XM Radio 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Sirius XM Holdings Inc. Long-Term Stock Incentive Plan. Under the terms of these Plans, the

outstanding unvested equity awards granted to the named executive officers are subject to potential

accelerated vesting upon termination without “cause” by the company or termination by the

executive for “good reason” during a two year period following a “change of control” (each as

defined in the Plans), to the extent outstanding awards granted under these Plans are either

assumed, converted or replaced by the resulting entity in the event of a change of control.

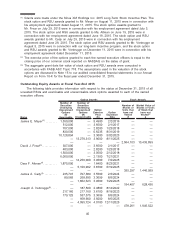

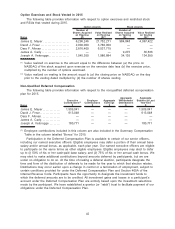

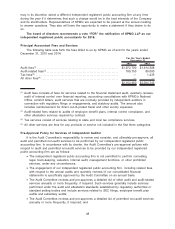

Potential Payments and Benefits

The following table describes the potential payments and benefits under the named executive

officers’ agreements and our stock incentive plans to which they would have been entitled if a

termination of employment or change in control had occurred as of December 31, 2015:

Name Triggering Event

Severance

Payment(1)

($)

Accelerated

Equity

Vesting(2)

($)

Continuation of

Insurance

Benefits

($)(3) Total

($)

James E. Meyer(4) ......... Termination due to death or disability 6,600,000 12,693,382 — 19,293,382

Termination without cause or for good

reason 14,400,000 12,693,382 28,072 27,121,454

Termination without cause or for good

reason following a change in control 14,400,000 12,693,382 28,072 27,121,454

David J. Frear............. Termination due to death or disability — 1,710,000 — 1,710,000

Termination without cause or for good

reason 2,800,000 1,710,000 27,395 4,537,395

Termination without cause or for good

reason following a change in control 2,800,000 1,710,000 27,395 4,537,395

Dara F. Altman............ Termination due to death or disability — 2,466,251 — 2,466,251

Termination without cause or for good

reason 1,650,000 2,466,251 40,612 4,156,863

Termination without cause or for good

reason following a change in control 1,650,000 2,466,251 40,612 4,156,863

James A. Cady(5) .......... Termination due to death or disability — 738,704 — 738,704

Termination without cause or for good

reason 300,000 738,704 9,104 1,047,808

Termination without cause or for good

reason following change-in-control 300,000 1,407,907 9,104 1,717,011

Joseph A. Verbrugge ...... Termination due to death or disability — 1,514,448 — 1,514,448

Termination without cause or for good

reason 925,000 1,514,448 26,568 2,466,016

Termination without cause or for good

reason following a change in control 925,000 3,110,336 26,568 4,061,904

(1) Any severance payments dues to Messrs. Meyer and Frear and Ms. Altman are required to be

paid in a lump sum. The employment agreements with Messrs. Cady and Verbrugge require us

to pay any severance in the form of salary continuation and to pay any amounts due on account

of their bonus on the date that bonuses are customarily paid to other employees.

(2) Amounts were calculated based on the closing price on NASDAQ of our common stock on

December 31, 2015 of $4.07. The accelerated vesting of options is valued at (a) the difference

between the closing price and the exercise price of the options multiplied by (b) the number of

shares of common stock underlying the options. The accelerated vesting of RSUs is valued at

the closing price multiplied by the number of shares of RSUs.

(3) Assumes that health benefits would be continued under COBRA for eighteen months for

Mr. Meyer and Ms. Altman, twelve months for Messrs. Frear and Verbrugge and six months for

Mr. Cady.

(4) Mr. Meyer is also eligible to receive a prorated bonus for the year in which his employment is

terminated. Payment is based on actual performance for such year and payable at such time as

45