converted to oil-equivalent gas (OEG) barrels at a rate of 6 MCF = 1 OEG barrel.

3 2011 and 2010 conformed to 2012 presentation.

Table IV Results of Operations for Oil and

Gas Producing Activities — Unit Prices and Costs1

76 Chevron Corporation 2012 Annual Report