XM Radio 2015 Annual Report Download - page 104

Download and view the complete annual report

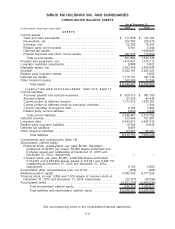

Please find page 104 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In April 2015, the FASB issued ASU 2015-03, Interest—Imputation of Interest (Subtopic

835-30), and, in August 2015, the FASB issued ASU 2015-15, Presentation and Subsequent

Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements. These ASUs

require debt issuance costs related to a recognized debt liability to be presented in the balance

sheet as a direct deduction from the carrying amount of that debt consistent with debt discounts.

The presentation and subsequent measurement of debt issuance costs associated with lines of

credit, may be presented as an asset and amortized ratably over the term of the line of credit

arrangement, regardless of whether there are outstanding borrowings on the arrangement. The

recognition and measurement guidance for debt issuance costs are not affected by these ASUs.

These ASUs are effective for financial statements issued for fiscal years beginning after December

15, 2015 and interim periods within those years. Early adoption is permitted for financial statements

that have not been previously issued, and retrospective application is required for each balance

sheet presented. We early adopted these ASUs in the fourth quarter of 2015, and debt issuance

costs previously recorded as an asset, other than those related to our Credit Facility, in the amount

of $7,155 and $6,444 for the years ended December 31, 2015 and 2014, respectively, have been

reclassified as a reduction to our debt liability within our consolidated balance sheets.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers

(Topic 606). This ASU is a comprehensive new revenue recognition model that requires a company

to recognize revenue to depict the transfer of goods or services to a customer at an amount that

reflects the consideration it expects to receive in exchange for those goods or services. This ASU

also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and

cash flows arising from customer contracts, including significant judgments and changes in

judgments and assets recognized from costs incurred to obtain or fulfill a contract. In August 2015,

the FASB issued ASU 2015-14 which amended the effective date of this ASU to fiscal years

beginning after December 15, 2017, and early adoption is permitted only for fiscal years beginning

after December 15, 2016. Accordingly, we plan to adopt this ASU on January 1, 2018. Companies

may use either a full retrospective or a modified retrospective approach to adopt this ASU. We are

currently evaluating the impact of the adoption of this ASU on our consolidated financial statements.

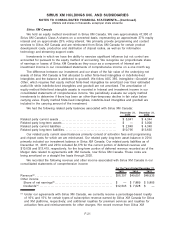

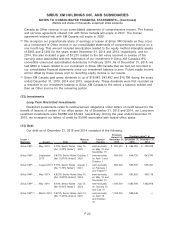

(4) Fair Value Measurements

The fair value of a financial instrument is the amount at which the instrument could be

exchanged in an orderly transaction between market participants. As of December 31, 2015 and

2014, the carrying amounts of cash and cash equivalents, receivables, and accounts payable

approximated fair value due to the short-term nature of these instruments. ASC 820, Fair Value

Measurements and Disclosures, establishes a fair value hierarchy for input into valuation techniques

as follows:

i. Level 1 input: unadjusted quoted prices in active markets for identical instrument;

ii. Level 2 input: observable market data for the same or similar instrument but not Level 1,

including quoted prices for identical or similar assets or liabilities in markets that are not

active or other inputs that are observable or can be corroborated by observable market data

for substantially the full term of the assets or liabilities; and

iii. Level 3 input: unobservable inputs developed using management’s assumptions about the

inputs used for pricing the asset or liability.

Investments are periodically reviewed for impairment and an impairment is recorded whenever

declines in fair value below carrying value are determined to be other than temporary. In making

this determination, we consider, among other factors, the severity and duration of the decline as

well as the likelihood of a recovery within a reasonable timeframe.

F-13

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)