XM Radio 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenses related to direct mail, outbound telemarketing and email communications. We also incur

advertising production costs related to cooperative marketing and promotional events and

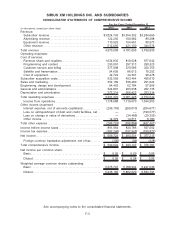

sponsorships. During the years ended December 31, 2015, 2014 and 2013, we recorded advertising

costs of $228,676, $222,962 and $178,364, respectively. These costs are reflected in Sales and

marketing expense in our consolidated statements of comprehensive income.

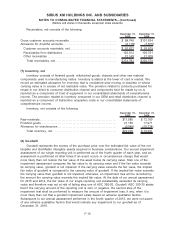

Subscriber Acquisition Costs

Subscriber acquisition costs consist of costs incurred to acquire new subscribers which include

hardware subsidies paid to radio manufacturers, distributors and automakers, including subsidies

paid to automakers who include a satellite radio and a prepaid subscription to our service in the

sale or lease price of a new vehicle; subsidies paid for chipsets and certain other components used

in manufacturing radios; device royalties for certain radios and chipsets; commissions paid to

retailers and automakers as incentives to purchase, install and activate radios; product warranty

obligations; freight; and provisions for inventory allowance attributable to inventory consumed in our

OEM and retail distribution channels. Subscriber acquisition costs do not include advertising costs,

loyalty payments to distributors and dealers of radios and revenue share payments to automakers

and retailers of radios.

Subsidies paid to radio manufacturers and automakers are expensed upon installation,

shipment, receipt of product or activation and are included in Subscriber acquisition costs because

we are responsible for providing the service to the customers. Commissions paid to retailers and

automakers are expensed upon either the sale or activation of radios. Chipsets that are shipped to

radio manufacturers and held on consignment are recorded as inventory and expensed as

Subscriber acquisition costs when placed into production by radio manufacturers. Costs for chipsets

not held on consignment are expensed as Subscriber acquisition costs when the automaker

confirms receipt.

Research & Development Costs

Research and development costs are expensed as incurred and primarily include the cost of

new product development, chipset design, software development and engineering. During the years

ended December 31, 2015, 2014 and 2013, we recorded research and development costs of

$54,933, $54,109 and $50,564, respectively. These costs are reported as a component of

Engineering, design and development expense in our consolidated statements of comprehensive

income.

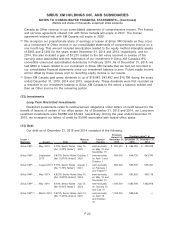

Recent Accounting Pronouncements

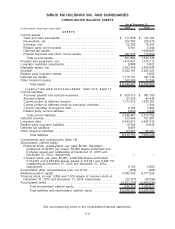

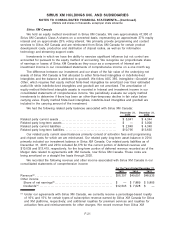

In November 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting

Standards Update (“ASU”) 2015-17, Income Taxes—Balance Sheet Reclassification of Deferred

Taxes (Topic 740). This ASU requires that deferred tax liabilities and assets be classified as

noncurrent in a classified statement of financial position. The current requirement that deferred tax

liabilities and assets of a tax-paying component of an entity be offset and presented as a single

amount is not affected by the amendments in this update. The amendments in this update are

effective for financial statements issued for annual periods beginning after December 15, 2016, and

interim periods within those annual periods. Early adoption is permitted and the amendments may

be applied either prospectively to all deferred tax liabilities and assets or retrospectively to all

periods presented. We early adopted this ASU in the fourth quarter of 2015 on a prospective basis

and included the current portion of deferred tax assets within the non-current portion of deferred tax

assets within our consolidated balance sheets. We did not adjust our prior period consolidated

balance sheet as a result of the adoption of this ASU.

F-12

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)