XM Radio 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

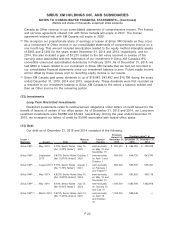

Sirius XM Canada

We hold an equity method investment in Sirius XM Canada. We own approximately 47,300 of

Sirius XM Canada’s Class A shares on a converted basis, representing an approximate 37% equity

interest and an approximate 25% voting interest. We primarily provide programming and content

services to Sirius XM Canada and are reimbursed from Sirius XM Canada for certain product

development costs, production and distribution of chipset radios, as well as for information

technology and streaming support costs.

Investments in which we have the ability to exercise significant influence but not control are

accounted for pursuant to the equity method of accounting. We recognize our proportionate share

of earnings or losses of Sirius XM Canada as they occur as a component of Interest and

investment income in our consolidated statements of comprehensive income on a one month lag.

The difference between our investment and our share of the fair value of the underlying net

assets of Sirius XM Canada is first allocated to either finite-lived intangibles or indefinite-lived

intangibles and the balance is attributed to goodwill. We follow ASC 350, Intangibles—Goodwill and

Other, which requires that equity method finite-lived intangibles be amortized over their estimated

useful life while indefinite-lived intangibles and goodwill are not amortized. The amortization of

equity method finite-lived intangible assets is recorded in Interest and investment income in our

consolidated statements of comprehensive income. We periodically evaluate our equity method

investments to determine if there has been an other-than-temporary decline in fair value below

carrying value. Equity method finite-lived intangibles, indefinite-lived intangibles and goodwill are

included in the carrying amount of the investment.

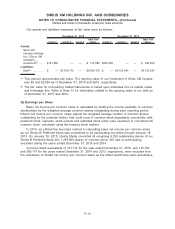

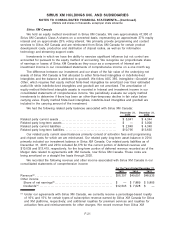

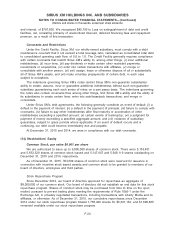

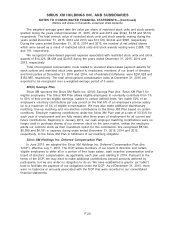

We had the following related party balances associated with Sirius XM Canada:

December 31,

2015

December 31,

2014

Related party current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,941 $ 4,344

Related party long-term assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 3,000

Related party current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,840 $ 4,340

Related party long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $10,795 $13,635

Our related party current asset balances primarily consist of activation fees and programming

and chipset costs for which we are reimbursed. Our related party long-term asset balance in 2014

primarily included our investment balance in Sirius XM Canada. Our related party liabilities as of

December 31, 2015 and 2014 included $2,776 for the current portion of deferred revenue and

$10,639 and $13,415, respectively, for the long-term portion of deferred revenue recorded as of the

Merger date related to agreements with XM Canada, now Sirius XM Canada. These costs are

being amortized on a straight line basis through 2020.

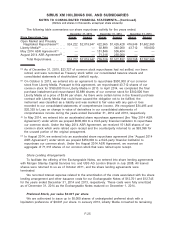

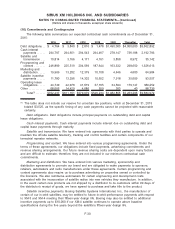

We recorded the following revenue and other income associated with Sirius XM Canada in our

consolidated statements of comprehensive income:

2015 2014 2013

For the Years Ended December 31,

Revenue(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $56,397 $49,691 $48,935

Other income

Share of net earnings(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 7,889 $ 5,865

Dividends(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,645 $ 7,628 $ —

(a) Under our agreements with Sirius XM Canada, we currently receive a percentage-based royalty

of 10% and 15% for certain types of subscription revenue earned by Sirius XM Canada for Sirius

and XM platforms, respectively; and additional royalties for premium services and royalties for

activation fees and reimbursements for other charges. We record revenue from Sirius XM

F-21

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)