XM Radio 2015 Annual Report Download - page 48

Download and view the complete annual report

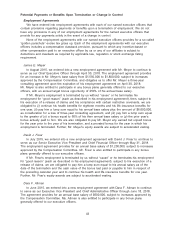

Please find page 48 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Compensation Committee has again adopted a bonus program which is intended to

comply with Section 162(m) of the Internal Revenue Code for our Chief Executive Officer and the

other three most highly compensated executive officers (except for our Chief Financial Officer). That

bonus program is designed to promote the achievement of our key financial goals for 2016.

The Compensation Committee does not believe that any risks that may arise from our

compensation policies and practices are reasonably likely to have a material adverse effect on our

Company. The Compensation Committee considered various factors that have the effect of

mitigating compensation-related risks and have reviewed our compensation policies and practices

for our employees, including the elements of our executive compensation programs, to determine

whether any portion of such compensation encourages excessive risk taking.

Policy with Respect to Section 162(m) of the Internal Revenue Code

As described above, in 2016 the Compensation Committee again adopted a bonus plan which

is intended to comply with Section 162(m) of the Internal Revenue Code for our Chief Executive

Officer and the other three most highly compensated executive officers, except for our Chief

Financial Officer. The Compensation Committee anticipates that this plan will result in tax

deductibility for any compensation we pay to such executive officers that exceeds $1 million with

respect to 2016. However, the Compensation Committee may from time to time approve

compensation that is not deductible under Section 162(m) of the Internal Revenue Code if it

determines that it is in our best interest to do so.

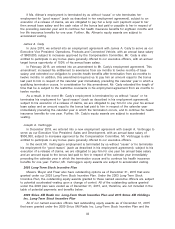

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and

Analysis with management. Based on such review and discussion, the Compensation Committee

recommended to the board of directors that the Compensation Discussion and Analysis be included

in this proxy statement and incorporated by reference into our Annual Report on Form 10-K for the

fiscal year ended December 31, 2015.

Compensation Committee

CARL E. VOGEL,Chairman

GEORGE W. BODENHEIMER

MARK D. CARLETON

JAMES P. HOLDEN

38