UPS 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

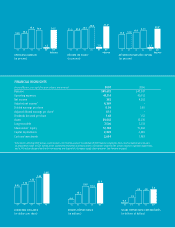

In a slow-growth economic environment, cost control

is essential, and UPS people did an excellent job in this

area. Workers’ compensation expense was down signif-

icantly, a consequence of reducing work-related injuries

by almost 50 percent since 2002 to 1.6 per 100,000

hours, a win-win for our employees’ well-being and

for the bottom line.

Internationally, UPS experienced 10.4 percent export

volume growth, more than twice the rate of overall

economic expansion. O ur international operations

reported the highest revenue and operating profi t ever.

Revenue was up 13.1 percent to $10.3 billion with

operating profi t improving 7.1 percent to $1.8 billion.

O perating margin was very strong at 17.8 percent.

In 2007, we laid the groundwork

for future growth with invest-

ments in our worldwide air oper-

ations. We began construction on

our Shanghai air hub, scheduled

for completion in 2008, the fi rst

in China to be operated by a U.S.

carrier. It will link cities in China

to UPS’s international network,

and provide direct service to the

Americas, Europe and other countries in Asia.

Additionally, we put in place another around-the-world

fl ight to connect the fast-growing Asian and European

trade lanes to each other and to the United States.

Lastly, UPS received the authority to operate six daily

fl ights between the United States and Nagoya, Japan,

in addition to our daily fl ights to Tokyo and O saka.

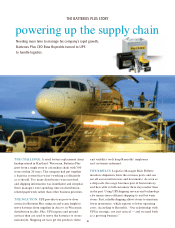

SUPPLY CH AIN AN D FREIGH T TURN AROUN D

UPS’s supply chain and freight capabilities are integral

to our vision of synchronized, transportation-focused

solutions that help move our customers forward. To

that end, we were very encouraged by the signifi cant

performance improvement of our Supply Chain and

Freight segment, which posted a 5.3 percent revenue

gain and a $276 million increase in operating profi t.

The Supply Chain operations, namely Forwarding and

Logistics, capitalized on initiatives that enhanced rev-

enue management and customer service, while reducing

operating cost. In the Forwarding business, interna-

tional air freight forwarding made notable progress.

O cean freight forwarding will be a priority in 2008.

Logistics streamlined its operations and posted signifi -

cant profi t gains on moderate revenue growth. In 2008,

its focus will be on developing solutions for the health-

care and technology sectors.

UPS Freight® experienced a very good year in 2007 with

revenue, profi t and shipment growth. This was especially

noteworthy given the U.S. trucking industry’s highly

competitive operating environment. The UPS brand

strengths of reliability and technology associated with

our small package business are attracting customers to

our freight services. We intend to continue leveraging

our small package customer base through cross-selling

the full complement of UPS services.

TR EN DS AN D GROW T H

OPPO RTUN ITIES

UPS is a major player in world

commerce; we enable it and we

benefi t from it. Long-term industry

fundamentals are favorable for our

business and, in fact, play to UPS

strengths. These include expanding

global trade, direct-to-consumer

shipping, and outsourcing supply chain management.

Increasingly, supply chain strategy means that research

and development, production, component-making, fi nal

assembly, marketing and distribution are located where

the best resources are available, and where the most

value can be added to the end product. Today’s supply

chain leaders are focused on “time-in-trade” — ensuring

that each component of the value chain arrives at precisely

the right location, at the right time, and at the most

competitive cost — in short, synchronized commerce.

In today’s global environment, our market opportuni-

ties are signifi cant. UPS participates in a $225 billion

global arena that includes small package shipping,

domestic less-than-truckload freight and global air

freight. We have about a 20 percent share of this highly

competitive space, in which there is no leading player.

Additionally, the ocean freight forwarding sector in

which we compete is a $60 billion industry, and the

outsourced logistics market is estimated at almost

$190 billion. Therefore, growth opportunities abound.

4

Worldwide,

UPS delivered a record

number of packages —

3.97 billion.