Chevron 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

Table of contents

-

Page 1

2012 Annual Report -

Page 2

... Financial Highlights Chevron Operating Highlights Chevron at a Glance 8 9 69 70 Glossary of Energy and Financial Terms Financial Review Five-Year Financial Summary Five-Year Operating Summary 85 86 87 88 Chevron History Board of Directors Corporate Officers Stockholder and Investor Information -

Page 3

... and affordable energy. The long-term investments we are making will help contribute to energy supplies, while creating sustained value for our stockholders, employees, business partners and the communities where we operate. The online version of this report contains additional information about our... -

Page 4

... records for water injection in deepwater production. Over the next five years, we anticipate 16 project startups with a Chevron share of investment greater than $1 billion each. Among them are two of our three new liquefied natural gas projects: Angola and Gorgon, offshore Western Australia; our... -

Page 5

... improved product yields and energy efficiency. Our 2013 capital and exploratory budget of $36.7 billion, combined with our strong financial position, supports our long-term growth strategy. This record level of capital spending reflects our unmatched Pennsylvania, water recycling technology... -

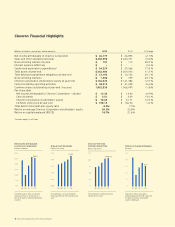

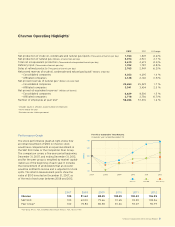

Page 6

...oil production volume. The company's annual dividend increased for the 25th consecutive year. The company's stock price rose 1 .6 percent in 2012. Chevron's return on capital employed declined to 18.7 percent on lower earnings and higher capital employed. 4 Chevron Corporation 2012 Annual Report -

Page 7

... for stock splits. The interim measurement points show the value of $100 invested on December 31, 2007, as of the end of each year between 2008 and 2012. 140 Five-Year Cumulative Total Returns (Calendar years ended December 31) 120 Dollars 100 80 60 2007 2008 2009 2010 2011 2012 Chevron... -

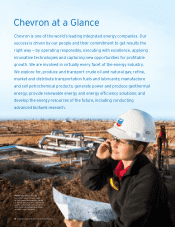

Page 8

... and transport crude oil and natural gas; refine, market and distribute transportation fuels and lubricants; manufacture and sell petrochemical products; generate power and produce geothermal energy; provide renewable energy and energy efficiency solutions; and develop the energy resources of the... -

Page 9

... in 14 fuel refineries and market transportation fuels and lubricants under the Chevron, Texaco and Caltex brands. Products are sold through a network of 16,769 retail stations, including those of affiliated companies. Our chemicals business includes Chevron Phillips Chemical Company LLC, a 50... -

Page 10

...related to the company's financing and investing activities. Earnings Net income attributable to Chevron Corporation as presented on the Consolidated Statement of Income. Margin The difference between the cost of purchasing, producing and/or marketing a product and its sales price. Return on capital... -

Page 11

...Note 20 Employee Benefit Plans 57 Note 21 Equity 63 Note 22 Other Contingencies and Commitments 63 Note 23 Asset Retirement Obligations 66 Note 24 Other Financial Information 66 Note 25 Earnings Per Share 67 Note 26 Acquisition of Atlas Energy, Inc. 68 29 Consolidated Financial Statements Report of... -

Page 12

... Chevron Corporation 2012 Annual Report To sustain its long-term competitive position in the upstream business, the company must develop and replenish an inventory of projects that offer attractive financial returns for the investment required. Identifying promising areas for exploration, acquiring... -

Page 13

.... In some locations, Chevron is investing in long-term projects to install infrastructure to produce and liquefy natural gas for transport by tanker to other markets. International natural gas realizations averaged about $6.00 per MCF during 2012, compared with about $5.40 per MCF during 2011. (See... -

Page 14

... 12 United States Other Americas Africa Asia Australia Europe Affiliates Net proved reserves for consolidated companies and affiliated companies increased 1 percent in 2012. *2012, 2011, 2010 and 2009 include barrels of oil-equivalent (BOE) reserves for Canadian synthetic oil. Natural Gas Liquids... -

