Chevron 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Chevron Corporation 2012 Annual Report

Note 23

Asset Retirement Obligations

e company records the fair value of a liability for an asset

retirement obligation (ARO) as an asset and liability when

there is a legal obligation associated with the retirement of a

tangible long-lived asset and the liability can be reasonably

estimated. e legal obligation to perform the asset retire-

ment activity is unconditional, even though uncertainty may

exist about the timing and/or method of settlement that may

be beyond the company’s control. is uncertainty about the

timing and/or method of settlement is factored into the mea-

surement of the liability when sucient information exists

to reasonably estimate fair value. Recognition of the ARO

includes: (1) the present value of a liability and osetting

asset, (2) the subsequent accretion of that liability and depre-

ciation of the asset, and (3) the periodic review of the ARO

liability estimates and discount rates.

AROs are primarily recorded for the company’s crude

oil and natural gas producing assets. No signicant AROs

associated with any legal obligations to retire downstream

long-lived assets have been recognized, as indeterminate set-

tlement dates for the asset retirements prevent estimation of

the fair value of the associated ARO. e company performs

periodic reviews of its downstream long-lived assets for any

changes in facts and circumstances that might require recog-

nition of a retirement obligation.

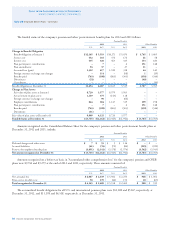

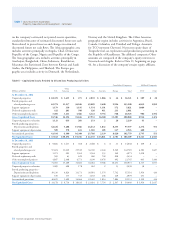

e following table indicates the changes to the company’s

before-tax asset retirement obligations in 2012, 2011 and 2010:

2012 2011 2010

Balance at January 1 $ 12,767 $ 12,488 $ 10,175

Liabilities incurred 133 62 129

Liabilities settled (966) (1,316) (755)

Accretion expense 629 628 513

Revisions in estimated cash ows 708 905 2,426

Balance at December 31 $ 13, 271 $ 12,767 $ 12,488

e long-term portion of the $13,271 balance at the end

of 2012 was $12,375.

Note 24

Other Financial Information

Earnings in 2012 included gains of approximately $2,800

relating to the sale of nonstrategic properties. Of this amount,

approximately $2,200 and $600 related to upstream and

downstream assets, respectively. Earnings in 2011 included

gains of approximately $1,300 relating to the sale of nonstra-

tegic properties. Of this amount, approximately $800 and

$500 related to downstream and upstream assets, respectively.

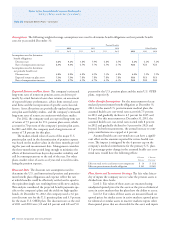

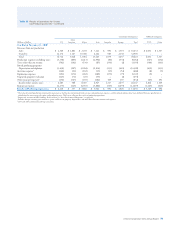

Other nancial information is as follows:

Year ended December 31

2012 2011 2010

Total nancing interest and debt costs $ 242 $ 288 $ 317

Less: Capitalized interest 242 288 267

Interest and debt expense $ – $ – $ 50

Research and development expenses $ 648 $ 627 $ 526

Foreign currency eects* $ (454) $ 121 $ (423)

*

Includes $(202), $(27) and $(71) in 2012, 2011 and 2010, respectively, for the com-

pany’s share of equity aliates’ foreign currency eects.

e excess of replacement cost over the carrying value of

inventories for which the last-in, rst-out (LIFO) method is

used was $9,292 and $9,025 at December 31, 2012 and 2011,

respectively. Replacement cost is generally based on average

acquisition costs for the year. LIFO prots (charges) of $121,

$193 and $21 were included in earnings for the years 2012,

2011 and 2010, respectively.

e company has $4,640 in goodwill on the Consoli-

dated Balance Sheet related to the 2005 acquisition of Unocal

and to the 2011 acquisition of Atlas Energy, Inc. Under the

accounting standard for goodwill (ASC 350), the company

tested this goodwill for impairment during 2012 and con-

cluded no impairment was necessary.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts