Chevron 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

14 Chevron Corporation 2012 Annual Report

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Kurdistan Region of Iraq In third quarter 2012,

Chevron acquired an 80 percent interest and operatorship in

the Rovi and Sarta blocks.

Lithuania In October 2012, Chevron acquired a 50

percent interest in a company with exploration interests in a

shale gas block.

Morocco In January 2013, the company announced that

it had signed agreements to explore three oshore areas.

Nigeria In February 2012, production commenced at

the deepwater Usan project.

Sierra Leone In September 2012, the company was

awarded a 55 percent interest and operatorship in two deep-

water exploration blocks.

Suriname In November 2012, the company acquired a

50 percent interest in two oshore exploration blocks.

Ukraine In second quarter 2012, the company bid suc-

cessfully for the right to exclusively negotiate a 50 percent

interest and operatorship in a shale gas block.

United Kingdom In July 2012, the company initiated

front-end engineering and design (FEED) for the deepwater

Rosebank project west of the Shetland Islands.

United States In October 2012, the company acquired

additional acreage in New Mexico. A major portion of the

acreage is located in the Delaware Basin, where the company

is already one of the largest leaseholders.

In second quarter 2012, the company successfully bid

for additional shelf and deepwater exploration acreage in the

central Gulf of Mexico. In fourth quarter 2012, the company

submitted high bids for additional deepwater acreage in the

western Gulf of Mexico.

In rst quarter 2012, production commenced at the

Caesar/Tonga project in the deepwater Gulf of Mexico.

Downstream

Caribbean During 2012, the company completed the sale of

its fuels marketing and aviation businesses in eight countries

in the Caribbean.

Europe During rst quarter 2012, the company com-

pleted the sale of its fuels marketing, nished lubricants and

aviation businesses in Spain.

Saudi Arabia In October 2012, the company’s 50

percent-owned Chevron Phillips Chemical Company LLC

announced that its 35 percent-owned Saudi Polymers Com-

pany began commercial production at its new petrochemical

facility in Al-Jubail.

South Korea During 2012, the company’s 50 percent-

owned GS Caltex aliate completed the sale of certain power

and other assets.

United States In third quarter 2012, the company com-

pleted the sale of its idled Perth Amboy, New Jersey, renery,

which had been operating as a terminal.

In April 2012, the company’s 50 percent-owned Chevron

Phillips Chemical Company LLC announced the execution

of FEED contracts for an ethane cracker at its Cedar Bayou

facility in Baytown, Texas, and two polyethylene facilities

near its Sweeny facility in Old Ocean, Texas.

Other

Common Stock Dividends e quarterly common stock

dividend was increased by 11.1 percent in April 2012 to $0.90

per common share, making 2012 the 25th consecutive year

that the company increased its annual dividend payment.

Common Stock Repurchase Program e company

purchased $5.0 billion of its common stock in 2012 under its

share repurchase program. e program began in 2010 and

has no set term or monetary limits.

Results of Operations

Major Operating Areas e following section presents the

results of operations for the company’s business segments –

Upstream and Downstream – as well as for “All Other.”

Earnings are also presented for the U.S. and international

geographic areas of the Upstream and Downstream business

segments. Refer to Note 10, beginning on page 44, for a

discussion of the company’s “reportable segments,” as dened

in accounting standards forsegment reporting (Accounting

Standards Codication (ASC) 280). is section should also

be read in conjunction with the discussion in “Business

Environment and Outlook” on pages 10 through 13.

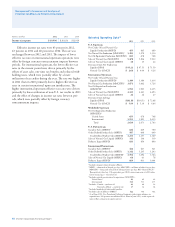

U.S. Upstream

Millions of dollars 2012 2011 2010

Earnings $ 5,332 $ 6,512 $ 4,122

U.S. upstream earnings of $5.3 billion in 2012 decreased

$1.2 billion from 2011, primarily due to lower natural gas

and crude oil realizations of $340 million and $200 million,

respectively, lower crude oil production of $240 million, and

lower gains on asset sales of $180 million.

U.S. upstream earnings of $6.5 billion in 2011 increased

$2.4 billion from 2010. e benet of higher crude oil realiza-

tions increased earnings by $2.8 billion between periods.

Partly osetting this eect were lower net oil-equivalent pro-

duction, which decreased earnings by about $400 million,

and higher operating expenses of $200 million.

e company’s average realization for U.S. crude oil and

natural gas liquids in 2012 was $95.21 per barrel, compared

with $97.51 in 2011 and $71.59 in 2010. e average natural

gas realization was $2.64 per thousand cubic feet in 2012,

compared with $4.04 and $4.26 in 2011 and 2010,

respectively.