XM Radio 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

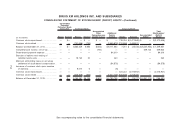

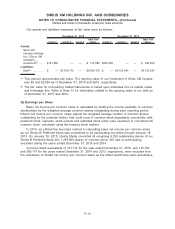

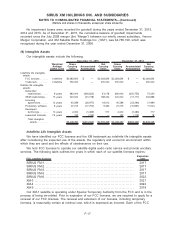

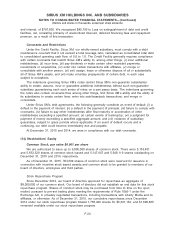

Our assets and liabilities measured at fair value were as follows:

Level 1 Level 2 Level 3

Total Fair

Value Level 1 Level 2 Level 3

Total Fair

Value

December 31, 2015 December 31, 2014

Assets:

Sirius XM

Canada Holdings

Inc. (“Sirius XM

Canada”)—

investment(a) . . . . . $141,850 — — $ 141,850 $246,500 — — $ 246,500

Liabilities:

Debt(b) . . . . . . . . . . . $ — $5,649,173 — $5,649,173 $ — $4,613,044 — $4,613,044

(a) This amount approximates fair value. The carrying value of our investment in Sirius XM Canada

was $0 and $2,654 as of December 31, 2015 and 2014, respectively.

(b) The fair value for non-publicly traded instruments is based upon estimates from a market maker

and brokerage firm. Refer to Note 13 for information related to the carrying value of our debt as

of December 31, 2015 and 2014.

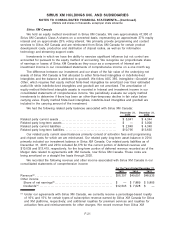

(5) Earnings per Share

Basic net income per common share is calculated by dividing the income available to common

stockholders by the weighted average common shares outstanding during each reporting period.

Diluted net income per common share adjusts the weighted average number of common shares

outstanding for the potential dilution that could occur if common stock equivalents (convertible debt,

preferred stock, warrants, stock options and restricted stock units) were exercised or converted into

common stock, calculated using the treasury stock method.

In 2013, we utilized the two-class method in calculating basic net income per common share,

as our Series B Preferred Stock was considered to be participating securities through January 18,

2013. On January 18, 2013, Liberty Media converted its remaining 6,250 outstanding shares of our

Series B Preferred Stock into 1,293,509 shares of common stock. We had no participating

securities during the years ended December 31, 2015 and 2014.

Common stock equivalents of 151,112 for the year ended December 31, 2015, and 132,162

and 365,177 for the years ended December 31, 2014 and 2013, respectively, were excluded from

the calculation of diluted net income per common share as the effect would have been anti-dilutive.

F-14

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)