XM Radio 2015 Annual Report Download - page 126

Download and view the complete annual report

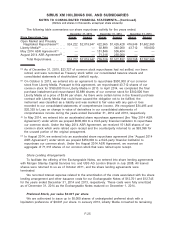

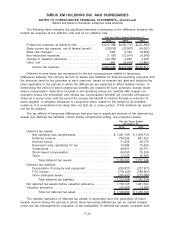

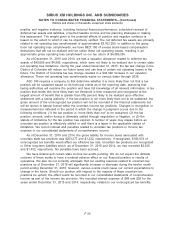

Please find page 126 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.positive and negative evidence, including historical financial performance, scheduled reversal of

deferred tax assets and liabilities, projected taxable income and tax planning strategies in making

this assessment. The weight given to the potential effects of positive and negative evidence is

based on the extent to which it can be objectively verified. The net deferred tax assets are primarily

related to net operating loss carryforwards of approximately $3,762,205. In addition to the gross

book net operating loss carryforwards, we have $827,150 of excess share-based compensation

deductions that will not be realized until we utilize these net operating losses, resulting in an

approximate gross operating loss carryforward on our tax return of $4,589,355.

As of December 31, 2015 and 2014, we had a valuation allowance related to deferred tax

assets of $49,095 and $4,995, respectively, which were not likely to be realized due to certain state

net operating loss limitations. During the year ended December 31, 2015, the tax law change in the

District of Columbia will reduce our future taxes and use less of certain net operating losses in the

future. The District of Columbia tax law change resulted in a $44,392 increase in our valuation

allowance. These net operating loss carryforwards expire on various dates through 2035.

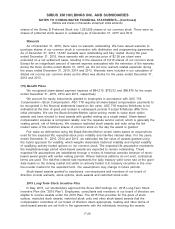

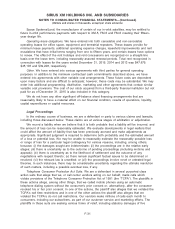

ASC 740 requires a company to first determine whether it is more likely than not that a tax

position will be sustained based on its technical merits as of the reporting date, assuming that

taxing authorities will examine the position and have full knowledge of all relevant information. A tax

position that meets this more likely than not threshold is then measured and recognized at the

largest amount of benefit that is greater than fifty percent likely to be realized upon effective

settlement with a taxing authority. If the tax position is not more likely than not to be sustained, the

gross amount of the unrecognized tax position will not be recorded in the financial statements but

will be shown in tabular format within the uncertain income tax positions. Changes in recognition or

measurement are reflected in the period in which the change in judgment occurs due to the

following conditions: (1) the tax position is “more likely than not” to be sustained, (2) the tax

position, amount, and/or timing is ultimately settled through negotiation or litigation, or (3) the

statute of limitations for the tax position has expired. A number of years may elapse before an

uncertain tax position is effectively settled or until there is a lapse in the applicable statute of

limitations. We record interest and penalties related to uncertain tax positions in Income tax

expense in our consolidated statements of comprehensive income.

As of December 31, 2015 and 2014, the gross liability for income taxes associated with

uncertain state tax positions was $253,277 and $1,432, respectively. If recognized, $183,974 of

unrecognized tax benefits would affect our effective tax rate. Uncertain tax positions are recognized

in Other long-term liabilities which, as of December 31, 2015 and 2014, we had recorded $3,525

and $1,432, respectively. No penalties have been accrued.

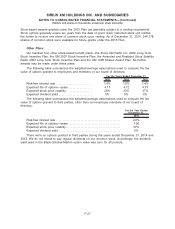

We have federal and certain state income tax audits pending. We do not expect the ultimate

outcome of these audits to have a material adverse effect on our financial position or results of

operations. We also do not currently anticipate that our existing reserves related to uncertain tax

positions as of December 31, 2015 will significantly increase or decrease during the twelve month

period ending December 31, 2016; however, various events could cause our current expectations to

change in the future. Should our position with respect to the majority of these uncertain tax

positions be upheld, the effect would be recorded in our consolidated statements of comprehensive

income as part of the income tax provision. We recorded interest expense of $89 and $55 for the

years ended December 31, 2015 and 2014, respectively, related to our unrecognized tax benefits.

F-35

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)