XM Radio 2015 Annual Report Download - page 81

Download and view the complete annual report

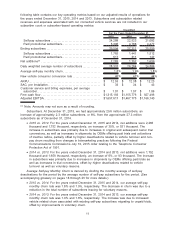

Please find page 81 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.asset is impaired. Accounting Standards Update 2012-02, Testing Indefinite-Lived Intangible Assets

for Impairment, establishes an option to first perform a qualitative assessment to determine whether

it is more likely than not that an asset is impaired. If the qualitative assessment supports that it is

more likely than not that the fair value of the asset exceeds its carrying value, a company is not

required to perform a quantitative impairment test. If the qualitative assessment does not support

the fair value of the asset, then a quantitative assessment is performed. During the fourth quarter of

2015, a qualitative impairment analysis was performed and we determined that the fair value of our

FCC licenses and trademark substantially exceeded the carrying value and therefore was not at risk

of impairment. Our qualitative assessment includes the consideration of our long-term financial

projections, current and historical weighted average cost of capital and liquidity factors, legal and

regulatory issues and industry and market pressures. Subsequent to our annual evaluation of the

carrying value of our long-lived assets, there were no events or circumstances that triggered the

need for an impairment evaluation.

There were no changes in the carrying value of our indefinite life intangible assets during the

years ended December 31, 2015 or 2014.

Useful Life of Broadcast/Transmission System. Our satellite system includes the costs of our

satellite construction, launch vehicles, launch insurance, capitalized interest, spare satellites,

terrestrial repeater network and satellite uplink facilities. We monitor our satellites for impairment

whenever events or changes in circumstances indicate that the carrying amount of the asset is not

recoverable.

We operate five in-orbit Sirius satellites, FM-1, FM-2, FM-3, FM-5 and FM-6. Our FM-1, FM-2

and FM-3 satellites were launched in 2000 and reached the end of their depreciable lives in 2013

and 2015 but are still in operation. We estimate that our FM-5 satellite launched in 2009 will

operate effectively through the end of its depreciable life in 2024. Our FM-6 satellite that was

launched in 2013, is currently used as an in-orbit spare that is planned to start full-time operation in

2016 and is expected to operate effectively through the end of its depreciable life in 2028.

We operate three in-orbit XM satellites, XM-3, XM-4 and XM-5. We estimate that our XM-3 and

XM-4 satellites launched in 2005 and 2006, respectively, will reach the end of their depreciable lives

in 2020 and 2021, respectively. Our XM-5 satellite was launched in 2010, is used as an in-orbit

spare and is expected to reach the end of its depreciable life in 2025.

Our satellites have been designed to last fifteen-years. Our in-orbit satellites may experience

component failures which could adversely affect their useful life. We monitor the operating condition

of our in-orbit satellites and if events or circumstances indicate that the depreciable lives of our in-

orbit satellites have changed, we will modify the depreciable life accordingly. If we were to revise

our estimates, our depreciation expense would change.

Income Taxes. Deferred income taxes are recognized for the tax consequences related to

temporary differences between the carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for tax purposes, based on enacted tax laws and statutory tax

rates applicable to the periods in which the differences are expected to affect taxable income. In

determining the period in which related tax benefits are realized for book purposes, excess share-

based compensation deductions included in net operating losses are realized after regular net

operating losses are exhausted; excess tax compensation benefits are recorded off-balance sheet

as a memo entry until the period the excess tax benefit is realized through a reduction of taxes

payable. Income tax expense is the sum of current income tax plus the change in deferred tax

assets and liabilities.

We assess the recoverability of deferred tax assets at each reporting date and, where

applicable, a valuation allowance is recognized when, based on the weight of all available evidence,

it is considered more likely than not that all, or some portion, of the deferred tax assets will not be

realized. Our assessment includes an analysis of whether deferred tax assets will be realized in the

ordinary course of operations based on the available positive and negative evidence, including the

scheduling of deferred tax liabilities and forecasted income from operations. The underlying

assumptions we use in forecasting future taxable income require significant judgment. In the event

that actual income from operations differs from forecasted amounts, or if we change our estimates

17