XM Radio 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

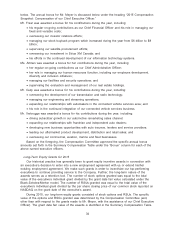

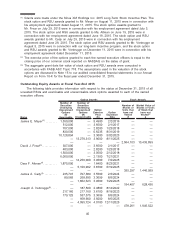

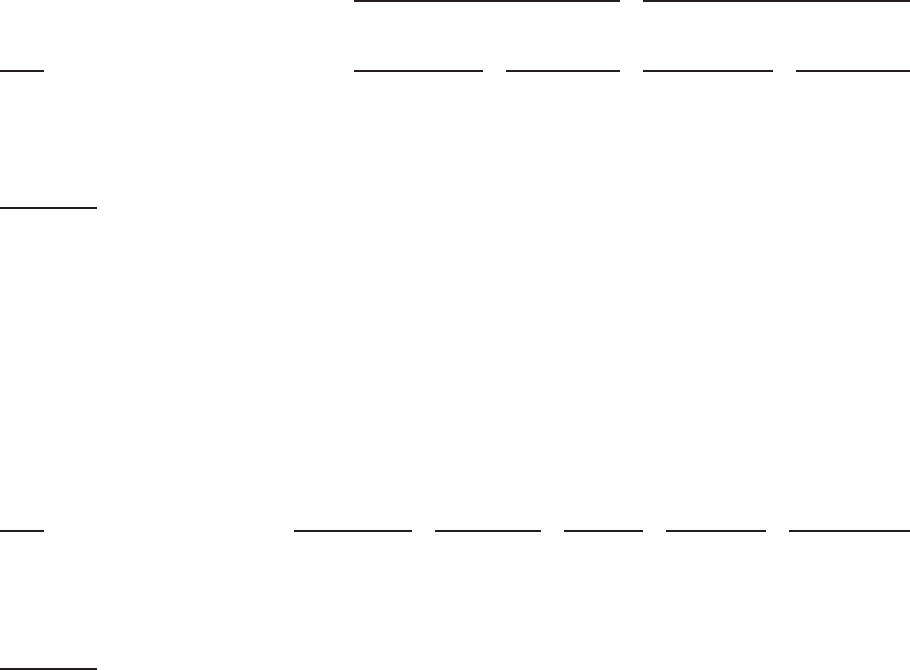

Option Exercises and Stock Vested in 2015

The following table provides information with respect to option exercises and restricted stock

and RSUs that vested during 2015.

Name

Number of

Shares Acquired

on Exercise

(#)

Value Realized

on Exercise

($)(1)

Number of

Shares Acquired

on Vesting

(#)

Value Realized

on Vesting

($)(2)

Option Awards Stock Awards

James E. Meyer . . . . . . . . . . . . . . . . . . . 6,296,246 21,752,271 984,848 4,067,422

David J. Frear . . . . . . . . . . . . . . . . . . . . . 2,000,000 3,780,000 — —

Dara F. Altman . . . . . . . . . . . . . . . . . . . . 2,816,400 6,537,719 — —

James A. Cady . . . . . . . . . . . . . . . . . . . . — — 9,275 36,636

Joseph A. Verbrugge. . . . . . . . . . . . . . . 1,045,350 1,986,884 34,135 134,599

(1) Value realized on exercise is the amount equal to the difference between (a) the price on

NASDAQ of the stock acquired upon exercise on the exercise date less (b) the exercise price,

multiplied by the number of options exercised.

(2) Value realized on vesting is the amount equal to (a) the closing price on NASDAQ on the day

prior to the vesting dated multiplied by (b) the number of shares vesting.

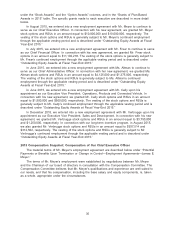

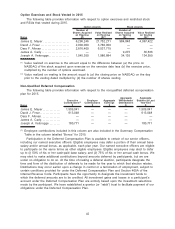

Non-Qualified Deferred Compensation

The following table provides information with respect to the nonqualified deferred compensation

plan for 2015.

Name

Executive

Contributions(1)

$

Employer

Contributions

$

Aggregate

Earnings

$

Aggregate

Withdrawals/

Distributions

$

Aggregate

Balance at Last

Year-End

$

James E. Meyer . . . . . . . . . . . . . 1,509,041 — — — 1,509,041

David J. Frear . . . . . . . . . . . . . . . 613,048 — — — 613,048

Dara F. Altman . . . . . . . . . . . . . . — — — — —

James A. Cady . . . . . . . . . . . . . . — — — — —

Joseph A. Verbrugge . . . . . . . . 180,771 — — — 180,771

(1) Employee contributions included in this column are also included in the Summary Compensation

Table in the column labelled “Bonus” for 2015.

Participation in the Deferred Compensation Plan is available to certain of our senior officers,

including our named executive officers. Eligible employees may defer a portion of their annual base

salary and/or annual bonus, as applicable, each plan year. Our named executive officers are eligible

to participate on the same terms as other eligible employees. Eligible employees may elect to defer

up to (i) 50% of his or her cash-paid base salary; and (ii) 75% of his or her annual cash bonus. We

may elect to make additional contributions beyond amounts deferred by participants, but we are

under no obligation to do so. At the time of making a deferral election, participants designate the

time and form of the distribution of deferrals to be made for the year to which that election relates.

Distributions may occur earlier upon a change in control or a termination of employment, subject to

certain conditions provided for under the Deferred Compensation Plan and Section 409A of the

Internal Revenue Code. Participants have the opportunity to designate the investment funds to

which the deferred amounts are to be credited. All investment gains and losses in a participant’s

account under the Deferred Compensation Plan are entirely based upon the investment selections

made by the participant. We have established a grantor (or “rabbi”) trust to facilitate payment of our

obligations under the Deferred Compensation Plan.

42