Page 15

... resources and capital on strategic assets. In third quarter 2012, the company completed the sale of its Perth Amboy, New Jersey, refinery, which had been operated as a products terminal in recent years. In 2012, the company completed the sale of its fuels marketing and aviation businesses... -

Page 16

... the sale of its fuels marketing, finished lubricants and aviation businesses in Spain. Saudi Arabia In October 2012, the company's 50 percent-owned Chevron Phillips Chemical Company LLC announced that its 35 percent-owned Saudi Polymers Company began commercial production at its new petrochemical... -

Page 17

... absence of 2010 charges related to employee reductions. These benefits were partly offset by the absence of a $400 million gain on the sale of the company's ownership interest in the Colonial Pipeline Company recognized in 2010. Refined product sales of 1.21 million barrels per day in 2012 declined... -

Page 18

.... *Includes equity in afï¬liates. Gasvline Jet Fuel Gas Oils & Kerosene Residual Fuel Oil Other Reï¬ned product sales volumes decreased 4 percent from 2011 on lower sales of gasoline and lower sales of residual fuel oil. International Downstream Millions of dollars 2012 2011 2010 derivative... -

Page 19

..., increased fuel purchases in 2011 reflected a new commercial arrangement that replaced a prior product exchange agreement for upstream operations in Indonesia. Millions of dollars 2012 2011 2010 Income from equity affiliates decreased in 2012 from 2011 mainly due to lower upstream-related earnings... -

Page 20

... (MMCFPD): United States 63 69 62 International 523 513 475 4 Includes: Canada - synthetic oil 43 40 24 Venezuela affiliate - synthetic oil 17 32 28 5 Includes branded and unbranded gasoline. 6 Includes sales of affiliates (MBPD): 522 556 562 7 As of June 2012, Star Petroleum Refining Company crude... -

Page 21

... $1.2 billion associated with tax payments, upstream abandonment activities, funds held in escrow for an asset acquisition and capital investment projects at December 31, 2012 and 2011, respectively, was invested in short-term marketable securities and recorded as "Deferred charges and other assets... -

Page 22

... the United States. Major capital outlays include projects under construction at refineries in the United States, expansion of additives production capacity in Singapore and chemicals projects in the United States. Investments in technology companies, power generation and other corporate businesses... -

Page 23

... company's ability to pay interest on outstanding debt. The company's interest coverage ratio in 2012 was higher than 2011 and 2010 due to lower before-tax interest costs. Debt Ratio - total debt as a percentage of total debt plus Chevron Corporation Stockholders' Equity, which indicates the company... -

Page 24

...of the company's 2012 Annual Report on Form 10-K. Derivative Commodity Instruments Chevron is exposed to market risks related to the price volatility of crude oil, refined products, natural gas, natural gas liquids, liquefied natural gas and refinery feedstocks. The company uses derivative commodity... -

Page 25

... Chevron enters into a number of business arrangements with related parties, principally its equity affiliates. These arrangements include long-term supply or offtake agreements and long-term purchase agreements. Refer to "Other Information" in Note 11 of the Consolidated Financial Statements... -

Page 26

... are the expected long-term rate of return on plan assets and the discount rate applied to pension plan obligations. For other postretirement benefit (OPEB) plans, which provide for certain health care and life insurance benefits for qualifying retired employees and which are not funded, critical... -

Page 27

... the projected benefit payments specific to the company's plans and the yields on high-quality bonds. At December 31, 2012, the company used a 3.6 percent discount rate for the U.S. pension plans and 3.9 percent for the main U.S. OPEB plan. The discount rates at the end of 2011 and 2010 were... -

Page 28

... for global or regional market supply-and-demand conditions for crude oil, natural gas, commodity chemicals and refined products. However, the impairment reviews and calculations are based on assumptions that are consistent with the company's business plans and long-term investment decisions. Refer... -

Page 29

... possible outcomes, both in terms of the probability of loss and the estimates of such loss. New Accounting Standards Refer to Note 17, on page 55 in the Notes to Consolidated Financial Statements, for information regarding new accounting standards. Chevron Corporation 2012 Annual Report 27 -

Page 30

... taxes: Intraday price. The company's common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 11, 2013, stockholders of record numbered approximately 168,000. There are no restrictions on the company's ability to pay dividends. 28 Chevron Corporation 2012 Annual... -

