XM Radio 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of forecasted income from operations, we could record additional charges or reduce allowances in

order to adjust the carrying value of deferred tax assets to their realizable amount. Such

adjustments could be material to our consolidated financial statements.

As of December 31, 2015, we had a valuation allowance of $49,095 relating to deferred tax

assets that are not likely to be realized due to certain state net operating loss limitations and

acquired net operating losses that we were not likely to utilize.

ASC 740 requires a company to first determine whether it is more likely than not that a tax

position will be sustained based on its technical merits as of the reporting date, assuming that

taxing authorities will examine the position and have full knowledge of all relevant information. A tax

position that meets this more likely than not threshold is then measured and recognized at the

largest amount of benefit that is greater than fifty percent likely to be realized upon effective

settlement with a taxing authority. If the tax position is not more likely than not to be sustained, the

gross amount of the unrecognized tax position will not be recorded in the financial statements but

will be shown in tabular format within the uncertain income tax positions. Changes in recognition or

measurement are reflected in the period in which the change in judgment occurs due to the

following conditions: (1) the tax position is “more likely than not” to be sustained, (2) the tax

position, amount, and/or timing is ultimately settled through negotiation or litigation, or (3) the

statute of limitations for the tax position has expired. A number of years may elapse before an

uncertain tax position is effectively settled or until there is a lapse in the applicable statute of

limitations. We record interest and penalties related to uncertain tax positions in Income tax

expense in our consolidated statements of comprehensive income. As of December 31, 2015, the

gross liability for income taxes associated with uncertain state tax positions was $253,277.

Glossary

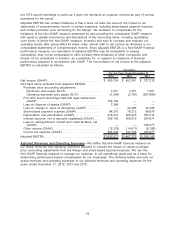

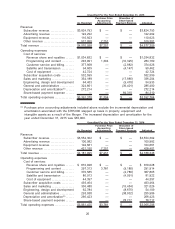

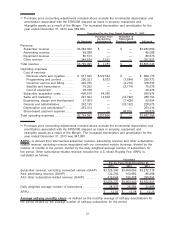

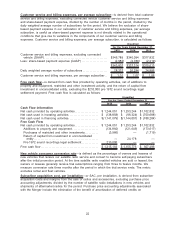

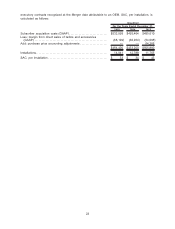

Adjusted EBITDA—EBITDA is defined as net income before interest expense, net of amounts

capitalized; income tax expense and depreciation and amortization. We adjust EBITDA to exclude

the impact of other income, loss on disposal of assets, loss on extinguishment of debt, loss on

change in value of derivatives as well as certain other charges discussed below. This measure is

one of the primary Non-GAAP financial measures on which we (i) evaluate the performance of our

on-going core operating results period over period, (ii) base our internal budgets and

(iii) compensate management. As such, adjusted EBITDA is a Non-GAAP financial performance

measure that excludes (if applicable): (i) certain adjustments as a result of the purchase price

accounting for the Merger, (ii) depreciation and amortization, (iii) share-based payment expense and

(iv) other significant operating expense (income) that do not relate to the on-going performance of

our business. The purchase price accounting adjustments include: (i) the elimination of deferred

revenue associated with the investment in XM Canada, (ii) recognition of deferred subscriber

revenues not recognized in purchase price accounting, and (iii) elimination of the benefit of deferred

credits on executory contracts, which are primarily attributable to third party arrangements with an

OEM and programming providers. We believe adjusted EBITDA is a useful measure of the

underlying trend of our operating performance, which provides useful information about our business

apart from the costs associated with our physical plant, capital structure and purchase price

accounting. We believe investors find this Non-GAAP financial measure useful when analyzing our

results and comparing our operating performance to the performance of other communications,

entertainment and media companies. We believe investors use current and projected adjusted

EBITDA to estimate our current and prospective enterprise value and to make investment decisions.

Because we fund and build-out our satellite radio system through the periodic raising and

expenditure of large amounts of capital, our results of operations reflect significant charges for

depreciation expense. The exclusion of depreciation and amortization expense is useful given

significant variation in depreciation and amortization expense that can result from the potential

variations in estimated useful lives, all of which can vary widely across different industries or among

companies within the same industry. We believe the exclusion of share-based payment expense

and loss on disposal of assets is useful as they are not directly related to the operational conditions

of our business. We also believe the exclusion of settlements related only to the historical use of

18