XM Radio 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amounts, and the amount of the bonus awards to our named executive officers, is discussed below

under the heading “Fiscal Year 2015 Pay Results–Payment of Performance-Based Discretionary

Annual Bonuses for 2015” and are reflected in the Summary Compensation Table.

Long-term Incentive Compensation

The Compensation Committee determines the level of long-term incentive compensation in

conjunction with total compensation provided to named executive officers and the objectives of the

above-described compensation program.

Why Long-Term Incentives Are a Key Aspect of Our Executive Compensation Program

Long-term incentive awards have historically represented a significant portion of our named

executive officers’ compensation, thus ensuring that our executives, through their equity-based

compensation, have a continuing stake in our success, aligning their interests with that of our

stockholders and supporting the goal of retention through vesting requirements and forfeiture

provisions.

The Compensation Committee grants long-term incentive awards to directly align compensation

for our named executive officers over a multi-year period with the interests of our stockholders

by motivating and rewarding actions that enhance long-term stockholder value, while also

ensuring the continued retention of our named executive officers.

Consistent with the past few years, in 2015 the Compensation Committee determined that long-

term incentive compensation for our named executive officers would consist of both stock options and

RSUs. A summary of the terms applicable to grants of stock options and RSUs is set forth below.

Stock Options

Stock options have an exercise price

equal to the fair market value of our

common stock on the date of grant,

and therefore reward the executives

only if the price of our stock increases

after the date of grant

Generally vest over a period of three or

four years in equal annual installments

Generally vest subject to the

executive’s continued employment,

incentivizing executives to remain with

the Company and sustain increases in

stockholder value over extended

periods of time

Restricted Stock Units

The Compensation Committee believes

that the use of RSUs, as a form of

equity-based compensation, provides

predictable retention value and

alignment of executive interests with

stockholder interests, particularly in

volatile equity markets

Vest on varying schedules

Generally vest subject to the

executive’s continued employment,

incentivizing executives to remain with

the Company and sustain increases in

stockholder value over extended

periods of time

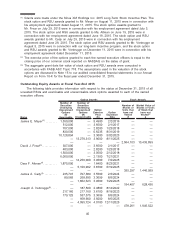

The specific number of options and RSUs granted is determined either as part of an

employment agreement or by the Compensation Committee with the assistance of our Chief

Executive Officer (other than in the case of any equity awards to himself) and by using their

32