XM Radio 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.If Ms. Altman’s employment is terminated by us without “cause” or she terminates her

employment for “good reason” (each as described in her employment agreement), subject to an

execution of a release of claims, we are obligated to pay her a lump sum payment equal to her

then annual base salary and the cash value of the bonus last paid or payable to her in respect of

the preceding calendar year and to continue her health insurance benefits for eighteen months and

her life insurance benefits for one year. Further, Ms. Altman’s equity awards are subject to

accelerated vesting.

James A. Cady

In June 2015, we entered into an employment agreement with James A. Cady to serve as our

Executive Vice President, Operations, Products and Connected Vehicle, with an annual base salary

of $600,000, subject to increases approved by the Compensation Committee. Mr. Cady is also

entitled to participate in any bonus plans generally offered to our executive officers, with an annual

target bonus opportunity of 150% of his annual base salary.

In February 2016, we entered into an amendment to Mr. Cady’s employment agreement. This

amendment: increased his entitlement to severance from six months to twelve months of base

salary; and extended our obligation to provide health benefits after termination from six months to

twelve months. In addition, this amendment required us to pay him an amount equal to the bonus

last paid to him in respect of the calendar year immediately preceding the calendar year in which a

qualifying termination occurs. In consideration for this amendment, Mr. Cady extended the length of

time that he is subject to the restrictive covenants in his employment agreement from six months to

twelve months.

As a result, in the event Mr. Cady’s employment is terminated by us without “cause” or he

terminates his employment for “good reason” (each as described in his employment agreement),

subject to his execution of a release of claims, we are obligated to pay him for one year his annual

base salary and an amount equal to the bonus last paid to him in respect of the calendar year

immediately preceding the calendar year in which the termination occurs, and to continue his health

insurance benefits for one year. Further, Mr. Cady’s equity awards are subject to accelerated

vesting.

Joseph A. Verbrugge

In December 2015, we entered into a new employment agreement with Joseph A. Verbrugge to

serve as our Executive Vice President, Sales and Development, with an annual base salary of

$500,000, subject to increases approved by the Compensation Committee. Mr. Verbrugge is also

entitled to participate in any bonus plans generally offered to our executive officers.

In the event Mr. Verbrugge’s employment is terminated by us without “cause” or he terminates

his employment for “good reason” (each as described in his employment agreement), subject to his

execution of a release of claims, we are obligated to pay him for one year his annual base salary

and an amount equal to the bonus last paid to him in respect of the calendar year immediately

preceding the calendar year in which the termination occurs and to continue his health insurance

benefits for one year. Further, Mr. Verbrugge’s equity awards are subject to accelerated vesting.

2003 Long-Term Stock Incentive Plan

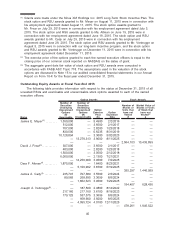

Messrs. Meyer and Frear also have outstanding options as of December 31, 2015 that were

granted under our 2003 Long-Term Stock Incentive Plan. Under the 2003 Long-Term Stock

Incentive Plan, the outstanding equity awards granted to these named executive officers are subject

to potential accelerated vesting upon a change of control. All of the outstanding options granted

under the 2003 plan were vested as of December 31, 2015, and, therefore, are not included in the

table of potential payments and benefits below.

2009 Sirius XM Radio Inc. Long-Term Stock Incentive Plan and 2015 Sirius XM Holdings

Inc. Long-Term Stock Incentive Plan

All of our named executive officers had outstanding equity awards as of December 31, 2015

that were granted under the 2009 Sirius XM Radio Inc. Long-Term Stock Incentive Plan and the

44