UPS 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The applicable benefit plan committees establish investment guidelines and strategies, and regularly monitor

the performance of the funds and portfolio managers. Our investment strategy with respect to pension assets is to

invest the assets in accordance with applicable laws and regulations. The long-term primary objectives for our

pension assets are to (1) provide for a reasonable amount of long-term growth of capital, without undue exposure

to risk; and protect the assets from erosion of purchasing power, and (2) provide investment results that meet or

exceed the plans’ actuarially assumed long-term rate of return.

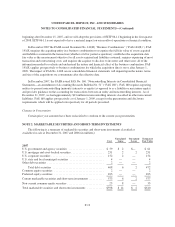

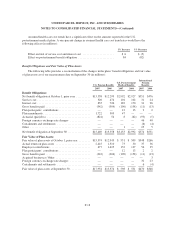

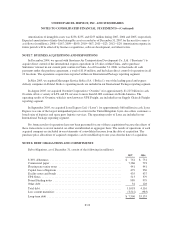

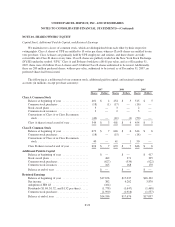

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in

millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Employer Contributions:

2008 (expected) to plan trusts ..................... $ 101 $ — $ 32

2008 (expected) to plan participants ................ 17 67 7

Expected Benefit Payments:

2008 ..................................... $ 367 $ 158 $ 13

2009 ..................................... 435 173 15

2010 ..................................... 499 188 16

2011 ..................................... 569 203 17

2012 ..................................... 644 212 20

2013 - 2017 ............................... 4,549 1,294 129

Expected benefit payments for pensions will be primarily paid from plan trusts. Expected benefit payments

for postretirement medical benefits will be paid from plan trusts and corporate assets. Our funding policy for U.S.

plans is to contribute amounts annually that are at least equal to the amounts required by applicable laws and

regulations, or to directly fund payments to plan participants, as applicable. International plans will be funded in

accordance with local regulations. Additional discretionary contributions will be made when deemed appropriate

to meet the long-term obligations of the plans.

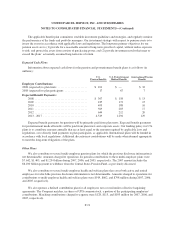

Other Plans

We also contribute to several multi-employer pension plans for which the previous disclosure information is

not determinable. Amounts charged to operations for pension contributions to these multi-employer plans were

$7.642, $1.405, and $1.234 billion during 2007, 2006, and 2005, respectively. The 2007 amount includes the

$6.100 billion payment to withdraw from the Central States Pension Fund, as previously discussed.

We also contribute to several multi-employer health and welfare plans that cover both active and retired

employees for which the previous disclosure information is not determinable. Amounts charged to operations for

contributions to multi-employer health and welfare plans were $919, $862, and $798 million during 2007, 2006,

and 2005, respectively.

We also sponsor a defined contribution plan for all employees not covered under collective bargaining

agreements. The Company matches, in shares of UPS common stock, a portion of the participating employees’

contributions. Matching contributions charged to expense were $128, $113, and $105 million for 2007, 2006, and

2005, respectively.

F-21