UPS 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

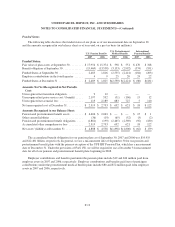

Goodwill and Intangible Assets

Costs of purchased businesses in excess of net assets acquired (goodwill), and intangible assets are

accounted for under the provisions of FASB Statement No. 142 “Goodwill and Other Intangible Assets” (“FAS

142”). Under FAS 142, we are required to test all goodwill for impairment at least annually, unless changes in

circumstances indicate an impairment may have occurred sooner. We are required to test goodwill on a

“reporting unit” basis. A reporting unit is the operating segment unless, for businesses within that operating

segment, discrete financial information is prepared and regularly reviewed by management, in which case such a

component business is the reporting unit.

A fair value approach is used to test goodwill for impairment. An impairment charge is recognized for the

amount, if any, by which the carrying amount of goodwill exceeds its fair value. Fair values are established using

discounted cash flows. When available and as appropriate, comparative market multiples were used to

corroborate discounted cash flow results. Our annual impairment tests performed in 2007, 2006, and 2005

resulted in no goodwill impairment.

Finite-lived intangible assets, including trademarks, licenses, patents, customer lists, non-compete

agreements, and franchise rights are amortized on a straight-line basis over the estimated useful lives of the

assets, which range from 2 to 20 years. Capitalized software is amortized over periods ranging from 3 to 5 years.

Self-Insurance Accruals

We self-insure costs associated with workers’ compensation claims, automotive liability, health and welfare,

and general business liabilities, up to certain limits. Insurance reserves are established for estimates of the loss

that we will ultimately incur on reported claims, as well as estimates of claims that have been incurred but not yet

reported. Recorded balances are based on reserve levels, which incorporate historical loss experience and

judgments about the present and expected levels of cost per claim.

Income Taxes

Income taxes are accounted for under FASB Statement No. 109, “Accounting for Income Taxes”

(“FAS 109”). FAS 109 is an asset and liability approach that requires the recognition of deferred tax assets and

liabilities for the expected future tax consequences of events that have been recognized in our financial

statements or tax returns. In estimating future tax consequences, FAS 109 generally considers all expected future

events other than proposed changes in the tax law or rates. Valuation allowances are provided if it is more likely

than not that a deferred tax asset will not be realized.

We recognize liabilities for uncertain tax positions based on a two-step process. The first step is to evaluate

the tax position for recognition by determining if the weight of available evidence indicates that it is more likely

than not that the position will be sustained on audit, including resolution of related appeals or litigation

processes, if any. The second step requires us to estimate and measure the tax benefit as the largest amount that is

more than 50% likely to be realized upon ultimate settlement. It is inherently difficult and subjective to estimate

such amounts, as we have to determine the probability of various possible outcomes. We reevaluate these

uncertain tax positions on a quarterly basis. This evaluation is based on factors including, but not limited to,

changes in facts or circumstances, changes in tax law, effectively settled issues under audit, and new audit

activity. Such a change in recognition or measurement would result in the recognition of a tax benefit or an

additional charge to the tax provision.

F-9