Chevron 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Chevron Corporation 2012 Annual Report

Note 1

Summary of Significant Accounting Policies

General Upstream operations consist primarily of explor-

ing for, developing and producing crude oil and natural gas;

liquefaction, transportation and regasication associated with

liqueed natural gas (LNG); transporting crude oil by major

international oil export pipelines; processing, transporting,

storage and marketing of natural gas; and a gas-to-liquids

project. Downstream operations relate primarily to ren-

ing crude oil into petroleum products; marketing of crude

oil and rened products; transporting crude oil and rened

products by pipeline, marine vessel, motor equipment and

rail car; and manufacturing and marketing of commodity

petrochemicals, plastics for industrial uses, and additives for

fuels and lubricant oils.

e company’s Consolidated Financial Statements are

prepared in accordance with accounting principles gener-

ally accepted in the United States of America. ese require

the use of estimates and assumptions that aect the assets,

liabilities, revenues and expenses reported in the nancial

statements, as well as amounts included in the notes thereto,

including discussion and disclosure of contingent liabilities.

Although the company uses its best estimates and judgments,

actual results could dier from these estimates as future con-

rming events occur.

Subsidiary and Affiliated Companies e Consolidated

Financial Statements include the accounts of controlled sub-

sidiary companies more than 50 percent-owned and any

variable-interest entities in which the company is the primary

beneciary. Undivided interests in oil and gas joint ventures

and certain other assets are consolidated on a proportionate

basis. Investments in and advances to aliates in which the

company has a substantial ownership interest of approxi-

mately 20 percent to 50 percent, or for which the company

exercises signicant inuence but not control over policy

decisions, are accounted for by the equity method. As part of

that accounting, the company recognizes gains and losses

that arise from the issuance of stock by an aliate that

results in changes in thecompany’s proportionate share of

the dollar amount of the aliate’s equity currently in income.

Investments are assessed for possible impairment when

events indicate that the fair value of the investment may be

below the company’s carrying value. When such a condition

is deemed to be other than temporary, the carrying value of

the investment is written down to its fair value, and the

amount of the write-down is included in net income. In

making the determination as to whether a decline is other

than temporary, the company considers such factors as the

duration and extent of the decline, the investee’s nancial

performance, and the company’s ability and intention to

retain its investment for a period that will be sucient to

allow for any anticipated recovery in the investment’s market

value. e new cost basis of investments in these equity

investees is not changed for subsequent recoveries in fair value.

Dierences between the company’s carrying value of an

equity investment and its underlying equity in the net assets

of the aliate are assigned to the extent practicable to specic

assets and liabilities based on the company’s analysis of the

various factors giving rise to the dierence. When appro priate,

the company’s share of the aliate’s reported earnings is

adjusted quarterly to reect the dierence between these allo-

cated values and the aliate’s historical book values.

Derivatives e majority of the company’s activity in

derivative commodity instruments is intended to manage

the nancial risk posed by physical transactions. For some

of this derivative activity, generally limited to large, discrete

or infrequently occurring transactions, the company may

elect to apply fair value or cash ow hedge accounting. For

other similar derivative instruments, generally because of

the short-term nature of the contracts or their limited use,

the company does not apply hedge accounting, and changes

in the fair value of those contracts are reected in current

income. For the company’s commodity trading activity,

gains and losses from derivative instruments are reported in

current income. e company may enter into interest rate

swaps from time to time as part of its overall strategy to

manage the interest rate risk on its debt. Interest rate swaps

related to a portion of the company’s xed-rate debt, if any,

may be accounted for as fair value hedges. Interest rate swaps

related to oating-rate debt, if any, are recorded at fair value

on the balance sheet with resulting gains and losses reected

in income. Where Chevron is a party to master netting

arrangements, fair value receivable and payable amounts rec-

ognized for derivative instruments executed with the same

counterparty are generally oset on the balance sheet.

Short-Term Investments All short-term investments are

classied as available for sale and are in highly liquid debt

securities. ose investments that are part of the company’s

cash management portfolio and have original maturities

of three months or less are reported as “Cash equivalents.”

Bank time deposits with maturities greater than 90 days

are reported as “Time deposits.” e balance of short-term

investments is reported as “Marketable securities” and is

marked-to-market, with any unrealized gains or losses

included in “Other comprehensive income.”

Inventories Crude oil, petroleum products and chemicals

inventories aregenerally stated at cost, using a last-in, rst-

out method. In the aggregate, these costs are below market.

“Materials, supplies and other” inventories generally are

stated at average cost.

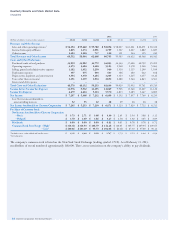

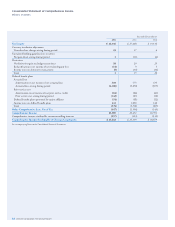

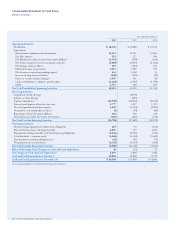

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts