XM Radio 2015 Annual Report Download - page 59

Download and view the complete annual report

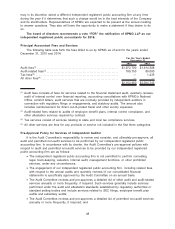

Please find page 59 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•The Audit Committee pre-approves each proposed engagement to provide services not

previously included in the approved list of audit and non-audit services and for fees in excess

of amounts previously pre-approved.

The Audit Committee has delegated to the chair of the Audit Committee the authority to

approve permitted services by the independent registered public accounting firm so long as he or

she reports decisions to the Audit Committee at its next meeting.

All of the services covered under the captions “Audit Fees”, “Audit-Related Fees” and “Tax

Fees” were pre-approved by the Audit Committee.

Who is the Audit Committee’s financial expert?

Our board of directors has determined that Joan L. Amble, the chairwoman of the Audit

Committee and an independent director, is qualified as an “audit committee financial expert” within

the meaning of SEC regulations and that she is “financially sophisticated” within the meaning of the

NASDAQ listing standards.

REPORT OF THE AUDIT COMMITTEE

As described more fully in its charter, the purpose of the Audit Committee is to assist our

board of directors in its general oversight of our financial reporting, internal control and audit

functions. Management is responsible for the preparation, presentation and integrity of our

consolidated financial statements; accounting and financial reporting principles; and internal controls

and procedures designed to ensure compliance with accounting standards, applicable laws and

regulations. KPMG, our independent registered public accounting firm, is responsible for performing

an independent audit of our consolidated financial statements and the effectiveness of internal

control over financial reporting in accordance with auditing standards of the Public Company

Accounting Oversight Board (United States) (the “PCAOB”).

In this context, the Audit Committee has met and held discussions with management and the

independent registered public accounting firm regarding the fair and complete presentation of our

results and the assessment of our internal control over financial reporting. The Audit Committee has

discussed significant accounting policies applied by us in our financial statements, as well as, when

applicable, alternative accounting treatments. Management has represented to the Audit Committee

that our consolidated financial statements were prepared in accordance with accounting principles

generally accepted in the United States of America, and the Audit Committee has reviewed and

discussed the consolidated financial statements with management and KPMG.

The Audit Committee also reviewed and discussed our compliance with Section 404 of the

Sarbanes-Oxley Act of 2002. In this regard, the Audit Committee reviewed and discussed, with

management and our independent registered public accounting firm, management’s annual report

on the effectiveness of internal control over financial reporting as of December 31, 2015 and

KPMG’s related attestation report.

The Audit Committee has discussed with KPMG the matters that are required to be discussed

under PCAOB standards. The Audit Committee discussed with KPMG matters required to be

discussed by Auditing Standard No. 16, Communications with Audit Committees, as adopted by the

PCAOB, and Rule 2-07, Communication with Audit Committees, of Regulation S-X. The Audit

Committee has concluded that KPMG’s provision of audit and non-audit services to us and our

affiliates is compatible with KPMG’s independence.

At each regularly scheduled meeting, the Audit Committee met and held discussions with

management, our internal auditors and KPMG. Prior to their issuance, the Audit Committee

reviewed and discussed our quarterly and annual consolidated financial statements (including the

presentation of non-GAAP financial information) and disclosures under “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” (including significant accounting

policies and judgments) with management, our internal auditors and KPMG. The Audit Committee

also reviewed our policies and practices with respect to financial risk assessment, as well as

49