Page 31

... of Chevron Corporation Management of Chevron is responsible for preparing the accompanying consolidated financial statements and the related information appearing in this report. The statements were prepared in accordance with accounting principles generally accepted in the United States of America... -

Page 32

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was... -

Page 33

... Statement of Income Millions of dollars, except per-share amounts Year ended December 31 2012 2011 2010 Revenues and Other Income Sales and other operating revenues* Income from equity afï¬liates Other income Total Revenues and Other Income Costs and Other Deductions Purchased crude oil... -

Page 34

... affiliates Income taxes on defined benefit plans Total Other Comprehensive Loss, Net of Tax Comprehensive Income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to Chevron Corporation See accompanying Notes to the Consolidated Financial Statements... -

Page 35

... compensation and benefit plan trust Treasury stock, at cost (2012 - 495,978,691 shares; 2011 - 461,509,656 shares) Total Chevron Corporation Stockholders' Equity Noncontrolling interests Total Equity Total Liabilities and Equity See accompanying Notes to the Consolidated Financial Statements. $ 20... -

Page 36

... Activities Acquisition of Atlas Energy Advance to Atlas Energy Capital expenditures Proceeds and deposits related to asset sales Net sales (purchases) of time deposits Net purchases of marketable securities Repayment of loans by equity affiliates Net purchases of other short-term investments Net... -

Page 37

...Shares 2010 Amount Preferred Stock Common Stock Capital in Excess of Par Balance at January 1 Treasury stock transactions Balance at December 31 Retained Earnings Balance at January 1 Net income attributable to Chevron Corporation Cash dividends on common stock Stock dividends Tax (charge) benefit... -

Page 38

... than 90 days are reported as "Time deposits." The balance of short-term investments is reported as "Marketable securities" and is marked-to-market, with any unrealized gains or losses included in "Other comprehensive income." Inventories Crude oil, petroleum products and chemicals inventories are... -

Page 39

... previously estimated useful life. Impaired assets are written down to their estimated fair values, generally their discounted, future net before-tax cash flows. For proved crude oil and natural gas properties in the United States, the company generally performs an impairment review on an individual... -

Page 40

... title passes to the customer, net of royalties, discounts and allowances, as applicable. Revenues from natural gas production from properties in which Chevron has an interest with other producers are generally recognized using the entitlement method. Excise, value-added and similar taxes assessed... -

Page 41

..., respectively. In 2012 and 2011, "Net purchases of other short-term investments" consist of restricted cash associated with tax payments, upstream abandonment activities, funds held in escrow for an asset acquisition and capital investment projects that was invested in short-term securities and... -

Page 42

..., marketing, supply and distribution of products derived from petroleum, excluding most of the regulated pipeline operations of Chevron. CUSA also holds the company's investment in the Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method. During 2012... -

Page 43

... to purchase the leased property during or at the end of the initial or renewal lease period for the fair market value or other specified amount at that time. At December 31, 2012, the estimated future minimum lease payments (net of noncancelable sublease rentals) under operating and capital leases... -

Page 44

... futures, swaps and options contracts traded in active markets such as the New York Mercantile Exchange. Derivatives classified as Level 2 include swaps, options, and forward contracts principally with financial institutions and other oil and gas companies, the fair values of which are obtained from... -

Page 45

... funds related to tax payments, upstream abandonment activities, funds held in escrow for an asset acquisition and capital investment projects, all of which are reported in "Deferred charges and other assets" on the Consolidated Balance Sheet. Long-term debt of $6,086 and $4,101 at December 31, 2012... -

Page 46

... its cash equivalents, time deposits, marketable securities, derivative financial instruments and trade receivables. The company's short-term investments are placed with a wide array of financial institutions with high credit ratings. Company investment policies limit the company's exposure both to... -

Page 47

..., time deposits and marketable securities, real estate, energy services, information systems, mining operations, power generation businesses, alternative fuels, technology companies, and assets of the corporate administrative functions. Segment Earnings Upstream United States International Total... -

