UPS 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

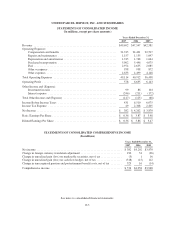

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

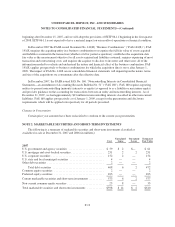

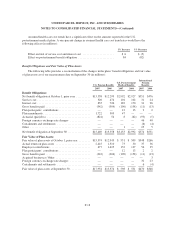

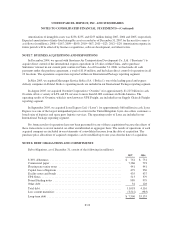

The carrying value of finance receivables at December 31, 2007, by contractual maturity, is shown below

(in millions). Actual maturities may differ from contractual maturities because some borrowers have the right to

prepay these receivables without prepayment penalties.

Carrying

Value

Due in one year or less ....................................................... $474

Due after one year through three years ........................................... 69

Due after three years through five years .......................................... 43

Due after five years .......................................................... 326

$912

Based on interest rates for financial instruments with similar terms and maturities, the estimated fair value

of finance receivables is approximately $895 and $795 million as of December 31, 2007 and 2006, respectively.

At December 31, 2007, we had unfunded loan commitments totaling $860 million, consisting of standby letters

of credit of $117 million and other unfunded lending commitments of $743 million.

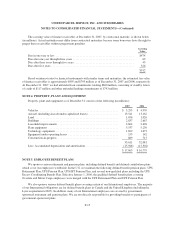

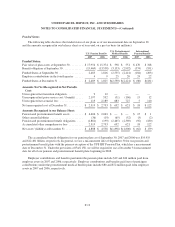

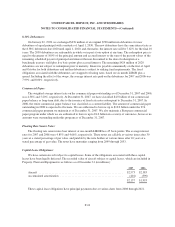

NOTE 4. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment as of December 31 consists of the following (in millions):

2007 2006

Vehicles ....................................................... $ 5,295 $ 4,970

Aircraft (including aircraft under capitalized leases) ..................... 13,541 13,162

Land .......................................................... 1,056 1,026

Buildings ....................................................... 2,837 2,667

Leasehold improvements .......................................... 2,604 2,496

Plant equipment ................................................. 5,537 5,230

Technology equipment ............................................ 1,699 1,673

Equipment under operating leases ................................... 153 142

Construction-in-progress .......................................... 889 715

33,611 32,081

Less: Accumulated depreciation and amortization ....................... (15,948) (15,302)

$ 17,663 $ 16,779

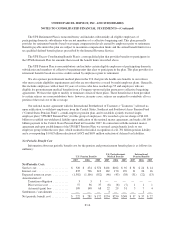

NOTE 5. EMPLOYEE BENEFIT PLANS

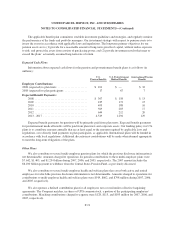

We sponsor various retirement and pension plans, including defined benefit and defined contribution plans

which cover our employees worldwide. In the U.S. we maintain the following defined benefit pension plans: UPS

Retirement Plan, UPS Pension Plan, UPS IBT Pension Plan, and several non-qualified plans including the UPS

Excess Coordinating Benefit Plan. Effective January 1, 2006, the qualified defined benefit plans covering

Overnite and Motor Cargo employees were merged with the UPS Retirement Plan and UPS Pension Plan.

We also sponsor various defined benefit plans covering certain of our International employees. The majority

of our International obligations are for defined benefit plans in Canada and the United Kingdom (including the

Lynx acquisition in 2005). In addition, many of our International employees are covered by government-

sponsored retirement and pension plans. We are not directly responsible for providing benefits to participants of

government-sponsored plans.

F-15