UPS 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

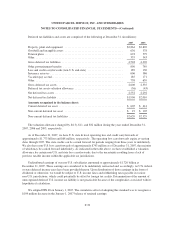

Income Effects of Derivatives

In the context of hedging relationships, “effectiveness” refers to the degree to which fair value changes in

the hedging instrument offset corresponding changes in the hedged item. Certain elements of hedge positions

cannot qualify for hedge accounting under FAS 133 whether effective or not, and must therefore be marked to

market through income. Both the effective and ineffective portions of gains and losses on hedges are reported in

the income statement category related to the hedged exposure. Ineffectiveness included in the income statement

was a loss of $12 million for 2007, and was immaterial for 2006 and 2005. The elements excluded from the

measure of effectiveness were immaterial for 2007, 2006 and 2005.

As of December 31, 2007, $296 million in pre-tax losses related to cash flow hedges that are currently

deferred in OCI are expected to be reclassified to income over the 12 month period ending December 31, 2008.

The actual amounts that will be reclassified to income over the next 12 months will vary from this amount as a

result of changes in market conditions. No amounts were reclassified to income during 2007 in connection with

forecasted transactions that were no longer considered probable of occurring.

At December 31, 2007, the maximum term of derivative instruments that hedge forecasted transactions was

2 years.

Fair Value of Financial Instruments

At December 31, 2007 and 2006, our financial instruments included cash and cash equivalents, marketable

securities and short-term investments, accounts receivable, finance receivables, accounts payable, short-term and

long-term borrowings, and commodity, interest rate, foreign currency, and equity options, forwards, and swaps.

The fair values of cash and cash equivalents, accounts receivable, and accounts payable approximate carrying

values because of the short-term nature of these instruments. The fair value of our marketable securities and

short-term investments is disclosed in Note 2, finance receivables in Note 3, and debt instruments in Note 8.

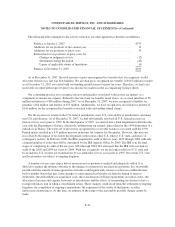

NOTE 16. RESTRUCTURING COSTS AND RELATED EXPENSES

In connection with recent acquisitions and integration initiatives, we have incurred restructuring costs

associated with the termination of employees, facility consolidations and other costs directly related to the

restructuring initiatives implemented. These costs have resulted from the integration of our Menlo Worldwide

Forwarding and Lynx acquisitions as well as restructuring activities associated with our Supply Chain Solutions

operations. For specific restructuring costs recognized in conjunction with the cost from acquisitions, we have

accounted for these costs in accordance with EITF 95-3, “Recognition of Liabilities Assumed in Connection with

a Purchase Business Combination.” All other restructuring costs have been accounted for in accordance with

SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” and SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets.”

Menlo Worldwide Forwarding

In February 2005, we announced our intention to transfer the heavy air freight operations at our facility in

Dayton, Ohio (acquired with the operations of Menlo Worldwide Forwarding in December 2004) to other UPS

facilities over approximately 12 to 18 months. This action was taken to remove redundancies between the Dayton

air freight facility and existing UPS transportation networks, and thus provide efficiencies and better leverage the

current UPS infrastructure in the movement of air freight. During the third quarter of 2005, we finalized our

F-43