UPS 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

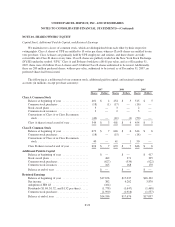

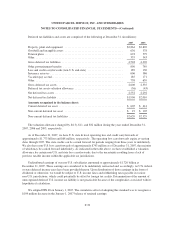

Deferred Compensation Obligations and Treasury Stock

We maintain a deferred compensation plan whereby certain employees were previously able to elect to defer

the gains on stock option exercises by deferring the shares received upon exercise into a rabbi trust. The shares

held in this trust are classified as treasury stock, and the liability to participating employees is classified as

“deferred compensation obligations” in the shareowners’ equity section of the balance sheet. The number of

shares needed to settle the liability for deferred compensation obligations is included in the denominator in both

the basic and diluted earnings per share calculations. Employees are generally no longer able to defer the gains

from stock options exercised subsequent to December 31, 2004. Activity in the deferred compensation program

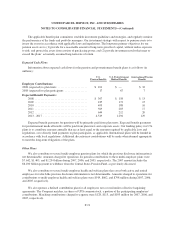

for the years ended December 31, 2007, 2006, and 2005 is as follows (in millions):

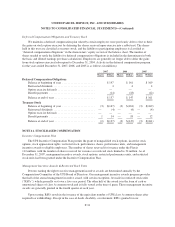

2007 2006 2005

Shares Dollars Shares Dollars Shares Dollars

Deferred Compensation Obligations

Balance at beginning of year ....................... $147 $161 $169

Reinvested dividends ............................. 4 4 4

Option exercise deferrals .......................... — — —

Benefit payments ................................ (14) (18) (12)

Balance at end of year ............................ $137 $147 $161

Treasury Stock

Balance at beginning of year ....................... (3) $(147) (3) $(161) (3) $(169)

Reinvested dividends ............................. — (4) — (4) — (4)

Option exercise deferrals .......................... — — — — — —

Benefit payments ................................ 1 14 — 18 — 12

Balance at end of year ............................ (2) $(137) (3) $(147) (3) $(161)

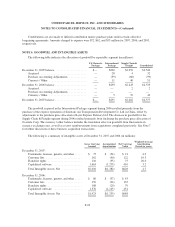

NOTE 11. STOCK-BASED COMPENSATION

Incentive Compensation Plan

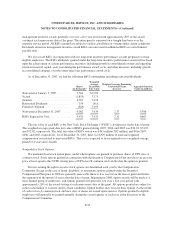

The UPS Incentive Compensation Plan permits the grant of nonqualified stock options, incentive stock

options, stock appreciation rights, restricted stock, performance shares, performance units, and management

incentive awards to eligible employees. The number of shares reserved for issuance under the Plan is

112 million, with the number of shares reserved for issuance as restricted stock limited to 34 million. As of

December 31, 2007, management incentive awards, stock options, restricted performance units, and restricted

stock units had been granted under the Incentive Compensation Plan.

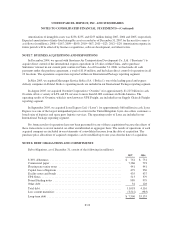

Management Incentive Awards & Restricted Stock Units

Persons earning the right to receive management incentive awards are determined annually by the

Compensation Committee of the UPS Board of Directors. Our management incentive awards program provides

that half of the annual management incentive award, with certain exceptions, be made in restricted stock units

(“RSUs”), which generally vest over a five-year period. The other half of the award is in the form of cash or

unrestricted shares of class A common stock and is fully vested at the time of grant. These management incentive

awards are generally granted in the fourth quarter of each year.

Upon vesting, RSUs result in the issuance of the equivalent number of UPS class A common shares after

required tax withholdings. Except in the case of death, disability, or retirement, RSUs granted for our

F-31