Chevron 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Chevron Corporation 2012 Annual Report 13

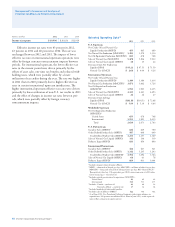

production in the Frade Field. e company’s ultimate expo-

sure related to the incident is not currently determinable, but

could be signicant to net income in any one period.

e company entered into a nonbinding nancing term

sheet with Petroboscan, a joint stock company owned 39.2

percent by Chevron, which operates the Boscan Field in Ven-

ezuela. When nalized, the nancing is expected to occur

in stages over a limited drawdown period and is intended to

support a specic work program to maintain and increase

production to an agreed-upon level. e terms are designed to

support cash needs for ongoing operations and new develop-

ment, as well as distributions to shareholders — including

current outstanding obligations. e loan will be repaid from

future Petroboscan crude sales. Denitive documents are

under negotiation.

Downstream Earnings for the downstream segment are

closely tied to margins on the rening, manufacturing and

marketing of products that include gasoline, diesel, jet fuel,

lubricants, fuel oil, fuel and lubricant additives, and petro-

chemicals. Industry margins are sometimes volatile and can

be aected by the global and regional supply-and-demand bal-

ance for rened products and petrochemicals and by changes

in the price of crude oil, other renery and petrochemical

feedstocks, and natural gas. Industry margins can also be

inuenced by inventory levels, geopolitical events, costs of

materials and services, renery or chemical plant capacity uti-

lization, maintenance programs, and disruptions at reneries

or chemical plants resulting from unplanned outages due to

severe weather, res or other operational events.

Other factors aecting protability for downstream opera-

tions include the reliability and eciency of the company’s

rening, marketing and petrochemical assets, the eectiveness

of its crude oil and product supply functions, and the volatility

of tanker-charter rates for the company’s shipping operations,

which are driven by the industry’s demand for crude oil and

product tankers. Other factors beyond the company’s control

include the general level of ination and energy costs to oper-

ate the company’s rening, marketing and petrochemical

assets.

e company’s most signicant marketing areas are the

West Coast of North America, the U.S. Gulf Coast, Asia and

southern Africa. Chevron operates or has signicant ownership

interests in reneries in each of these areas. e company com-

pleted a multiyear plan in 2012 to streamline the downstream

asset portfolio to concentrate resources and capital on strategic

assets. In third quarter 2012, the company completed the sale of

its Perth Amboy, New Jersey, renery, which had been operated

as a products terminal in recent years. In 2012, the company

completed the sale of its fuels marketing and aviation businesses

in eight countries in the Caribbean.

Refer to the “Results of Operations” section on pages 15

through 16 for additional discussion of the company’s down-

stream operations.

All Other consists of mining operations, power generation

businesses, worldwide cash management and debt nancing

activities, corporate administrative functions, insurance opera-

tions, real estate activities, energy services, alternative fuels, and

technology companies.

Operating Developments

Key operating developments and other events during 2012

and early 2013 included the following:

Upstream

Australia In October 2012, the company acquired addi-

tional interests in the Clio and Acme elds in the Carnarvon

Basin in exchange for Chevron’s interests in the Browse

development. Consolidating interests in the Carnarvon Basin

ts strategically with long-term plans to grow the Wheatstone

area resource base and creates expansion opportunities for the

Wheatstone Project.

In September 2012, the company completed the sale of

an equity interest in the Wheatstone Project to Tokyo Elec-

tric.

During 2012 and early 2013, the company announced

natural gas discoveries at the 47.3 percent-owned and oper-

ated Pontus prospect in Block WA-37-L, the 50 percent-owned

and operated Satyr prospect in Block WA-374-P, the 50 per-

cent-owned and operated Pinhoe prospect in Block

WA-383-P, the 50 percent-owned and operated Arnhem pros-

pect in Block WA-364-P, and the 50 percent-owned and

operated Kentish Knock South prospect in Block WA-365-P.

ese discoveries are expected to contribute to potential

expansion opportunities at company-operated LNG facilities.

During 2012, Chevron signed nonbinding Heads of

Agreement with Tohoku Electric and Chubu Electric and

additional binding agreements with Tokyo Electric for LNG

otake from the Wheatstone Project. To date, more than 80

percent of Chevron’s equity LNG from Wheatstone is cov-

ered under long-term agreements with customers in Asia.

Angola In early 2013, the company announced it plans

to proceed with the development of the Mafumeira Sul Project

located in Block 0.

Angola-Republic of the Congo Joint Development

Area In third quarter 2012, the company reached a nal

investment decision on the cross-border development of the

deepwater Lianzi Field.

Bangladesh In July 2012, the company reached a nal

investment decision on the Bibiyana Expansion Project.

Canada In February 2013, Chevron acquired a 50

percent-owned and operated interest in the Kitimat LNG

project and proposed Pacic Trail Pipeline, and a 50 percent

nonoperated interest in approximately 644,000 acres in the

Horn River and Liard Basins.

China In 2012, Chevron entered into an agreement to

acquire two exploration blocks in the South China Sea’s Pearl

River Mouth Basin. Government approval is expected in

2013.