Page 48

... LLC 3,451 Star Petroleum Refining Company Ltd. - Caltex Australia Ltd. 835 Colonial Pipeline Company - Other 837 Total Downstream 7,733 All Other Other 640 Total equity method $ 23,068 Other at or below cost 650 Total investments and advances $ 23,718 Total United States $ 5,788 Total International... -

Page 49

... value of Chevron's share of CAL common stock was $2,690. Other Information "Sales and other operating revenues" on the Consolidated Statement of Income includes $17,356, $20,164 and $13,672 with afï¬liated companies for 2012, 2011 and 2010, respectively. "Purchased crude oil and products" includes... -

Page 50

...,896 for 2012, 2011 and 2010, respectively. Australia had $21,770 and $12,423 in 2012 and 2011 respectively. Net of dry hole expense related to prior years' expenditures of $80, $45 and $82 in 2012, 2011 and 2010, respectively. 3 Includes properties acquired with the acquisition of Atlas Energy, Inc... -

Page 51

.... The lawsuit alleges damage to the environment from the oil exploration and production operations and seeks unspecified damages to fund environmental remediation and restoration of the alleged environmental harm, plus a health monitoring program. Until 1992, Texaco Petroleum Company (Texpet... -

Page 52

...Ingeniero Nortberto Priu, requiring shares of both companies to be "embargoed," requiring third parties to withhold 40% of any payments due to Chevron Argentina S.R.L. and 50 Chevron Corporation 2012 Annual Report ordering banks to withhold 40% of the funds in Chevron Argentina S.R.L. bank accounts... -

Page 53

...range of loss). Note 14 Taxes Income Taxes Year ended December 31 2012 2011 2010 Taxes on income U.S. federal Current Deferred State and local Current Deferred Total United States International Current Deferred Total International Total taxes on income $ 1,703 673 652 (145) 2,883 15,626 1,487 17... -

Page 54

... ended December 31, 2012, 2011 and 2010. The term "unrecognized tax benefits" in the accounting standards for income taxes refers to the differences between a tax position taken or expected to be taken in a tax return and the benefit measured and recognized in the financial statements. Interest and... -

Page 55

...$145, $(64) and $40 in 2012, 2011 and 2010, respectively. Taxes Other Than on Income Year ended December 31 2012 2011 2010 United States Excise and similar taxes on products and merchandise Import duties and other levies Property and other miscellaneous taxes Payroll taxes Taxes on production Total... -

Page 56

...Financial Statements Millions of dollars, except per-share amounts Note 15 Short-Term Debt At December 31 2012 2011 Note 16 Long-Term Debt Commercial paper* Notes payable to banks and others with originating terms of one year or less Current maturities of long-term debt Current maturities of long... -

Page 57

... impact on the company's financial statement presentation. The following table indicates the changes to the company's suspended exploratory well costs for the three years ended December 31, 2012: 2012 2011 2010 Beginning balance at January 1 Additions to capitalized exploratory well costs... -

Page 58

...Actual tax benefits realized for the tax deductions from option exercises were $101, $121 and $66 for 2012, 2011 and 2010, respectively. Cash paid to settle performance units and stock appreciation rights was $123, $151 and $140 for 2012, 2011 and 2010, respectively. Chevron Long-Term Incentive Plan... -

Page 59

...January 1, 2012, the number of LTIP performance units outstanding was equivalent to 2,881,836 shares. During 2012, 888,350 units were granted, 882,003 units vested with The company has defined benefit pension plans for many employees. The company typically prefunds defined benefit plans as required... -

Page 60

... Financial Statements Millions of dollars, except per-share amounts Note 20 Employee Benefit Plans - Continued The funded status of the company's pension and other postretirement benefit plans for 2012 and 2011 follows: Pension Benefits 2012 U.S. Int'l. U.S. 2011 Int'l. Other Benefits 2012 2011... -

Page 61

... other postretirement benefit plans. During 2013, the company estimates prior service (credits) costs of $1, $22 and $(50) will be amortized from "Accumulated other comprehensive loss" for U.S. pension, international pension and OPEB plans, respectively. Chevron Corporation 2012 Annual Report 59 -

Page 62

.... For 2012, the company used an expected long-term rate of return of 7.5 percent for U.S. pension plan assets, which account for 70 percent of the company's pension plan assets. In 2011 and 2010, the company used a long-term rate of return of 7.8 percent for this plan. The market-related value of... -

