XM Radio 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Key Operating Metrics

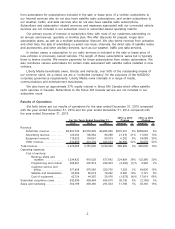

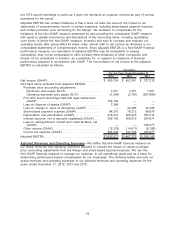

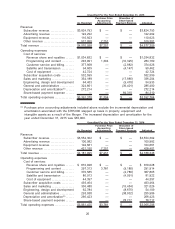

In this section, we present certain financial and operating performance measures that are not

calculated and presented in accordance with generally accepted accounting principles in the United

States (“Non-GAAP”). These metrics include: average monthly revenue per subscriber, or ARPU;

customer service and billing expenses, per average subscriber; subscriber acquisition cost, or SAC,

per installation; free cash flow; and adjusted EBITDA. These measures exclude the impact of share-

based payment expense and certain purchase price accounting adjustments related to the Merger,

which include the: (i) elimination of deferred revenue associated with the investment in XM Canada,

(ii) recognition of deferred subscriber revenues not recognized in purchase price accounting, and

(iii) elimination of the benefit of deferred credits on executory contracts, which are primarily

attributable to third party arrangements with an OEM and programming providers. Additionally, when

applicable, our adjusted EBITDA and free cash flow metrics exclude the effect of any significant

items that do not relate to the on-going performance of our business, such as settlements related to

our historical use of pre-1972 sound recordings. We use these Non-GAAP financial measures to

manage our business, to set operational goals and as a basis for determining performance-based

compensation for our employees.

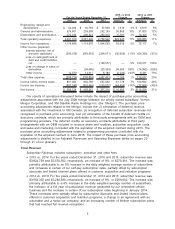

Free cash flow is a metric that our management and board of directors use to evaluate the

cash generated by our operations, net of capital expenditures and other investment activity and

significant items that do not relate to the on-going performance of our business. In a capital

intensive business, with significant investments in satellites, we look at our operating cash flow, net

of these investing cash outflows, to determine cash available for future subscriber acquisition and

capital expenditures, to repurchase or retire debt, to acquire other companies and to evaluate our

ability to return capital to stockholders. We believe free cash flow is an indicator of the long-term

financial stability of our business. Free cash flow, which is reconciled to “Net cash provided by

operating activities,” is a Non-GAAP financial measure. This measure can be calculated by

deducting amounts under the captions “Additions to property and equipment”, deducting or adding

Restricted and other investment activity and the return of capital from investment in unconsolidated

entity from “Net cash provided by operating activities” from the consolidated statements of cash

flows, adjusted for any significant legal settlements. Free cash flow should be used in conjunction

with other GAAP financial performance measures and may not be comparable to free cash flow

measures presented by other companies. Free cash flow should be viewed as a supplemental

measure rather than an alternative measure of cash flows from operating activities, as determined

in accordance with GAAP. Free cash flow is limited and does not represent remaining cash flows

available for discretionary expenditures due to the fact that the measure does not deduct the

payments required for debt maturities. We believe free cash flow provides useful supplemental

information to investors regarding our current and projected cash flow, along with other GAAP

measures (such as cash flows from operating and investing activities), to determine our financial

condition, and to compare our operating performance to other communications, entertainment and

media companies. We have excluded the $210,000 payment related to the pre-1972 sound

recordings legal settlement from our free cash flow calculation in the year ended December 31,

2015.

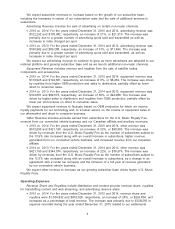

We believe these Non-GAAP financial measures provide useful information to investors

regarding our financial condition and results of operations. We believe investors find these Non-

GAAP financial performance measures useful in evaluating our core trends because it provides a

direct view of our underlying contractual costs. We believe investors use our current and projected

adjusted EBITDA to estimate our current or prospective enterprise value and to make investment

decisions. By providing these Non-GAAP financial measures, together with the reconciliations to the

most directly comparable GAAP measure, we believe we are enhancing investors’ understanding of

our business and our results of operations.

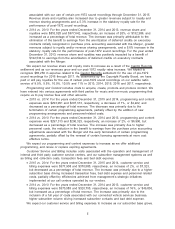

These Non-GAAP financial measures should be viewed in addition to, and not as an alternative

for or superior to, our reported results prepared in accordance with GAAP. In addition, these Non-

GAAP financial measures may not be comparable to similarly-titled measures by other companies.

Please refer to the glossary (pages 18 through 23) for a further discussion of such Non-GAAP

financial measures and reconciliations to the most directly comparable GAAP measure. The

10