XM Radio 2015 Annual Report Download - page 120

Download and view the complete annual report

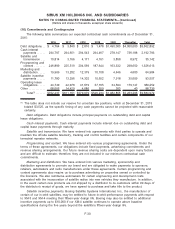

Please find page 120 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The weighted average grant date fair value per share of restricted stock units and stock awards

granted during the years ended December 31, 2015, 2014 and 2013 was $3.92, $3.38 and $3.59,

respectively. The total intrinsic value of restricted stock units and stock awards vesting during the

years ended December 31, 2015, 2014 and 2013 was $13,720, $4,044 and $605, respectively.

During the years ended December 31, 2015, 2014 and 2013, the number of net settled shares

which were issued as a result of restricted stock units and stock awards vesting were 2,088, 732

and 191, respectively.

We recognized share-based payment expense associated with restricted stock units and stock

awards of $14,226, $8,458 and $2,645 during the years ended December 31, 2015, 2014 and

2013, respectively.

Total unrecognized compensation costs related to unvested share-based payment awards for

stock options and restricted stock units granted to employees, members of our board of directors

and third parties at December 31, 2015 and 2014, net of estimated forfeitures, were $261,628 and

$162,985, respectively. The total unrecognized compensation costs at December 31, 2015 are

expected to be recognized over a weighted-average period of 3 years.

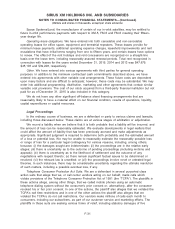

401(k) Savings Plan

Sirius XM sponsors the Sirius XM Radio Inc. 401(k) Savings Plan (the “Sirius XM Plan”) for

eligible employees. The Sirius XM Plan allows eligible employees to voluntarily contribute from 1%

to 50% of their pre-tax eligible earnings, subject to certain defined limits. We match 50% of an

employee’s voluntary contributions per pay period on the first 6% of an employee’s pre-tax salary

up to a maximum of 3% of eligible compensation. We may also make additional discretionary

matching, true-up matching and non-elective contributions to the Sirius XM Plan based on certain

conditions. Employer matching contributions under the Sirius XM Plan vest at a rate of 33.33% for

each year of employment and are fully vested after three years of employment for all current and

future contributions. Beginning in January 2014, our cash employer matching contributions were no

longer used to purchase shares of our common stock on the open market, unless the employee

elects our common stock as their investment option for this contribution. We recognized $8,144,

$5,385 and $4,181 in expense during years ended December 31, 2015, 2014 and 2013,

respectively, to the Sirius XM Plan in fulfillment of our matching obligation.

Sirius XM Holdings Inc. Deferred Compensation Plan

In June 2015, we adopted the Sirius XM Holdings Inc. Deferred Compensation Plan (the

“DCP”), effective July 1, 2015. The DCP allows members of our board of directors and certain

eligible employees to defer all or a portion of their base salary, cash incentive compensation and/or

board of directors’ compensation, as applicable, each plan year starting in 2016. Pursuant to the

terms of the DCP, we may elect to make additional contributions beyond amounts deferred by

participants, but we are under no obligation to do so. We have established a grantor (or “rabbi”)

trust to facilitate the payment of our obligations under the DCP. As of December 31, 2015, there

were no balances or amounts associated with the DCP that were recorded in our consolidated

financial statements.

F-29

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)