XM Radio 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

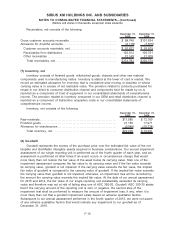

licenses authorizes us to use the radio spectrum, which is a renewable, reusable resource that

does not deplete or exhaust over time.

ASU 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment, established an option

to first perform a qualitative assessment to determine whether it is more likely than not that an

asset is impaired. If the qualitative assessment supports that it is more likely than not that the fair

value of the asset exceeds its carrying value, a quantitative impairment test is not required. If the

qualitative assessment does not support the fair value of the asset, then a quantitative assessment

is performed. Our annual impairment assessment of our indefinite intangible assets is performed as

of the fourth quarter of each year. An assessment is performed at other times if an event occurs or

circumstances change that would more likely than not reduce the fair value of the asset below its

carrying value. If the carrying value of the intangible assets exceeds its fair value, an impairment

loss is recognized in an amount equal to that excess.

We completed qualitative assessments of our FCC licenses and XM trademark during the

fourth quarter of 2015, 2014 and 2013. As of the date of our annual assessment for 2015, 2014

and 2013, our qualitative impairment assessment of the fair value of our indefinite intangible assets

indicated that such assets substantially exceeded their carrying value and therefore was not at risk

of impairment. No impairments were recorded for intangible assets with indefinite lives during the

years ended December 31, 2015, 2014, and 2013.

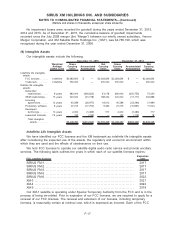

Definite Life Intangible Assets

Definite-lived intangible assets are amortized over their respective estimated useful lives to their

estimated residual values, in a pattern that reflects when the economic benefits will be consumed,

and are reviewed for impairment under the provisions of ASC 360-10-35, Property, Plant and

Equipment/Overall/Subsequent Measurement. We review intangible assets subject to amortization

for impairment whenever events or circumstances indicate that the carrying amount of an asset may

not be recoverable. If the sum of the expected cash flows, undiscounted and without interest, is

less than the carrying amount of the asset, an impairment loss is recognized as the amount by

which the carrying amount of the asset exceeds its fair value. No impairment was recorded to our

intangible assets with definite lives in 2015, 2014 or 2013.

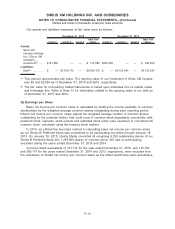

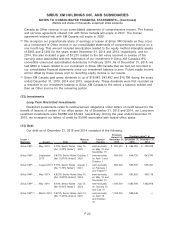

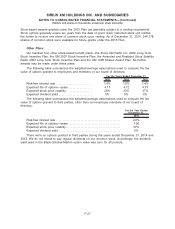

Amortization expense for all definite life intangible assets was $51,700, $55,016 and $50,011

for the years ended December 31, 2015, 2014 and 2013, respectively. Expected amortization

expense for each of the fiscal years 2016 through 2020 and for periods thereafter is as follows:

Years ending December 31, Amount

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,545

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,882

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,463

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,026

2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,446

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119,330

Total definite life intangible assets, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $259,692

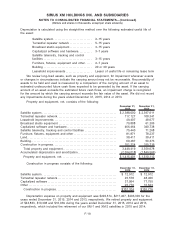

(10) Property and Equipment

Property and equipment, including satellites, are stated at cost, less accumulated depreciation.

Equipment under capital leases is stated at the present value of minimum lease payments.

F-18

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)