XM Radio 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

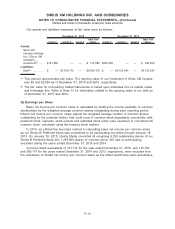

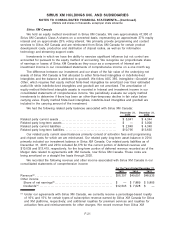

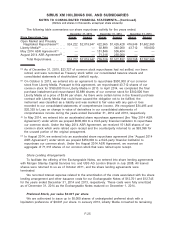

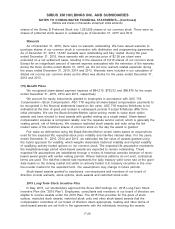

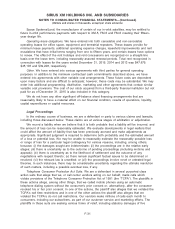

Issuer /

Borrower Issued Debt

Maturity

Date

Interest

Payable

Principal

Amount at

December 31,

2015

December 31,

2015

December 31,

2014

Carrying value(a) at

Sirius XM(b)(d) . . . August 2012 5.25% Senior

Secured Notes (the

“5.25% Notes”)

August 15,

2022

semi-annually

on February 15

and August 15

400,000 395,675 395,147

Sirius XM(e) ..... December

2012

Senior Secured

Revolving Credit

Facility (the “Credit

Facility”)

June 16,

2020

variable fee

paid quarterly

1,750,000 340,000 380,000

Sirius XM. ...... Various Capital leases Various n/a n/a 12,892 12,754

Total Debt ......................................... 5,455,533 4,501,345

Less: total current maturities ................... 4,764 7,482

Less: total deferred financing costs for Notes . . . 7,155 6,444

Total long-term debt ............................... $5,443,614 $4,487,419

(a) The carrying value of the obligations is net of any remaining unamortized original issue discount.

(b) Substantially all of our domestic wholly-owned subsidiaries have guaranteed these notes.

(c) In March 2015, Sirius XM issued $1,000,000 aggregate principal amount of 5.375% Senior Notes

due 2025, with an original issuance discount of $11,250.

(d) The liens securing the 5.25% Notes are equal and ratable to the liens granted to secure the

Credit Facility.

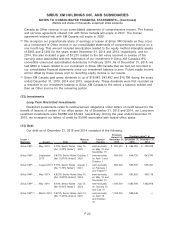

(e) In December 2012, Sirius XM entered into a five-year Credit Facility with a syndicate of financial

institutions for $1,250,000. In June 2015, Sirius XM entered into an amendment to increase the

total borrowing capacity under the Credit Facility to $1,750,000 and to extend the maturity to

June 2020. Sirius XM’s obligations under the Credit Facility are guaranteed by certain of its

material domestic subsidiaries and are secured by a lien on substantially all of Sirius XM’s

assets and the assets of its material domestic subsidiaries. Interest on borrowings is payable on

a monthly basis and accrues at a rate based on LIBOR plus an applicable rate. Sirius XM is

also required to pay a variable fee on the average daily unused portion of the Credit Facility

which is payable on a quarterly basis. The variable rate for the unused portion of the Credit

Facility was 0.30% per annum as of December 31, 2015. As of December 31, 2015, $1,410,000

was available for future borrowing under the Credit Facility. Sirius XM’s outstanding borrowings

under the Credit Facility are classified as Long-term debt within our consolidated balance sheets

due to the long-term maturity of this debt.

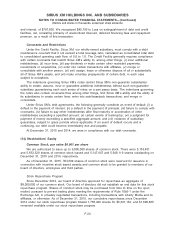

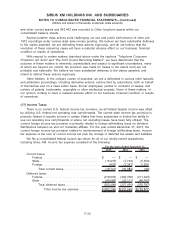

Retired and Converted Debt

During the year ended December 31, 2014, $502,370 in principal amount of the Exchangeable

Notes were converted, resulting in the issuance of 272,856 shares of our common stock. No loss

was recognized as a result of this conversion.

During the year ended December 31, 2013, we purchased $800,000 of our then outstanding

8.75% Senior Notes due 2015, for an aggregate purchase price, including premium and interest, of

$927,860. We recognized $104,818 to Loss on extinguishment of debt and credit facilities, net,

consisting primarily of unamortized discount, deferred financing fees and repayment premium, as a

result of this transaction.

During the year ended December 31, 2013, we also purchased $700,000 of our then

outstanding 7.625% Senior Notes due 2018, for an aggregate purchase price, including premium

F-23

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollars and shares in thousands, except per share amounts)