Page 63

.... 5 The "Other" asset class includes net payables for securities purchased but not yet settled (Level 1); dividends and interest- and tax-related receivables (Level 2); insurance contracts and investments in private-equity limited partnerships (Level 3). Chevron Corporation 2012 Annual Report 61 -

Page 64

... and Benefit Payments In 2012, the company contributed $844 and $384 to its U.S. and international pension plans, respectively. In 2013, the company expects contributions to be approximately $650 62 Chevron Corporation 2012 Annual Report and $350 to its U.S. and international pension plans... -

Page 65

.... Employee Incentive Plans The Chevron Incentive Plan is an annual cash bonus plan for eligible employees that links awards to corporate, unit and individual performance in the prior year. Charges to expense for cash bonuses were $898, $1,217 and $766 in 2012, 2011 and 2010, respectively. Chevron... -

Page 66

... paragraphs. 64 Chevron Corporation 2012 Annual Report In the acquisition of Unocal, the company assumed certain indemnities relating to contingent environmental liabilities associated with assets that were sold in 1997. The acquirer of those assets shared in certain environmental remediation costs... -

Page 67

..., $782 related to the company's U.S. downstream operations, including refineries and other plants, marketing locations (i.e., service stations and terminals), chemical facilities, and pipelines. The remaining $464 was associated with various sites in international downstream $93, upstream $309 and... -

Page 68

... Consolidated Balance Sheet related to the 2005 acquisition of Unocal and to the 2011 acquisition of Atlas Energy, Inc. Under the accounting standard for goodwill (ASC 350), the company tested this goodwill for impairment during 2012 and concluded no impairment was necessary. The long-term portion... -

Page 69

... December 31 2012 2011 2010 Basic EPS Calculation Earnings available to common stockholders - Basic* Weighted-average number of common shares outstanding Add: Deferred awards held as stock units Total weighted-average number of common shares outstanding Earnings per share of common stock - Basic... -

Page 70

... to the close of the transaction, the company paid off the assumed debt and made payments of $184 in connection with Atlas equity awards. As part of the acquisition, Chevron assumed the terms of a carry arrangement whereby Reliance Marcellus, LLC, funds 75 percent of Chevron's drilling costs... -

Page 71

Five-Year Financial Summary Unaudited Millions of dollars, except per-share amounts 2012 2011 2010 2009 2008 Statement of Income Data Revenues and Other Income Total sales and other operating revenues* Income from equity affiliates and other income Total Revenues and Other Income Total Costs ... -

Page 72

... per day 2012 2011 2010 2009 2008 United States Net production of crude oil and natural gas liquids Net production of natural gas1 Net oil-equivalent production Refinery input Sales of refined products Sales of natural gas liquids Total sales of petroleum products Sales of natural gas International... -

Page 73

... acquisition of Clio and Acme fields in Australia. 3 Includes $963, $1,035 and $745 costs incurred prior to assignment of proved reserves for consolidated companies in 2012, 2011 and 2010, respectively. 4 Reconciliation of consolidated and affiliated companies total cost incurred to Upstream capital... -

Page 74

... major equity affiliates. Table gg - Capitalized Costs Related to Oil and Gas Producing Activities Consolidated Companies Affiliated Companies TCO Other Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2012 Unproved properties Proved properties and... -

Page 75

... II Capitalized Costs Related to Oil and Gas Producing Actisities - Continued Consolidated Companies Affiliated Companies TCO Other Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2010 Unproved properties Proved properties and related producing... -

Page 76

... Operations for Oil and Gas Producing Actisities1 The company's results of operations from oil and gas producing activities for the years 2012, 2011 and 2010 are shown in the following table. Net income from exploration and production activities as reported on page 45 reflects income taxes computed... -

Page 77

... for Oil and Gas Producing Actisities1 - Continued Consolidated Companies Affiliated Companies TCO Other Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total Year Ended December 31, 2010 4 Revenues from net production Sales Transfers Total Production expenses... -

Page 78

..., a corporate department that reports directly to the Vice Chairman responsible for the company's worldwide exploration and production activities. The Manager of Corporate Reserves has more than 30 years' experience working in the oil and gas industry and a Master of Science in Petroleum Engineering... -

