XM Radio 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

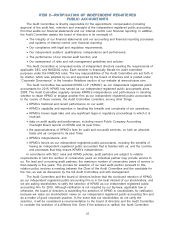

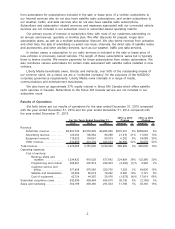

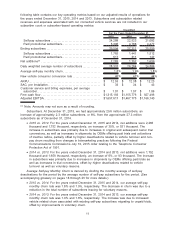

2015 2014 2013 Amount % Amount %

For the Years Ended December 31,

2015 vs 2014

Change

2014 vs 2013

Change

Engineering, design and

development . . . . . . . . . . . . . . . . . $ 64,403 $ 62,784 $ 57,969 $ 1,619 3% $ 4,815 8%

General and administrative. . . . . . 324,801 293,938 262,135 30,863 10% 31,803 12%

Depreciation and amortization . . . 272,214 266,423 253,314 5,791 2% 13,109 5%

Total operating expenses . . . . . . . 3,391,370 3,061,425 2,754,542 329,945 11% 306,883 11%

Income from operations. . . . . . . . . 1,178,688 1,119,670 1,044,553 59,018 5% 75,117 7%

Other income (expense):

Interest expense, net of

amounts capitalized . . . . . . (299,103) (269,010) (204,671) (30,093) (11)% (64,339) (31)%

Loss on extinguishment of

debt and credit facilities,

net . . . . . . . . . . . . . . . . . . . . . . — — (190,577) — 0% 190,577 100%

Loss on change in value of

derivatives . . . . . . . . . . . . . . . — (34,485) (20,393) 34,485 100% (14,092) (69)%

Other income . . . . . . . . . . . . . . 12,379 14,611 8,180 (2,232) (15)% 6,431 79%

Total other expense . . . . . . . . . . . . (286,724) (288,884) (407,461) 2,160 1% 118,577 29%

Income before income taxes . . . . 891,964 830,786 637,092 61,178 7% 193,694 30%

Income tax expense . . . . . . . . . . . . (382,240) (337,545) (259,877) (44,695) (13)% (77,668) (30)%

Net income . . . . . . . . . . . . . . . . . . . . $ 509,724 $ 493,241 $ 377,215 $ 16,483 3% $116,026 31%

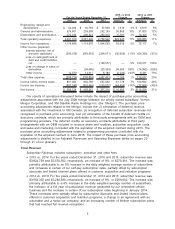

Our results of operations discussed below include the impact of purchase price accounting

adjustments associated with the July 2008 merger between our wholly owned subsidiary, Vernon

Merger Corporation, and XM Satellite Radio Holdings Inc. (the “Merger”). The purchase price

accounting adjustments related to the Merger, include the: (i) elimination of deferred revenue

associated with the investment in XM Canada, (ii) recognition of deferred subscriber revenues not

recognized in purchase price accounting, and (iii) elimination of the benefit of deferred credits on

executory contracts, which are primarily attributable to third party arrangements with an OEM and

programming providers. The deferred credits on executory contracts attributable to third party

arrangements with an OEM included in revenue share and royalties, subscriber acquisition costs,

and sales and marketing concluded with the expiration of the acquired contract during 2013. The

purchase price accounting adjustments related to programming providers concluded with the

expiration of the acquired contract in June 2015. The impact of these purchase price accounting

adjustments is detailed in our Adjusted Revenues and Operating Expenses tables on pages 20

through 21 of our glossary.

Total Revenue

Subscriber Revenue includes subscription, activation and other fees.

•2015 vs. 2014: For the years ended December 31, 2015 and 2014, subscriber revenue was

$3,824,793 and $3,554,302, respectively, an increase of 8%, or $270,491. The increase was

primarily attributable to an 8% increase in the daily weighted average number of subscribers

and increases in certain of our self-pay subscription rates, partially offset by subscription

discounts and limited channel plans offered in customer acquisition and retention programs.

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, subscriber revenue was

$3,554,302 and $3,284,660, respectively, an increase of 8%, or $269,642. The increase was

primarily attributable to a 6% increase in the daily weighted average number of subscribers,

the inclusion of a full year of subscription revenue generated by our connected vehicle

business and the increase in certain of our subscription rates beginning in January 2014.

These increases were partially offset by subscription discounts and limited channel plans

offered in customer acquisition and retention programs, a change in an agreement with an

automaker and a rental car company, and an increasing number of lifetime subscription plans

that had reached full revenue recognition.

3