XM Radio 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and other current assets and $43,442 was recorded to Other long-term assets within our

consolidated balance sheets.

Several putative class actions suits challenging our use and public performance of other pre-

1972 recordings under various state laws remain pending. We believe we have substantial defenses

to the claims asserted, we are defending these actions vigorously, and do not believe that the

resolution of these remaining cases will have a material adverse effect on our business, financial

condition or results of operations.

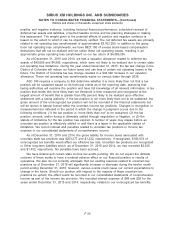

With respect to certain matters described above under the captions “Telephone Consumer

Protection Act Suits” and “Pre-1972 Sound Recording Matters”, we have determined that the

outcome of these matters is inherently unpredictable and subject to significant uncertainties, many

of which are beyond our control. No provision was made for losses to the extent such are not

probable and estimable. We believe we have substantial defenses to the claims asserted, and

intend to defend these actions vigorously.

Other Matters. In the ordinary course of business, we are a defendant in various other lawsuits

and arbitration proceedings, including derivative actions; actions filed by subscribers, both on behalf

of themselves and on a class action basis; former employees; parties to contracts or leases; and

owners of patents, trademarks, copyrights or other intellectual property. None of these matters, in

our opinion, is likely to have a material adverse effect on our business, financial condition or results

of operations.

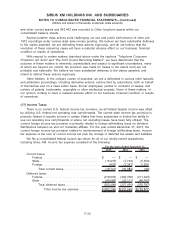

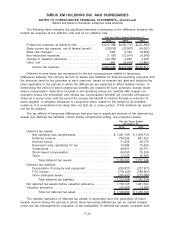

(17) Income Taxes

There is no current U.S. federal income tax provision, as all federal taxable income was offset

by utilizing U.S. federal net operating loss carryforwards. The current state income tax provision is

primarily related to taxable income in certain States that have suspended or limited the ability to

use net operating loss carryforwards or where net operating losses have been fully utilized. The

current foreign income tax provision is primarily related to foreign withholding taxes on dividend

distributions between us and our Canadian affiliate. For the year ended December 31, 2013, the

current foreign income tax provision related to reimbursement of foreign withholding taxes. Income

tax expense is the sum of current income tax plus the change in deferred tax assets and liabilities.

We file a consolidated federal income tax return for all of our wholly-owned subsidiaries,

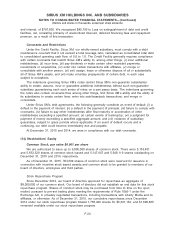

including Sirius XM. Income tax expense consisted of the following:

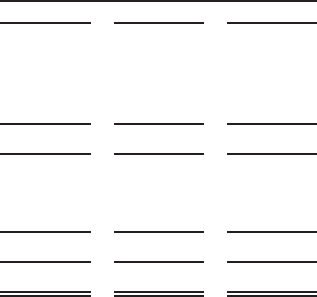

2015 2014 2013

For the Years Ended December 31,

Current taxes:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ —

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15,916) (7,743) (5,359)

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (825) (2,341) 5,269

Total current taxes. . . . . . . . . . . . . . . . . . . . . . . . . . (16,741) (10,084) (90)

Deferred taxes:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (318,933) (302,350) (211,044)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (46,566) (25,111) (48,743)

Total deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . (365,499) (327,461) (259,787)

Total income tax expense. . . . . . . . . . . . . . . $(382,240) $(337,545) $(259,877)

F-33

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)