Page 79

... NGLs Synthetic Oil 2010* Natural Gas Crude Oil Condensate NGLs Liquids in Millions of Barrels Natural Gas in Billions of Cubic Feet Synthetic Oil Natural Gas Proved Developed Consolidated Companies U.S. Other Americas Africa Asia Australia Europe Total Consolidated Affiliated Companies TCO... -

Page 80

... proved reserves, which in the aggregate accounted for 45 percent of the company's total oil-equivalent proved reserves. These properties were geographically dispersed, located in the United States, Canada, South America, Africa, Asia and Australia. 78 Chesron Corporation 2012 Annual Report -

Page 81

...end reserve quantities related to production-sharing contracts (PSC) (refer to page 8 for the definition of a PSC). PSC-related reserve quantities are 20 percent, 22 percent and 24 percent for consolidated companies for 2012, 2011 and 2010, respectively. 3 Chesron Corporation 2012 Annual Report 79 -

Page 82

...continent region were primarily responsible for the 77 million barrel increase. Purchases In 2011, purchases increased worldwide liquid volumes 42 million barrels. The acquisition of additional acreage in Canada increased synthetic oil reserves 40 million barrels. 80 Chesron Corporation 2012 Annual... -

Page 83

... quantities related to production-sharing contracts (PSC) (refer to page 8 for the definition of a PSC). PSC-related reserve quantities are 21 percent, 21 percent and 29 percent for consolidated companies for 2012, 2011 and 2010, respectively. 3 Noteworthy amounts in the categories of natural gas... -

Page 84

... Gorgon Project. Purchases In 2011, purchases increased reserves 1,233 BCF. In the United States, acquisitions in the Marcellus Shale increased reserves 1,230 BCF. Sales In 2011, sales decreased reserves 174 BCF. In Australia, the Wheatstone Project unitization and equity sales agreements reduced... -

Page 85

...- Standardized Measure of Discounted Future Net Cash Flows Related to Proved Oil and Gas Reserves Consolidated Companies Total Affiliated Companies Consolidated and Affiliated TCO Other Companies Millions of dollars U.S. Other Americas Africa Asia Australia Europe Total At December 31, 2012... -

Page 86

... of discount Net change in income tax Net change for 2011 Present Value at December 31, 2011 Sales and transfers of oil and gas produced net of production costs Development costs incurred Purchases of reserves Sales of reserves Extensions, discoveries and improved recovery less related costs... -

Page 87

... an outlet for crude oil through The Texas Company's marketing network in Africa and Asia. 2011 Acquired Atlas Energy, Inc., an independent U.S. developer and producer of shale gas resources. The acquired assets provide a targeted, high-quality core acreage position primarily in the Marcellus Shale... -

Page 88

... and President, Chevron International Exploration and Production Company; Vice President and Chief Financial Ofï¬cer; and Corporate Vice President, Strategic Planning. He is a member of the Board of Directors and the Executive Committee of the American Petroleum Institute. Joined Chevron in 1980... -

Page 89

...tax, treasury, audit and investor relations activities. Chairman of the San Francisco Federal Reserve's Board of Directors. Previously a Director, Chevron Phillips Chemical Company LLC; Corporate Vice President and Treasurer; Corporate Vice President, Policy, Government and Public Affairs; Corporate... -

Page 90

... of ï¬nancial institutions may contact: Investor Relations Chevron Corporation 6001 Bollinger Canyon Road, A3064 San Ramon, CA 94583-2324 925 842 5690 Email: [email protected] Notice As used in this report, the term "Chevron" and such terms as "the company," "the corporation," "our," "we" and "us... -

Page 91

...Exchange Commission and the Supplement to the Annual Report, containing additional financial and operating data, are available on the company's website, Chevron.com, or copies may be requested by writing to: Comptroller's Department Chevron Corporation 6001 Bollinger Canyon Road, A3201 San Ramon, CA... -

Page 92

Chevron Corporation 6001 Bollinger CanSon Road San Ramon, CA 94583-2324 USA www.chevron.com 10% RecScled 100% RecSclable © 2013 Chevron Corporation. All rights reserved. 912-0968