XM Radio 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ISSUER PURCHASES OF EQUITY SECURITIES

Since December 2012, our board of directors approved for repurchase an aggregate of $8.0

billion of our common stock. Our board of directors did not establish an end date for this stock

repurchase program. Shares of common stock may be purchased from time to time on the open

market, pursuant to pre-set trading plans meeting the requirements of Rule 10b5-1 under the

Exchange Act, in privately negotiated transactions, including transactions with Liberty Media and its

affiliates, or otherwise. As of December 31, 2015, our cumulative repurchases since December

2012 under our stock repurchase program totaled 1.8 billion shares for $6.3 billion, and $1.7 billion

remained available under our stock repurchase program. The size and timing of our repurchases

will be based on a number of factors, including price and business and market conditions.

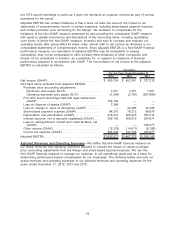

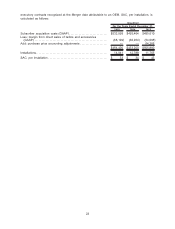

The following table provides information about our purchases of equity securities registered

pursuant to Section 12 of the Exchange Act during the quarter ended December 31, 2015:

Period

Total Number of

Shares

Purchased

Average Price

Paid Per Share(a)

Total Number of

Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

Approximate

Dollar Value of

Shares that May

Yet Be

Purchased Under

the Plans or

Programs(a)

October 1, 2015 – October 31,

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,667,244 $3.93 29,667,244 $1,951,440,398

November 1, 2015 – November 30,

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,121,892 $4.12 19,121,892 $1,872,689,142

December 1, 2015 – December 31,

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,816,509 $4.06 42,816,509 $1,698,860,143

Total . . . . . . . . . . . . . . . . . . . . . . . . . . 91,605,645 $4.03 91,605,645

(a) These amounts include fees and commissions associated with shares repurchased. All of these

repurchases were made pursuant to our share repurchase program.

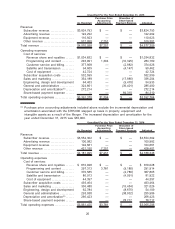

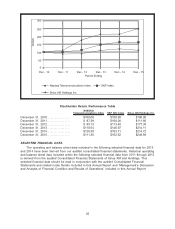

COMPARISON OF CUMULATIVE TOTAL RETURNS

Set forth below is a graph comparing the cumulative performance of our common stock with

the Standard & Poor’s Composite-500 Stock Index, or the S&P 500, and the NASDAQ

Telecommunications Index from December 31, 2010 to December 31, 2015. The graph assumes

that $100 was invested on December 31, 2010 in each of our common stock, the S&P 500 and the

NASDAQ Telecommunications Index. A dividend with respect to our common stock was declared in

2012 only.

24