UPS 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 13. INCOME TAXES

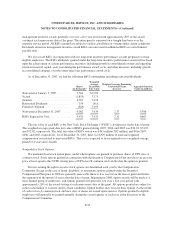

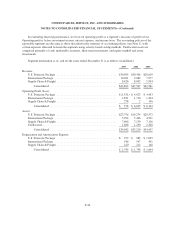

The income tax expense (benefit) for the years ended December 31 consists of the following (in millions):

2007 2006 2005

Current:

U.S. Federal ....................................................... $ 35 $1,674 $1,683

U.S. State and Local ................................................. 67 217 176

Non-U.S. ........................................................ 107 129 135

Total Current .................................................. 209 2,020 1,994

Deferred: .............................................................

U.S. Federal ....................................................... (79) 291 211

U.S. State and Local ................................................. (36) 33 6

Non-U.S. ........................................................ (45) (36) (6)

Total Deferred ................................................. (160) 288 211

Total ......................................................... $ 49 $2,308 $2,205

Income before income taxes includes the following components (in millions):

2007 2006 2005

United States ........................................................... $(32) $6,020 $5,738

Non-U.S. ............................................................. 463 490 337

$431 $6,510 $6,075

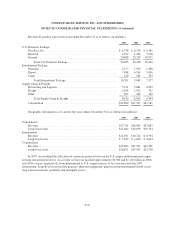

A reconciliation of the statutory federal income tax rate to the effective income tax rate for the years ended

December 31 consists of the following:

2007 2006 2005

Statutory U.S. federal income tax rate ........................................ 35.0% 35.0% 35.0%

U.S. state and local income taxes (net of federal benefit) ......................... 0.5 2.2 2.0

Non-U.S. tax rate differential ............................................... (21.6) (1.2) 0.2

Nondeductible/nontaxable items ............................................ 3.1 1.4 (0.1)

U.S. federal tax credits .................................................... (22.0) (2.0) (1.3)

Other .................................................................. 16.5 0.1 0.5

Effective income tax rate .................................................. 11.5% 35.5% 36.3%

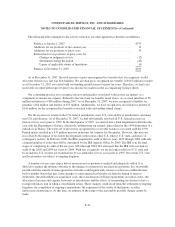

During the third quarter of 2006, we recognized a $52 million reduction of income tax expense related to

favorable developments with certain U.S. federal tax contingency matters involving non-U.S. operations.

F-38