XM Radio 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

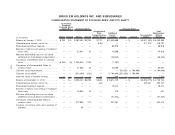

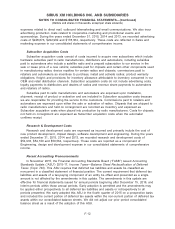

(in thousands) 2015 2014 2013

For the Years Ended December 31,

Cash flows from financing activities:

Proceeds from exercise of stock options . . . . . . . . . . . . $ 260 $ 331 $ 21,968

Taxes paid in lieu of shares issued for stock-based

compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (54,539) (37,318) (46,342)

Proceeds from long-term borrowings and revolving

credit facility, net of costs . . . . . . . . . . . . . . . . . . . . . . . . 1,728,571 2,406,205 3,156,063

Payment of premiums on redemption of debt . . . . . . . . — — (175,453)

Repayment of long-term borrowings and revolving

credit facility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (797,117) (1,016,420) (1,782,160)

Repayment of related party long-term borrowings . . . . — — (200,000)

Common stock repurchased and retired . . . . . . . . . . . . . (2,018,254) (2,496,799) (1,762,360)

Net cash used in financing activities. . . . (1,141,079) (1,144,001) (788,284)

Net (decrease) increase in cash and cash equivalents . . . (35,886) 12,919 (386,140)

Cash and cash equivalents at beginning of period . . . . . . . 147,724 134,805 520,945

Cash and cash equivalents at end of period . . . . . . . . . . . . . $ 111,838 $ 147,724 $ 134,805

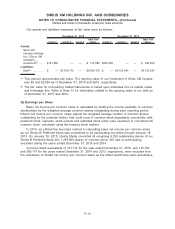

Supplemental Disclosure of Cash and Non-Cash Flow

Information

Cash paid during the period for:

Interest, net of amounts capitalized . . . . . . . . . . . . . . . . . $ 269,925 $ 199,424 $ 169,781

Income taxes paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,384 $ 8,713 $ 2,783

Acquisition related costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 2,902

Non-cash investing and financing activities:

Capital lease obligations incurred to acquire assets . . $ 7,487 $ 719 $ 11,966

Conversion of Series B preferred stock to common

stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 1,293

Treasury stock not yet settled . . . . . . . . . . . . . . . . . . . . . . $ 23,727 $ 26,034 $ —

Conversion of 7% Exchangeable Notes to common

stock, net of debt issuance and deferred financing

costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 502,097 $ 45,097

Performance incentive payments. . . . . . . . . . . . . . . . . . . . $ — $ — $ 16,900

Goodwill reduced for the exercise and vesting of

certain stock awards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 274

Purchase price accounting adjustments to goodwill . . $ — $ 1,698 $ —

See accompanying notes to the consolidated financial statements.

F-8

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS—(Continued)