UPS 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

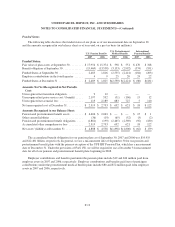

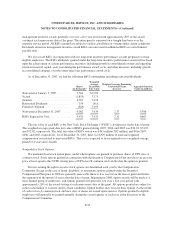

8.38% Debentures:

On January 22, 1998, we exchanged $276 million of an original $700 million in debentures for new

debentures of equal principal with a maturity of April 1, 2030. The new debentures have the same interest rate as

the 8.38% debentures due 2020 until April 1, 2020, and, thereafter, the interest rate will be 7.62% for the final 10

years. The 2030 debentures are redeemable in whole or in part at our option at any time. The redemption price is

equal to the greater of 100% of the principal amount and accrued interest or the sum of the present values of the

remaining scheduled payout of principal and interest thereon discounted to the date of redemption at a

benchmark treasury yield plus five basis points plus accrued interest. The remaining $424 million of 2020

debentures are not subject to redemption prior to maturity. Interest is payable semiannually on the first of April

and October for both debentures and neither debenture is subject to sinking fund requirements. The fixed

obligations associated with the debentures are swapped to floating rates, based on six month LIBOR plus a

spread. Including the effect of the swaps, the average interest rate paid on the debentures for 2007 and 2006 was

7.99% and 8.00%, respectively.

Commercial Paper:

The weighted average interest rate on the commercial paper outstanding as of December 31, 2007 and 2006,

was 4.36% and 5.20%, respectively. At December 31, 2007, we have classified $4.0 billion of our commercial

paper balance as long-term debt, due to the issuance of fixed rate notes subsequent to December 31, 2007. In

2006, the entire commercial paper balance was classified as a current liability. The amount of commercial paper

outstanding in 2008 is expected to fluctuate. We are authorized to borrow up to $10.0 billion under the U.S.

commercial paper program we maintain as of December 31, 2007. We also maintain a European commercial

paper program under which we are authorized to borrow up to €1.0 billion in a variety of currencies, however no

amounts were outstanding under this program as of December 31, 2007.

Floating Rate Senior Notes:

The floating rate senior notes bear interest at one-month LIBOR less 45 basis points. The average interest

rates for 2007 and 2006 were 4.85% and 4.66%, respectively. These notes are callable at various times after 30

years at a stated percentage of par value, and putable by the note holders at various times after 10 years at a

stated percentage of par value. The notes have maturities ranging from 2049 through 2053.

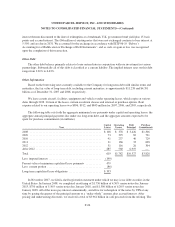

Capital Lease Obligations:

We have certain aircraft subject to capital leases. Some of the obligations associated with these capital

leases have been legally defeased. The recorded value of aircraft subject to capital leases, which are included in

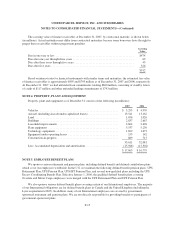

Property, Plant and Equipment is as follows as of December 31 (in millions):

2007 2006

Aircraft ........................................................... $2,573 $2,383

Accumulated amortization ............................................ (416) (390)

$2,157 $1,993

These capital lease obligations have principal payments due at various dates from 2008 through 2021.

F-24