XM Radio 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

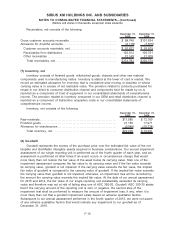

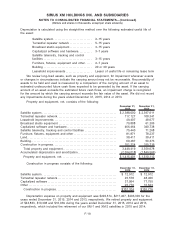

respectively. We recognized a loss on disposal of assets of $7,384 during the year ended

December 31, 2015, which related to the disposal of certain obsolete terrestrial repeaters and

related parts. We did not recognize any loss on disposal of assets during the years ended

December 31, 2014 and 2013.

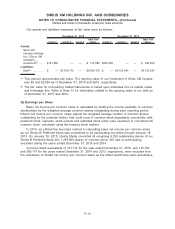

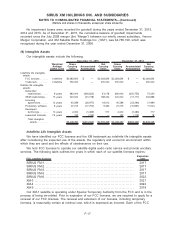

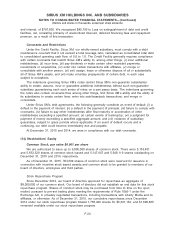

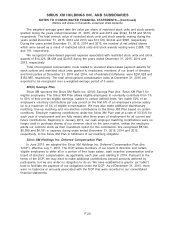

Satellites

We currently own a fleet of eight operating satellites. We are in the process of de-orbiting

XM-1, a satellite that is no longer in use and has also reached the end of its operational life. The

chart below provides certain information on our operating satellites:

Satellite Description Year Delivered

Estimated

End of

Depreciable

Life

FM-1* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2000 2013

FM-2* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2000 2013

FM-3* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2000 2015

FM-5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009 2024

FM-6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2013 2028

XM-3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2005 2020

XM-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2006 2021

XM-5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2010 2025

* Satellite was fully depreciated and was still in operation as of December 31, 2015.

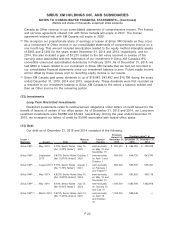

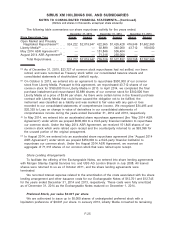

(11) Related Party Transactions

In the normal course of business, we enter into transactions with related parties. Our related

parties include:

Liberty Media

Liberty Media has beneficially owned over 50% of our outstanding common stock since January

2013 and has two executives and one of its directors on our board of directors. Gregory B. Maffei,

the President and Chief Executive Officer of Liberty Media, is the Chairman of our board of

directors.

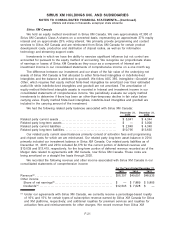

On October 9, 2013, we entered into an agreement with Liberty Media to repurchase $500,000

of our common stock from Liberty Media. Pursuant to that agreement, we repurchased $160,000 of

our common stock from Liberty Media in 2013 and in April 2014, we completed the final purchase

installment under this share repurchase agreement and repurchased the remaining $340,000 of our

shares of common stock from Liberty Media at a price of $3.66 per share. As there were certain

terms in the forward purchase contract that could have caused the obligation to not be fulfilled, the

instrument was recorded as a liability and was marked to fair value with $34,485 and $20,393

recorded to Loss on change in value of derivatives within our consolidated statements of

comprehensive income during the years ended December 31, 2014 and 2013, respectively.

During the years ended December 31, 2014 and 2013, we recognized $1,025 and $13,514 in

Interest expense, respectively, associated with the portion of the Exchangeable Notes, the 7.625%

Senior Notes due 2018 and the 8.75% Senior Notes due 2015 held by Liberty Media through

November 2014, October 2013 and August 2013, respectively.

F-20

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)