UPS 2007 Annual Report Download - page 44

Download and view the complete annual report

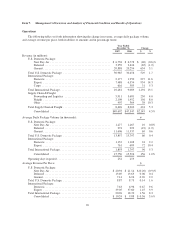

Please find page 44 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.period. We anticipate that this change in the award structure will have the effect of increasing the expense

recognized for our restricted stock unit grants in future years, until approximately 2010, when we the effect of

expensing new restricted stock unit grants will be somewhat offset with the elimination of expense from awards

that have become completely vested.

The expense associated with our self-insurance accruals for workers’ compensation claims, automotive

liability and general business liabilities was $46 million lower in 2007 compared with 2006. Insurance reserves

are established for estimates of the loss that we will ultimately incur on reported claims, as well as estimates of

claims that have been incurred but not yet reported. Recorded balances are based on reserve levels, which

incorporate historical loss experience and judgments about the present and expected levels of cost per claim. The

lower expense reflects favorable claims experience resulting from several company initiatives put into place over

the last several years and other factors, including initiatives to decrease accident frequencies, improved oversight

and management of claims, improved trends in health care costs, and favorable state legislative reforms.

The 0.2% increase in repairs and maintenance reflects higher maintenance expense on aircraft, largely offset

by lower maintenance expense on vehicles and buildings. The 0.2% decrease in depreciation and amortization

was influenced by several factors, including lower depreciation expense on aircraft and amortization expense on

capitalized software, partially offset by increased depreciation expense on vehicles. The 7.4% increase in

purchased transportation was impacted by volume growth in our International Package business and currency

fluctuations, as well as growth in our international forwarding business. The 12.0% increase in fuel expense for

the year was primarily due to higher prices for jet and diesel fuel, as well as higher usage, but was partially

mitigated by hedging gains. Other occupancy expense increased 2.1% for the year, and was affected by increased

rent expense and property taxes, but partially offset by lower utilities expense. The 3.0% increase in other

expenses for the year was affected by a $221 million aircraft impairment charge, discussed further below, but

partially offset with cost controls in several areas. The comparison in other expenses was also affected by the $87

million charge in the Cornn class action litigation in 2006 (see “Contingencies” section).

As a result of business changes that occurred in the first quarter of 2007, including capacity-optimization

programs in our domestic and international air freight forwarding business as well as changes to our aircraft

orders and planned delivery dates, we began a review process of our aircraft fleet types to ensure that we

maintain the optimum mix of aircraft types to service our international and domestic package businesses. The

review was completed in March 2007, and based on the results of our evaluation we accelerated the planned

retirement of certain Boeing 727 and 747 aircraft, and recognized an impairment and obsolescence charge of

$221 million for the aircraft and related engines and parts in 2007. This charge is included in the caption “Other

expenses” in the Statement of Consolidated Income, of which $159 million impacted our U.S. Domestic Package

segment and $62 million impacted our International Package segment.

2006 compared to 2005

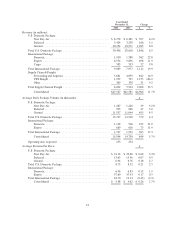

Consolidated operating expenses increased by $4.474 billion, or 12.3%, for the year, and were significantly

impacted by the acquisitions of Overnite, Stolica, and Lynx. Currency fluctuations in our International Package

and Supply Chain & Freight segments resulted in operating expenses increasing by $84 million for the year.

Compensation and benefits increased by $1.904 billion, or 8.5%, for the year, largely due to the acquisitions

mentioned above, as well as increased health and welfare benefit costs and higher pension expense. These

increases were partially offset by the decline in workers compensation expense, as previously discussed.

Excluding the effect of acquisitions, compensation and benefits expense increased 5.1% for the year. Stock-based

and other management incentive compensation expense increased $49 million, or 8.0% in 2006, due to the

expensing of restricted stock units granted in the fourth quarter of 2005, the impact of a new grant of stock options

and restricted performance units in the second quarter of 2006, and the impact of adopting the non-substantive

vesting period approach of FAS 123R (discussed further in Note 1 to the consolidated financial statements). These

grants were partially offset by lower accruals for our Management Incentive Awards program in 2006.

29