XM Radio 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Compensation Plan to be an important benefit to participants, it is not included in any quantitative

valuation with respect to the three main components of our executive compensation packages,

because participation in the Deferred Compensation Plan, and to what extent, is at each

participant’s discretion and there is no matching contribution from us at this time.

Pursuant to the Deferred Compensation Plan, eligible employees may elect to defer up to (i)

50% of his or her cash-paid base salary; and (ii) 75% of his or her annual cash bonus. We may

elect to make additional contributions beyond amounts deferred by participants, but we are under

no obligation to do so. At the time of making a deferral election, participants designate the time and

form of the distribution of deferrals to be made for the year to which that election relates.

Distributions may occur earlier upon a change in control or a termination of employment, subject to

certain conditions provided for under the Deferred Compensation Plan and Section 409A of the

Internal Revenue Code. Participants have the opportunity to designate the investment funds to

which the deferred amounts are to be credited. All investment gains and losses in a participant’s

account under the Deferred Compensation Plan are entirely based upon the investment selections

made by the participant. We have established a grantor (or “rabbi”) trust to facilitate payment of our

obligations under the Deferred Compensation Plan.

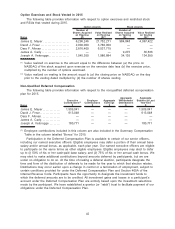

The contributions, earnings and account balances for the named executive officers in the

Deferred Compensation Plan are described in the “Non-Qualified Deferred Compensation” table.

Perquisites and Other Benefits for Named Executive Officers

The Compensation Committee supports providing other benefits to named executive officers

that are almost identical to those offered to our other full time employees and are provided to

similarly situated executives at companies with which we compete for executive talent.

In limited circumstances, a named executive officer may receive certain tailored benefits. For

example, in 2015, Mr. Cady, due to his principal residence being in the State of Oregon, was

reimbursed for the reasonable costs of coach class airfare from his home to our various offices,

along with reasonable hotel and meal expenses. The costs of these benefits for Mr. Cady

constituted less than 10% of his compensation in 2015.

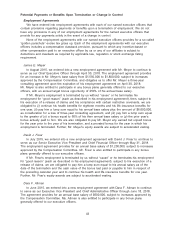

Payments to Named Executive Officers Upon Termination or Change in Control

The employment agreements with our named executive officers provide for severance

payments upon an involuntary termination of employment without “cause” or for “good reason” (as

each term is defined in their employment agreement). These arrangements vary among executives

due to individual negotiations. The material terms of these arrangements are described under

“Potential Payments or Benefits Upon Termination or Change in Control—Employment Agreements.”

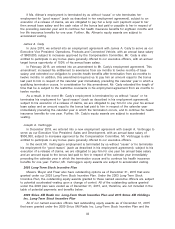

None of the employment agreements for the named executive officers provide for any special

payments solely due to a change in control. Under the terms of both the Sirius XM Radio Inc. 2009

Long-Term Stock Incentive Plan and the Sirius XM Holdings Inc. 2015 Long-Term Stock Incentive

Plan (collectively, the “Plans”), if the employment of any of our named executive officers is

terminated by us without cause, or by the executive for good reason, within two years following a

change in control, then in accordance with the Plans, their equity awards are subject to accelerated

vesting.

We believe that these severance arrangements mitigate some of the risk that exists for

executives working in our highly competitive industry. These arrangements are intended to attract

and retain qualified executives who could have other job alternatives that may appear to them, in

the absence of these arrangements, to be less risky, and such arrangements allow the executives

to focus exclusively on our interests.

Fiscal Year 2016 Compensation Considerations

The Compensation Committee plans to review our executive compensation program in 2016

with a view to ensuring that it continues to provide the correct incentives and is properly sized

given the scope and complexity of our business and the competition we face.

37