UPS 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

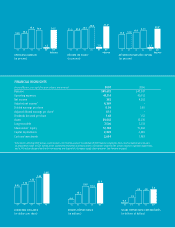

07

06

050403

33.5 36.6

47.5

42.6

49.7

REVENUE

(in billions of dollars)

NET INCOME (in billions)

07

06

050403

2.9

3.3

4.2

3.9

0.4

07

Adjusted

4.4*

NET INCOME

(in billions of dollars)

DILUTED EPS

07

06

050403

2.55

2.93

3.86

3.47

0.36

07

Adjusted

4.11*

DILUTED EPS

(in dollars)

* Adjustments affecting 2007 pre-tax results include: a $6.1 billion payment to

withdraw 45,000 Teamster employees from a multi-employer pension plan,

an impairment charge of $221 million on the accelerated retirement of certain

aircraft, a $68 million charge for the special voluntary separation opportunity,

and a $46 million charge related to the restructuring and disposal of a European

supply chain operation. Adjusted fi nancial measures exclude items that may not

be indicative of or are unrelated to our core operating results. We believe they

are an important indicator of our recurring operations and provide a better base-

line for analyzing our underlying businesses. We use these adjusted fi nancial

measures to determine incentive compensation awards for our management.

WH AT WE SEE FO R 2008

Economic uncertainty in the U.S. likely will make 2008

more challenging than 2007. However, UPS has a long

history of growth in many different economic environ-

ments. Strength in the International Package and the

Supply Chain and Freight segments should mitigate what

we expect will be only modest gains in the U.S. Package

segment. We will be vigilant about operating effi ciently,

while keeping a sharp eye on execution. For the year,

we anticipate achieving earnings per share in the range

of $4.30 to $4.50.

At UPS, we are committed to being a company that

people want to do business with, want to work for,

and want to invest in. These people — our customers,

our employees and our shareowners — have a tremendous

opportunity to move forward with us as we capitalize

on global opportunities.

FAREWELL TO A VISIONARY

At the close of 2007, M ike Eskew, our Chairman and

Chief Executive O ffi cer for six years, retired. In M ike’s

35-year career with UPS, he made signifi cant contri-

butions to the company. H e helped set up UPS’s foray

into international operations and was instrumental

in one of the fastest startups of a large airline in history.

M ike also led the company’s expansion into services

complementary to small package delivery — supply chain

management, international freight forwarding and less-

than-truckload freight shipment in the United States.

Under M ike’s leadership UPS realized substantial growth,

and we appreciate his insight and dedication to the com-

pany. H e leaves a strong UPS, and I am both honored

and humbled to be his successor.

D. Scott Davis

Chairman and

Chief Executive O ffi cer

5